Region:Asia

Author(s):Dev

Product Code:KRAD7645

Pages:91

Published On:December 2025

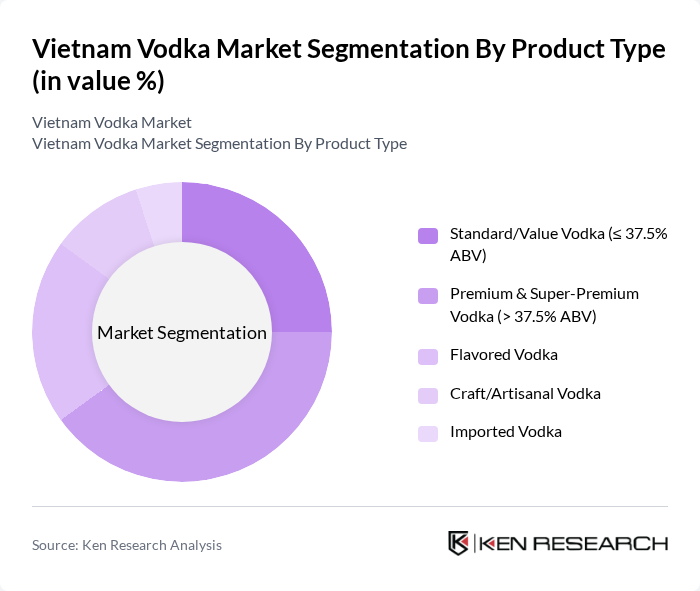

By Product Type:The product type segmentation of the vodka market includes various categories that cater to different consumer preferences. The subsegments are Standard/Value Vodka (? 37.5% ABV), Premium & Super-Premium Vodka (> 37.5% ABV), Flavored Vodka, Craft/Artisanal Vodka, and Imported Vodka. Among these, the Premium & Super-Premium Vodka segment is currently leading the market in value terms, supported by the premiumization trend in Vietnam’s spirits sector and rising willingness to pay for international and higher-quality brands among middle- and upper-income consumers. This trend is driven by a growing urban middle class with higher disposable incomes, increased exposure to Western drinking culture, and a desire for experiential and luxury-oriented consumption occasions in bars, clubs, and high-end restaurants. The Flavored Vodka segment is also gaining traction, particularly among younger consumers and female drinkers who seek approachable taste profiles, mixability in cocktails, and novel flavor innovations introduced by global brands and select local producers.

