Region:Middle East

Author(s):Rebecca

Product Code:KRAC4692

Pages:96

Published On:October 2025

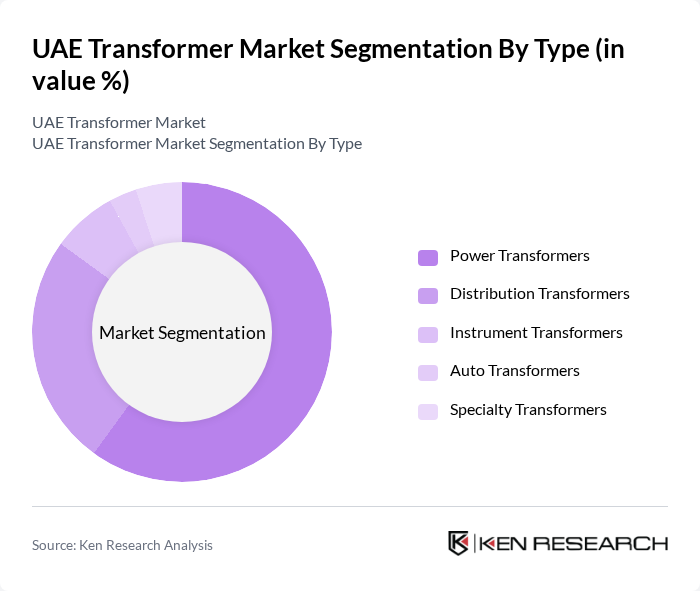

By Type:

The transformer market is segmented into various types, including Power Transformers, Distribution Transformers, Instrument Transformers, Auto Transformers, and Specialty Transformers. Among these, Power Transformers dominate the market due to their critical role in high-voltage transmission systems and the UAE's substantial investments in large-scale power generation projects, including renewable energy integration. The increasing demand for electricity, driven by urbanization and industrial growth, has led to a surge in the installation of power transformers. Distribution Transformers also hold a significant share, as they are essential for stepping down voltage levels for residential and commercial use and are increasingly deployed to support grid expansion and urban development. The trend towards renewable energy integration is further boosting the demand for Specialty Transformers, which cater to specific applications .

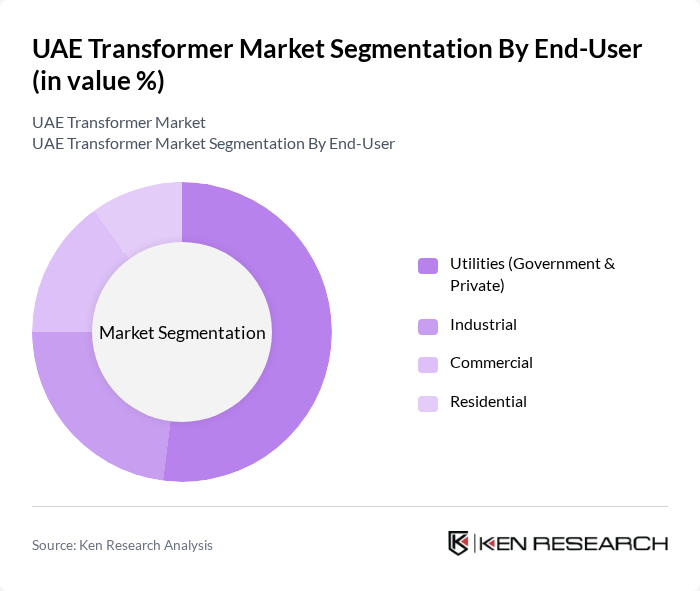

By End-User:

The end-user segmentation includes Utilities (Government & Private), Industrial, Commercial, and Residential sectors. Utilities are the leading end-user segment, driven by the need for reliable power supply and infrastructure development, with significant investments in grid modernization and renewable integration. The industrial sector follows closely, as manufacturing and processing facilities require robust transformer solutions for their operations. The commercial sector is also growing, fueled by the expansion of retail, hospitality, and service industries, particularly in Dubai and Abu Dhabi. Residential demand is increasing due to urbanization and the rise in new housing projects, contributing to the overall growth of the transformer market .

The UAE Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric SE, General Electric Company, Mitsubishi Electric Corporation, Eaton Corporation plc, Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd., CG Power and Industrial Solutions Limited, Bharat Heavy Electricals Limited (BHEL), Hitachi Energy Ltd., Emirates Transformer & Switchgear Ltd., Eurogulf Transformer FZE, Federal Power Transformers, SGB-SMIT Group contribute to innovation, geographic expansion, and service delivery in this space.

The UAE transformer market is poised for significant evolution, driven by technological advancements and a strong focus on sustainability. As the government continues to invest in renewable energy and smart grid technologies, the demand for innovative transformer solutions will likely increase. Additionally, the integration of IoT in energy management systems is expected to enhance operational efficiency. These trends indicate a dynamic market landscape, where adaptability and innovation will be crucial for stakeholders to thrive in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Power Transformers Distribution Transformers Instrument Transformers Auto Transformers Specialty Transformers |

| By End-User | Utilities (Government & Private) Industrial Commercial Residential |

| By Application | Power Generation Transmission Distribution Renewable Energy Integration |

| By Cooling Type | Oil-Cooled Transformers Dry-Type Transformers |

| By Insulation Type | Gas-Insulated Oil-Insulated Solid-Insulated Air-Insulated |

| By Phase | Single Phase Three Phase |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 50 | Energy Managers, Plant Operators |

| Distribution Network Operators | 45 | Network Engineers, Operations Supervisors |

| Industrial Applications | 40 | Facility Managers, Electrical Engineers |

| Renewable Energy Projects | 45 | Project Managers, Sustainability Consultants |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The UAE Transformer Market is valued at approximately USD 1.1 billion, driven by the growth in construction, infrastructure, and renewable energy sectors, alongside the government's focus on energy efficiency and sustainability.