Region:Middle East

Author(s):Rebecca

Product Code:KRAC8415

Pages:92

Published On:November 2025

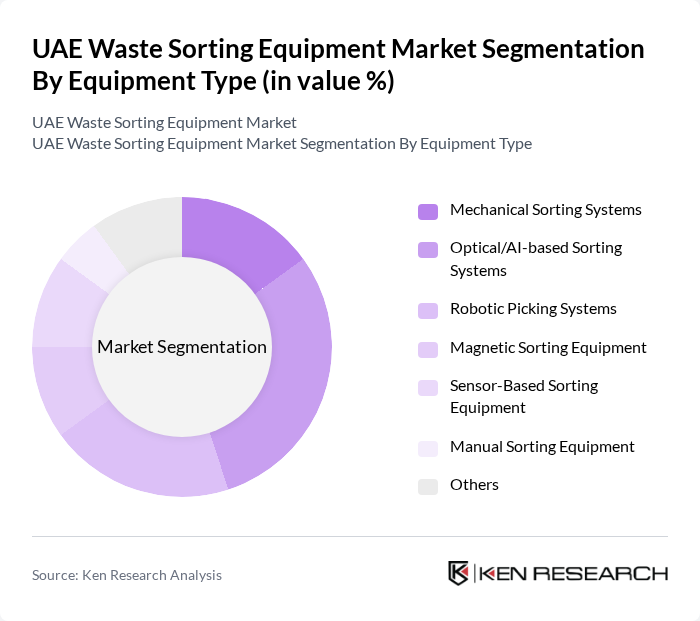

By Equipment Type:The equipment type segmentation includes various technologies used for waste sorting, each catering to different operational needs and efficiencies. The subsegments include Mechanical Sorting Systems, Optical/AI-based Sorting Systems, Robotic Picking Systems, Magnetic Sorting Equipment, Sensor-Based Sorting Equipment, Manual Sorting Equipment, and Others. Among these, Optical/AI-based Sorting Systems and other automated solutions are gaining traction due to their efficiency and accuracy in sorting various waste types, driven by advancements in technology and increasing demand for automation in waste management.

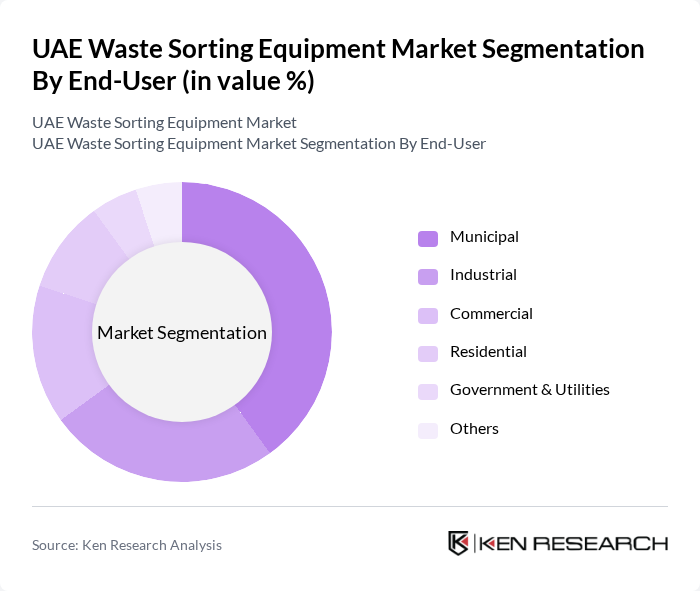

By End-User:The end-user segmentation encompasses various sectors utilizing waste sorting equipment, including Municipal, Industrial, Commercial, Residential, Government & Utilities, and Others. The Municipal segment is particularly dominant, driven by government initiatives to enhance waste management systems and improve recycling rates. The increasing population and urbanization in cities like Dubai and Abu Dhabi further contribute to the demand for efficient waste sorting solutions in municipal applications.

The UAE Waste Sorting Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environmental Services, SUEZ Recycling and Recovery, TOMRA Systems ASA, Dulsco LLC, Bee'ah (Sharjah Environment Company), Emirates Waste to Energy Company, Al Shirawi Equipment Company LLC, Enviroserve, Al Dhafra Recycling Industries, Abu Dhabi Waste Management Center (Tadweer), Green Planet Environmental Solutions, Mil-tek Middle East, Solwearth Ecotech, ZenRobotics, BHS-Sonthofen contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE waste sorting equipment market appears promising, driven by ongoing government initiatives and technological advancements. As the country aims to achieve its sustainability goals, investments in smart waste management solutions are expected to rise significantly. The integration of AI and IoT technologies will enhance operational efficiency, while public awareness campaigns will likely improve recycling rates. Overall, the market is poised for growth as stakeholders collaborate to create a more sustainable waste management ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Mechanical Sorting Systems Optical/AI-based Sorting Systems Robotic Picking Systems Magnetic Sorting Equipment Sensor-Based Sorting Equipment Manual Sorting Equipment Others |

| By End-User | Municipal Industrial Commercial Residential Government & Utilities Others |

| By Waste Type | Plastic Waste Organic Waste Metal Waste Paper & Cardboard E-Waste Glass Others |

| By Operation Mode | Automatic Semi-Automatic Manual Hybrid Others |

| By Application | Municipal Waste Management Industrial Waste Management Commercial Waste Management Construction & Demolition Waste Management Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Municipal Waste Management Authorities | 100 | Waste Management Directors, Environmental Policy Makers |

| Private Sector Waste Sorting Facilities | 60 | Facility Managers, Operations Supervisors |

| Manufacturers of Waste Sorting Equipment | 50 | Product Development Managers, Sales Directors |

| Environmental Consultants | 40 | Sustainability Consultants, Project Managers |

| Recycling Industry Stakeholders | 70 | Recycling Plant Managers, Business Development Executives |

The UAE Waste Sorting Equipment Market is valued at approximately USD 30 million, reflecting a growing demand driven by urbanization, advanced automation technologies, and sustainable waste management practices.