Region:Middle East

Author(s):Shubham

Product Code:KRAA8783

Pages:88

Published On:November 2025

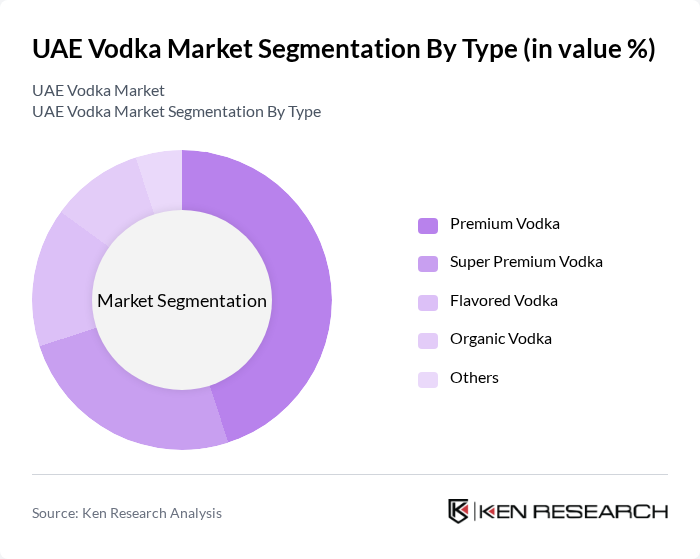

By Type:The vodka market is segmented into various types, including Premium Vodka, Super Premium Vodka, Flavored Vodka, Organic Vodka, and Others. Unflavored vodka accounts for a substantial share of the market, reflecting consumer preference for traditional vodka products. Among premium categories, Premium Vodka is currently the leading sub-segment, driven by consumer preferences for high-quality products and the growing trend of premiumization in the beverage industry. The demand for flavored vodka is also on the rise, appealing to younger consumers seeking unique and innovative drinking experiences.

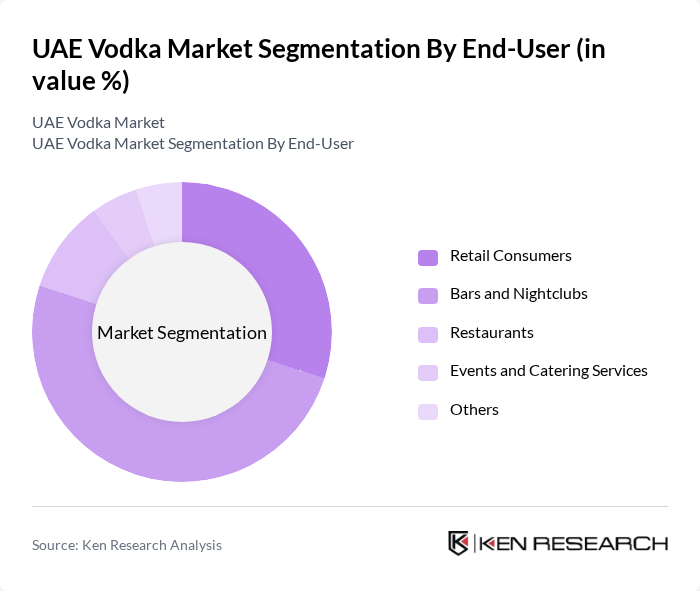

By End-User:The end-user segmentation includes Retail Consumers, Bars and Nightclubs, Restaurants, Events and Catering Services, and Others. On-trade channels constitute the highest market share by volume, with bars and nightclubs dominating this segment as the primary venues for vodka consumption, particularly in urban areas. The vibrant nightlife culture in cities like Dubai and Abu Dhabi significantly contributes to the high demand from this segment, with consumers often seeking premium vodka options for social occasions. Food and drinks specialists represent the next preferred retail channel, offering competitive pricing and product assortment.

The UAE Vodka Market is characterized by a dynamic mix of regional and international players. Leading participants such as Diageo, Pernod Ricard, Russian Standard Vodka, Absolut Vodka, Belvedere Vodka, Grey Goose, Smirnoff, Stolichnaya, Cîroc, Finlandia Vodka, Beluga Vodka, Skyy Vodka, Zubrówka, Three Olives Vodka, Tito's Handmade Vodka contribute to innovation, geographic expansion, and service delivery in this space.

The UAE vodka market is poised for continued growth, driven by evolving consumer preferences and an expanding nightlife scene. As the expatriate population increases and tourism rebounds, brands are likely to innovate with new flavors and health-conscious options. Additionally, the rise of e-commerce platforms for alcohol sales will enhance accessibility, allowing consumers to explore diverse vodka offerings. This dynamic environment presents opportunities for brands to engage with consumers through targeted marketing strategies and collaborations with local establishments.

| Segment | Sub-Segments |

|---|---|

| By Type | Premium Vodka Super Premium Vodka Flavored Vodka Organic Vodka Others |

| By End-User | Retail Consumers Bars and Nightclubs Restaurants Events and Catering Services Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Duty-Free Shops Others |

| By Packaging Type | Glass Bottles Plastic Bottles Cans Others |

| By Price Range | Economy Mid-Range Premium Super Premium Others |

| By Flavor Profile | Citrus Berry Spicy Herbal Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Vodka | 120 | Vodka Consumers, Age 21-45 |

| Retail Insights on Vodka Sales | 80 | Store Managers, Beverage Buyers |

| Hospitality Sector Trends | 70 | Bar Managers, Restaurant Owners |

| Distribution Channel Analysis | 60 | Distributors, Wholesalers |

| Market Entry Strategies for New Brands | 50 | Brand Managers, Marketing Directors |

The UAE Vodka Market is valued at approximately USD 1.0 billion, reflecting a significant growth trend driven by increasing consumer demand, particularly among expatriates and tourists, as well as a rising interest in premium and flavored vodka products.