Region:Middle East

Author(s):Shubham

Product Code:KRAD6796

Pages:92

Published On:December 2025

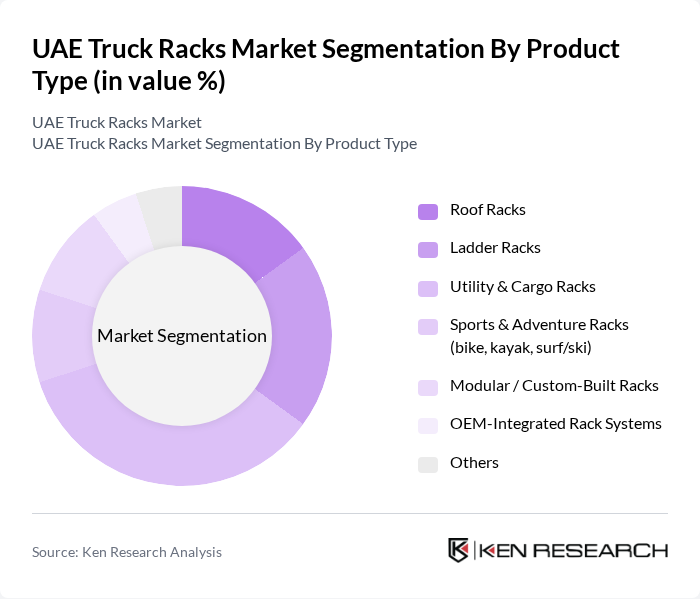

By Product Type:The product type segmentation includes various categories of truck racks that cater to different consumer needs and preferences. The subsegments are Roof Racks, Ladder Racks, Utility & Cargo Racks, Sports & Adventure Racks (bike, kayak, surf/ski), Modular / Custom-Built Racks, OEM-Integrated Rack Systems, and Others. Among these, Utility & Cargo Racks are currently dominating the market due to their versatility and practicality for both commercial and personal use, aligning with global trends where utility and ladder racks see strong uptake in construction, logistics, and service fleets. The increasing trend of e-commerce and logistics, together with growth in pickup and light commercial vehicle fleets in the UAE, has further fueled the demand for these racks, as they provide efficient solutions for transporting parcels, equipment, and tools.

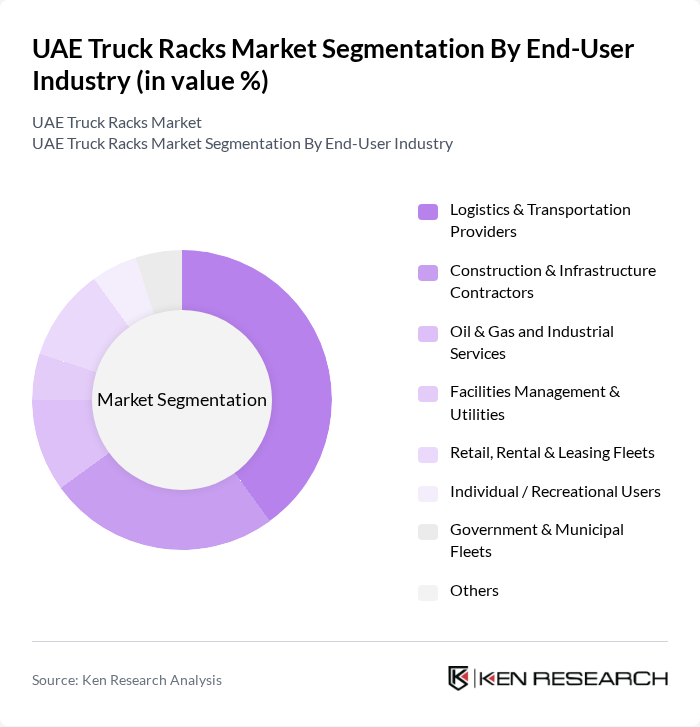

By End-User Industry:The end-user industry segmentation encompasses various sectors that utilize truck racks for their operations. This includes Logistics & Transportation Providers, Construction & Infrastructure Contractors, Oil & Gas and Industrial Services, Facilities Management & Utilities, Retail, Rental & Leasing Fleets, Individual / Recreational Users, Government & Municipal Fleets, and Others. The Logistics & Transportation Providers segment is leading the market, driven by the rapid growth of e-commerce, courier, and last?mile delivery services in the UAE and the need for efficient cargo transport and load?securement solutions. The increasing number of delivery services, ride?sharing?linked cargo operations, and dedicated logistics companies in the UAE has significantly boosted the demand for truck racks in this sector for optimized vehicle utilization and safer payload management.