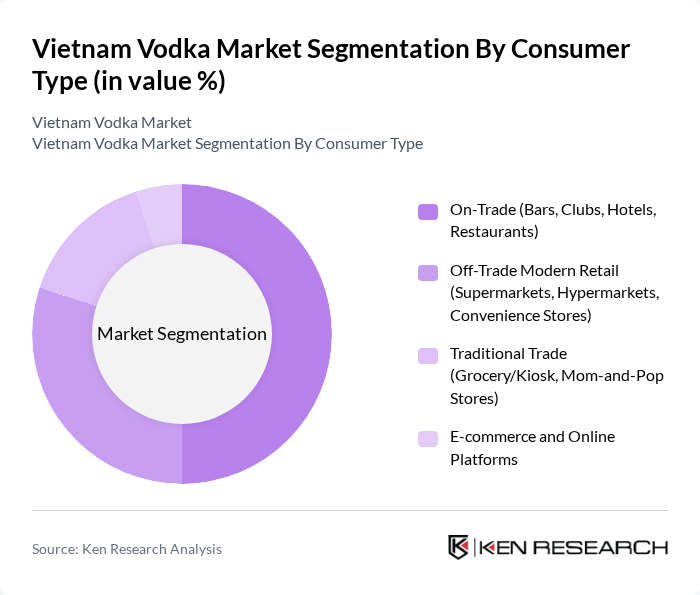

By Consumer Type:The consumer type segmentation includes On-Trade (Bars, Clubs, Hotels, Restaurants), Off-Trade Modern Retail (Supermarkets, Hypermarkets, Convenience Stores), Traditional Trade (Grocery/Kiosk, Mom-and-Pop Stores), and E-commerce and Online Platforms. The On-Trade segment is currently the dominant player for vodka in value terms, driven by Vietnam’s vibrant nightlife, tourism, and social drinking culture in major cities where spirits and cocktails command higher price points. Consumers are increasingly opting for vodka in bars and restaurants as part of mixed drinks and signature cocktails, linking vodka consumption to lifestyle and experiential occasions rather than purely at-home drinking. The Off-Trade Modern Retail segment is also significant and expanding, as supermarkets, hypermarkets, and convenience stores in urban areas broaden their imported spirits assortments, enabling consumers to purchase vodka for home gatherings, gifting, and festive occasions. E-commerce and online platforms, while still a smaller share, are growing in importance for spirits due to increasing digital adoption, home delivery services, and online promotional campaigns by licensed distributors.

The Vietnam Vodka Market is characterized by a dynamic mix of regional and international players. Leading participants such as T?ng Công Ty C? Ph?n Bia – R??u – N??c Gi?i Khát Sài Gòn (SABECO), T?ng Công Ty C? Ph?n Bia – R??u – N??c Gi?i Khát Hà N?i (HABECO), Công Ty C? Ph?n R??u Và N??c Gi?i Khát Hà N?i (HALICO) – Vodka Hà N?i, Diageo Vi?t Nam – Smirnoff, Pernod Ricard Vi?t Nam – Absolut Vodka, Bacardi Limited – Grey Goose Vodka (Imported), Russian Standard Vodka (Imported), Beluga Group – Beluga Vodka (Imported), Brown-Forman Corporation – Finlandia Vodka, Tito’s Handmade Vodka (Imported), Rémy Cointreau – Cîroc Vodka (Imported), Maspex Group – ?ubrówka Vodka (Imported), Công Ty TNHH R??u H?u Ngh? – Local Vodka Brands, Selected Craft/Artisanal Vodka Producers in Vietnam, Key Duty-Free and Travel Retail Vodka Suppliers Active in Vietnam contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam vodka market is poised for continued growth, driven by evolving consumer preferences and a burgeoning nightlife culture. As disposable incomes rise, consumers are increasingly seeking premium and artisanal vodka options. The trend towards health-conscious choices may also influence product offerings, with brands exploring low-calorie and organic variants. Furthermore, the expansion of e-commerce platforms is expected to enhance accessibility, allowing consumers to purchase vodka conveniently, thus broadening market reach and engagement.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Standard/Value Vodka Premium & Super-Premium Vodka Flavored Vodka Craft/Artisanal Vodka Imported Vodka |

| By Consumer Type | On-Trade Off-Trade Modern Retail Traditional Trade E-commerce and Online Platforms |

| By Packaging Type | Glass Bottles Miniatures PET/Plastic Bottles Gift Packs and Limited Editions |

| By Distribution Channel | Off-Trade Retail On-Trade Traditional Grocery and Liquor Stores Online Retail and Direct-to-Consumer |

| By Price Band | Economy Mid-Range Premium Travel Retail & Gifting SKUs |

| By Occasion of Consumption | Home Consumption and Casual Gatherings Nightlife and On-Premise Occasions Festive and Cultural Celebrations Corporate and Gifting Occasions |

| By Consumer Demographics | Age Group Gender Income Level Urban vs Rural Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Vodka | 120 | Vodka Consumers, Age 21-40 |

| Retail Insights on Vodka Sales | 100 | Retail Managers, Spirits Category Managers |

| Distribution Channel Analysis | 80 | Distributors, Wholesalers |

| Market Trends and Innovations | 70 | Industry Experts, Market Analysts |

| Brand Perception Studies | 90 | Brand Managers, Marketing Executives |

The Vietnam Vodka Market is valued at approximately USD 180 million, reflecting a significant share within the spirits category and indicating robust consumer demand for vodka in the country's alcoholic drinks market.