Region:Middle East

Author(s):Rebecca

Product Code:KRAB7360

Pages:84

Published On:October 2025

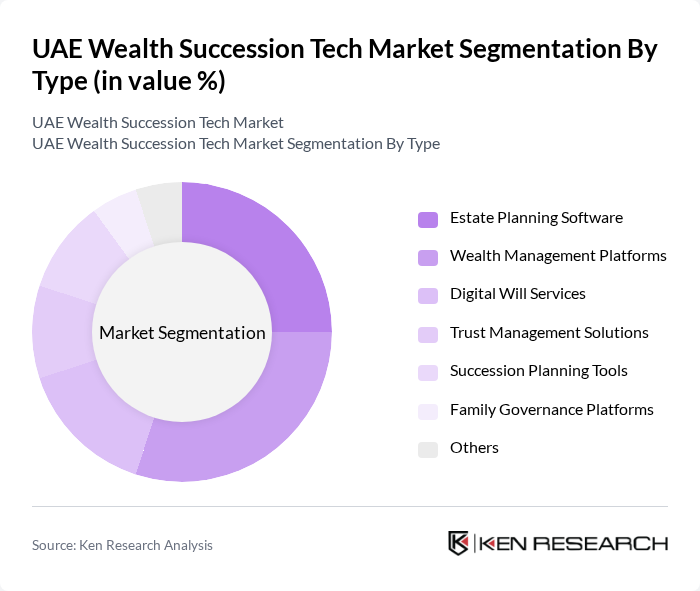

By Type:The market is segmented into various types, including Estate Planning Software, Wealth Management Platforms, Digital Will Services, Trust Management Solutions, Succession Planning Tools, Family Governance Platforms, and Others. Each of these segments caters to specific needs within wealth succession, with technology playing a crucial role in enhancing service delivery and client engagement.

By End-User:The end-user segmentation includes Individual HNWIs, Family Offices, Financial Advisors, Legal Firms, Corporations, Non-Profit Organizations, and Others. Each segment has unique requirements and preferences, influencing the types of technology solutions they adopt for wealth succession and management.

The UAE Wealth Succession Tech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wealth-X, Everplans, Trust & Will, EstateGuru, Willful, LegacyArmour, MyLifeLocker, Zola Suite, Wealthsimple, LegalZoom, Xero, Clio, Trusts & Estates, Family Office Exchange, CIBC Private Wealth contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE wealth succession tech market appears promising, driven by technological advancements and changing consumer preferences. As digital platforms become increasingly sophisticated, the integration of AI and machine learning will enhance personalization in wealth management services. Additionally, the growing trend towards sustainable investments will likely influence product offerings, as consumers seek solutions that align with their values. This evolving landscape presents significant opportunities for innovation and growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Estate Planning Software Wealth Management Platforms Digital Will Services Trust Management Solutions Succession Planning Tools Family Governance Platforms Others |

| By End-User | Individual HNWIs Family Offices Financial Advisors Legal Firms Corporations Non-Profit Organizations Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Financial Institutions Resellers and Distributors Others |

| By Pricing Model | Subscription-Based One-Time Purchase Freemium Model Pay-Per-Use Others |

| By Customer Segment | Affluent Individuals Ultra-HNWIs Small and Medium Enterprises Large Corporations Others |

| By Geographic Presence | UAE GCC Region International Markets Others |

| By Service Type | Consulting Services Implementation Services Support and Maintenance Training Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| High-Net-Worth Individual Insights | 150 | Wealthy Individuals, Family Business Owners |

| Wealth Management Firm Perspectives | 100 | Wealth Managers, Financial Advisors |

| Legal Experts on Succession Planning | 80 | Estate Planners, Legal Advisors |

| Technology Providers in Wealth Succession | 70 | Fintech Executives, Product Managers |

| Regulatory Bodies and Policy Makers | 50 | Government Officials, Regulatory Analysts |

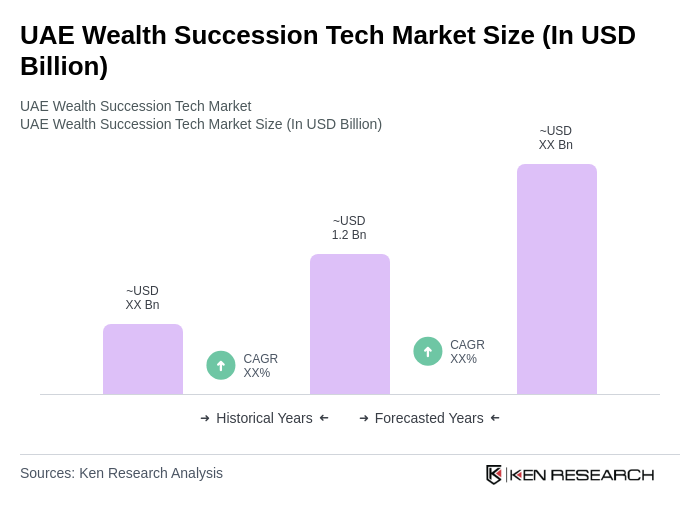

The UAE Wealth Succession Tech Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by an increasing number of high-net-worth individuals (HNWIs) and advancements in technology that enhance wealth management and succession planning services.