Region:Middle East

Author(s):Shubham

Product Code:KRAD3664

Pages:81

Published On:November 2025

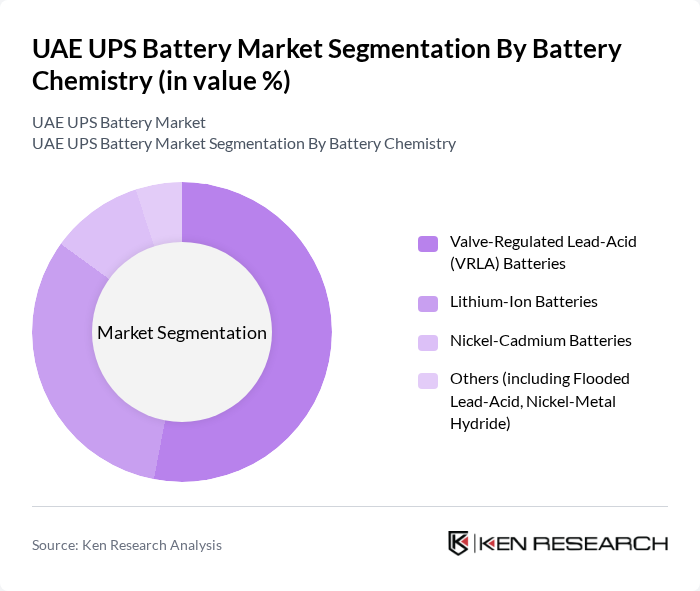

By Battery Chemistry:

The battery chemistry segment includes Valve-Regulated Lead-Acid (VRLA) Batteries, Lithium-Ion Batteries, Nickel-Cadmium Batteries, and Others (including Flooded Lead-Acid, Nickel-Metal Hydride). Among these, Valve-Regulated Lead-Acid (VRLA) Batteries lead the market due to their cost-effectiveness, reliability, and established use in backup applications. Lithium-Ion Batteries are rapidly gaining market share, driven by higher energy density, longer lifespan, and suitability for modern, high-demand environments such as data centers and smart infrastructure. The demand for Nickel-Cadmium Batteries is declining due to environmental concerns and regulatory restrictions, while the 'Others' category includes specialized products for niche applications. VRLA remains the dominant segment, but the shift toward lithium-ion is accelerating .

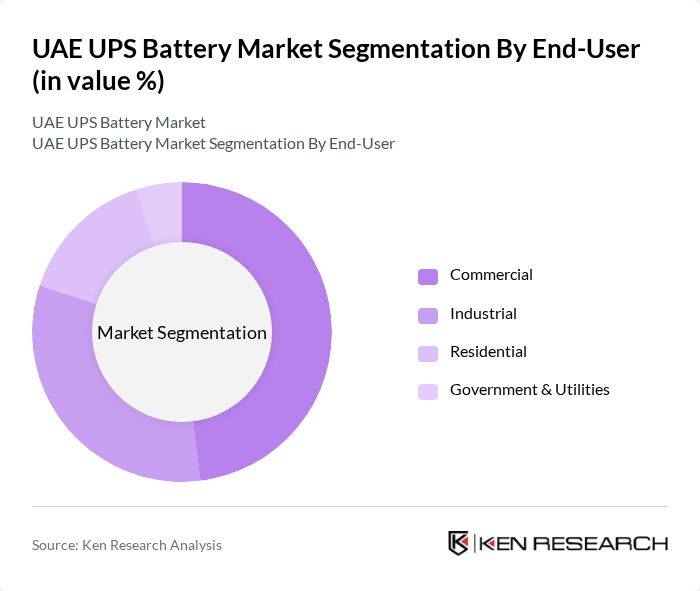

By End-User:

The end-user segment comprises Commercial, Industrial, Residential, and Government & Utilities. The Commercial sector leads the market, driven by the increasing need for reliable power supply in offices, retail spaces, and data centers. The Industrial segment follows, as manufacturing and processing facilities require uninterrupted power for critical operations. Residential demand is growing, supported by rising awareness of energy backup solutions and the adoption of smart home technologies. Government & Utilities contribute through investments in critical infrastructure and public safety systems. The Commercial sector’s dominance is reinforced by the high concentration of businesses and ongoing digital transformation in urban areas .

The UAE UPS Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Battery Manufacturing Company LLC, Gulf Batteries Company Limited, Exide Industries Limited, GS Yuasa Corporation, Saft Groupe S.A., Schneider Electric SE, Vertiv Group Corporation, APC by Schneider Electric, Eaton Corporation plc, Huawei Technologies Co., Ltd., Tripp Lite (an Eaton brand), Legrand S.A., Socomec Group S.A., Panasonic Corporation, and Toshiba Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The UAE UPS battery market is poised for significant growth, driven by technological advancements and increasing energy demands. As businesses prioritize energy efficiency and reliability, the shift towards lithium-ion batteries and smart UPS systems will gain momentum. Additionally, the integration of renewable energy sources will create new opportunities for UPS solutions. With government support for energy efficiency initiatives, the market is expected to evolve, fostering innovation and enhancing the overall resilience of the power supply infrastructure in the region.

| Segment | Sub-Segments |

|---|---|

| By Battery Chemistry | Valve-Regulated Lead-Acid (VRLA) Batteries Lithium-Ion Batteries Nickel-Cadmium Batteries Others (including Flooded Lead-Acid, Nickel-Metal Hydride) |

| By End-User | Commercial Industrial Residential Government & Utilities |

| By Application | Data Centers Telecommunications Healthcare Facilities Manufacturing & Industrial Facilities Others |

| By kVA Rating | Below 1.1 kVA to 5 kVA to 10 kVA to 20 kVA to 100 kVA to 250 kVA to 500 kVA to 800 kVA to 1500 kVA Above 1500 kVA |

| By Phase | Single-Phase Three-Phase |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Dubai Abu Dhabi Sharjah Fujairah Ras Al Khaimah Ajman Umm Al-Quwain Al Ain |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Sector UPS Usage | 100 | Network Operations Managers, IT Directors |

| Healthcare Facility Backup Systems | 80 | Facility Managers, Biomedical Engineers |

| Data Center Power Solutions | 90 | Data Center Managers, Electrical Engineers |

| Industrial UPS Applications | 70 | Operations Managers, Maintenance Supervisors |

| Retail Sector Power Backup | 60 | Store Managers, Supply Chain Coordinators |

The UAE UPS Battery Market is valued at approximately USD 110 million, driven by the increasing demand for uninterrupted power supply across various sectors, including telecommunications, healthcare, and data centers.