Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8373

Pages:98

Published On:November 2025

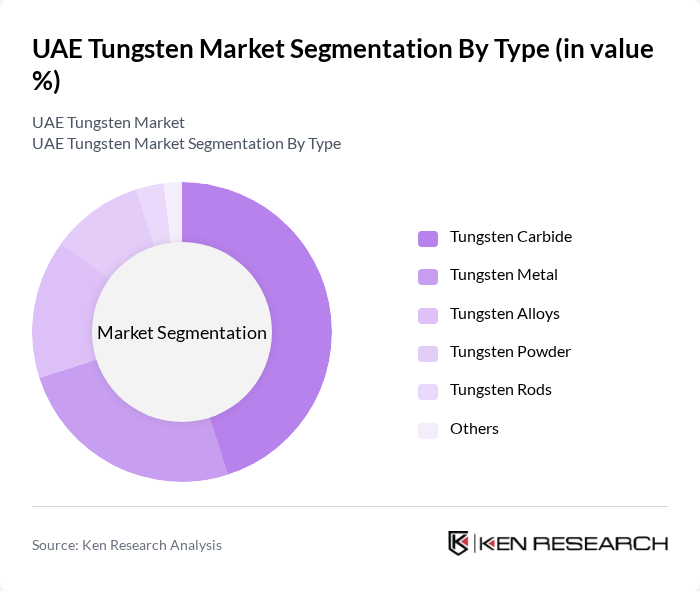

By Type:The tungsten market can be segmented into various types, including Tungsten Carbide, Tungsten Metal, Tungsten Alloys, Tungsten Powder, Tungsten Rods, and Others. Among these, Tungsten Carbide is the leading subsegment due to its extensive use in cutting tools and wear-resistant applications. The demand for Tungsten Metal is also significant, driven by its applications in electronics and aerospace. The market is characterized by a growing trend towards high-performance materials, which is further propelling the growth of these subsegments.

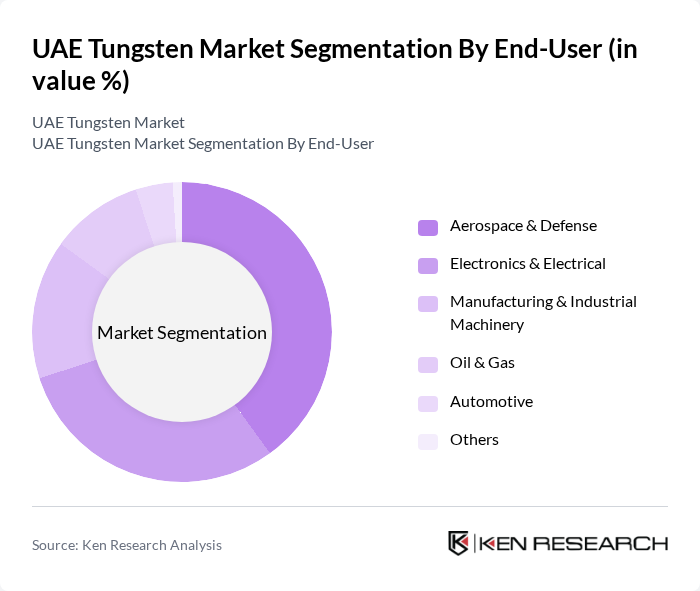

By End-User:The tungsten market is segmented by end-user industries, including Aerospace & Defense, Electronics & Electrical, Manufacturing & Industrial Machinery, Oil & Gas, Automotive, and Others. The Aerospace & Defense sector is the dominant end-user, driven by the increasing demand for high-performance materials in aircraft and military applications. The Electronics & Electrical sector also shows significant growth due to the rising use of tungsten in electrical contacts and components, reflecting a trend towards miniaturization and efficiency in electronic devices.

The UAE Tungsten Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wolframcarb Middle East, MB-Tungsten.Metals.Recycling Ltd., TFI Co. Industrial Knife, Saleh Ishaq Trading Co. LLC, Sealmech Trading LLC, Alpha Standard Trading LLC, Pipingmaterial.ae, Nikash Group, Saeed Juma Trading, Leakend, Mohammad Abdat, Jia Ur Rahaman, Sandvik AB, Kennametal Inc., Mitsubishi Materials Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UAE tungsten market is poised for growth, driven by increasing demand across various sectors, including aerospace, electronics, and manufacturing. As government initiatives promote sustainable mining practices and technological advancements in extraction processes, the market is expected to attract more investments. Additionally, the focus on high-performance alloys and recycling initiatives will likely enhance the market's resilience against challenges such as price fluctuations and environmental regulations, positioning it for a robust future.

| Segment | Sub-Segments |

|---|---|

| By Type | Tungsten Carbide Tungsten Metal Tungsten Alloys Tungsten Powder Tungsten Rods Others |

| By End-User | Aerospace & Defense Electronics & Electrical Manufacturing & Industrial Machinery Oil & Gas Automotive Others |

| By Application | Cutting Tools & Wear Parts Electrical Contacts & Electrodes Radiation Shielding Medical Devices Mining & Drilling Equipment Others |

| By Source | Primary Tungsten Mining Secondary Tungsten Recycling Imports Others |

| By Distribution Channel | Direct Sales Distributors & Traders Online Sales Others |

| By Geography | Abu Dhabi Dubai Sharjah Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tungsten Mining Operations | 60 | Mining Engineers, Operations Managers |

| Tungsten Product Manufacturers | 50 | Procurement Managers, Production Supervisors |

| Research Institutions and Universities | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Officers |

| End-User Industries (Electronics, Aerospace) | 50 | Product Development Managers, Supply Chain Directors |

The UAE Tungsten Market is valued at approximately USD 420 thousand, reflecting a five-year historical analysis. This valuation is influenced by the increasing demand for tungsten across various industries, including aerospace, electronics, and manufacturing.