The UAE Truck Racks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thule Group, Rhino-Rack, Yakima Products, Inc., Front Runner Vehicle Outfitters (Front Runner Trading LLC, Dubai), ARB Corporation Ltd. / ARB 4x4 Accessories (UAE distributors), Al Futtaim Auto Centers (vehicle accessories & rack installations), Abu Dhabi 4x4 & Auto Accessories Trading, Emirates National Auto Accessories LLC, Rak RAK LLC (local fabricated truck & ladder racks), Al Masaood Automobiles – Fleet & Accessories Division, Al Tayer Motors – Accessories & Upfit Solutions, Carryboy Company Limited (Middle East distributors), DECKED LLC, Truck Hero, Inc., Local Independent Fabricators & Custom Rack Workshops (Dubai, Sharjah) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE truck racks market is poised for significant evolution, driven by technological advancements and a growing emphasis on sustainability. As logistics companies increasingly adopt electric and hybrid trucks, the demand for specialized truck racks that accommodate these vehicles will rise. Furthermore, the integration of smart technology into truck racks will enhance operational efficiency, allowing for real-time tracking and improved cargo management. These trends indicate a dynamic market landscape that prioritizes innovation and environmental responsibility.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Roof Racks Ladder Racks Utility & Cargo Racks Sports & Adventure Racks (bike, kayak, surf/ski) Modular / Custom-Built Racks OEM-Integrated Rack Systems Others |

| By End-User Industry | Logistics & Transportation Providers Construction & Infrastructure Contractors Oil & Gas and Industrial Services Facilities Management & Utilities Retail, Rental & Leasing Fleets Individual / Recreational Users Government & Municipal Fleets Others |

| By Vehicle Type | Pickup Trucks (single & double cab) Light Commercial Vehicles & Vans Medium & Heavy-Duty Trucks Specialized & Fleet-Consolidated Vehicles Others |

| By Material | Aluminum Steel Stainless Steel Composite & Hybrid Materials Others |

| By Distribution Channel | OEM Dealerships Authorized Accessory Fitment Centers Independent Workshops & Fabricators Online Marketplaces & E-Retail Direct Corporate / Fleet Sales Others |

| By Emirate | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah & Umm Al Quwain Others |

| By Application | Commercial Cargo & Equipment Transport Construction & Industrial Operations Oilfield & Remote Site Support Recreational & Adventure Travel Emergency, Security & Government Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Vehicle Fleet Operators | 100 | Fleet Managers, Operations Directors |

| Construction Industry Stakeholders | 80 | Project Managers, Procurement Officers |

| Logistics and Delivery Services | 90 | Logistics Coordinators, Supply Chain Managers |

| Retail and E-commerce Businesses | 70 | Warehouse Managers, eCommerce Directors |

| Truck Rack Manufacturers and Distributors | 60 | Sales Managers, Product Development Heads |

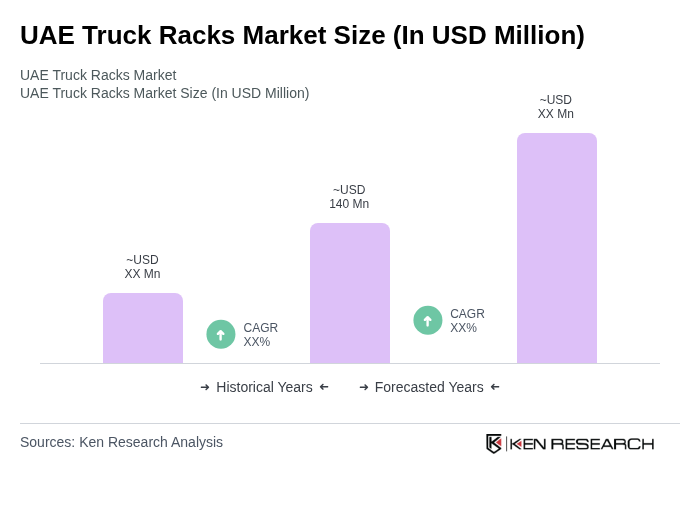

The UAE Truck Racks Market is valued at approximately USD 140 million, reflecting a robust growth trajectory driven by increasing demand in logistics, transportation, and construction sectors, alongside a rising interest in outdoor recreational activities.