3.1 Growth Drivers

3.1.1 Increasing Affluence and Wealth Concentration

3.1.2 Rising Awareness of Estate Planning

3.1.3 Technological Advancements in Financial Services

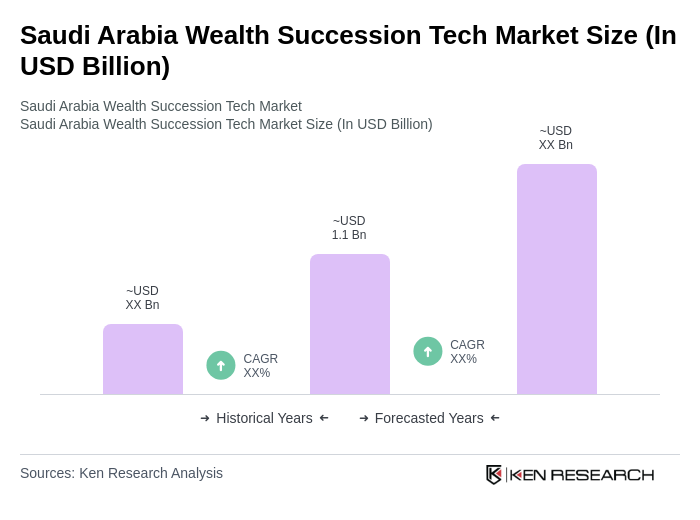

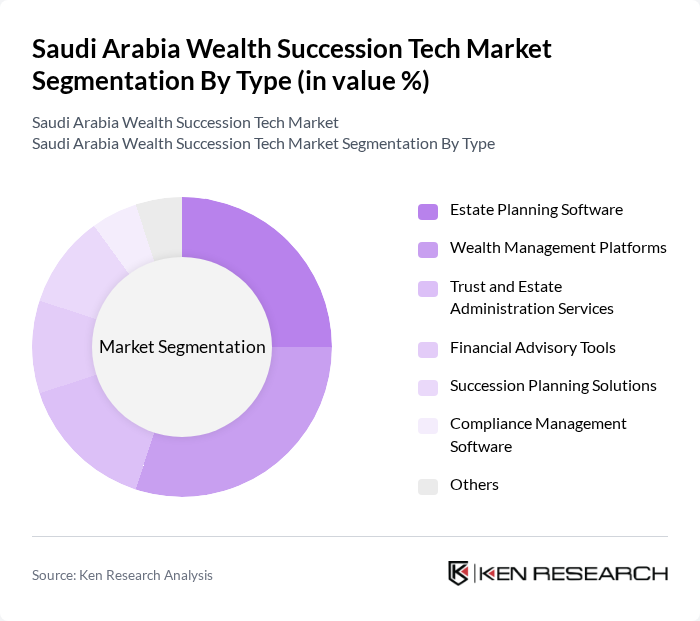

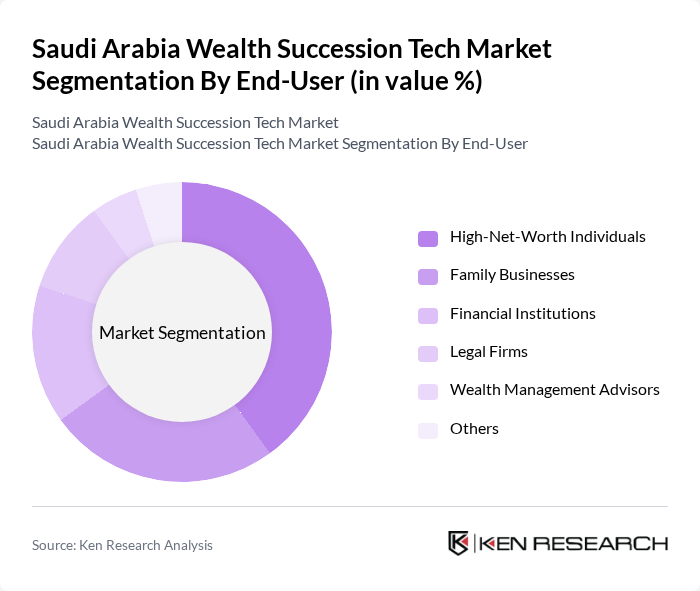

3.1.4 Government Initiatives Supporting Wealth Management3.2 Market Challenges3.2.1 Regulatory Compliance Complexity3.2.2 Cultural Resistance to Wealth Succession Planning3.2.3 Limited Awareness of Available Technologies3.2.4 Competition from Traditional Wealth Management Firms3.3 Market Opportunities3.3.1 Growth of Digital Financial Services3.3.2 Expansion of Family Offices3.3.3 Increasing Demand for Customized Solutions3.3.4 Collaboration with Fintech Startups3.4 Market Trends3.4.1 Shift Towards Digital Platforms for Wealth Management3.4.2 Integration of AI and Machine Learning in Services3.4.3 Focus on Sustainable and Ethical Investment3.4.4 Emergence of Blockchain for Secure Transactions3.5 Government Regulation3.5.1 New Tax Regulations on Inheritance3.5.2 Licensing Requirements for Wealth Management Firms3.5.3 Consumer Protection Laws in Financial Services3.5.4 Anti-Money Laundering Compliance Standards4. SWOT Analysis5. Stakeholder Analysis6. Porter's Five Forces Analysis7. Saudi Arabia Wealth Succession Tech Market Market Size, 2019-20247.1 By Value7.2 By Volume7.3 By Average Selling Price8. Saudi Arabia Wealth Succession Tech Market Segmentation8.1 By Type8.1.1 Estate Planning Software8.1.2 Wealth Management Platforms8.1.3 Trust and Estate Administration Services8.1.4 Financial Advisory Tools8.1.5 Succession Planning Solutions8.1.6 Compliance Management Software8.1.7 Others8.2 By End-User8.2.1 High-Net-Worth Individuals8.2.2 Family Businesses8.2.3 Financial Institutions8.2.4 Legal Firms8.2.5 Wealth Management Advisors8.2.6 Others8.3 By Application8.3.1 Estate Planning8.3.2 Tax Planning8.3.3 Asset Protection8.3.4 Investment Management8.3.5 Philanthropic Planning8.3.6 Others8.4 By Distribution Channel8.4.1 Direct Sales8.4.2 Online Platforms8.4.3 Financial Advisors8.4.4 Partnerships with Legal Firms8.4.5 Others8.5 By Pricing Model8.5.1 Subscription-Based8.5.2 One-Time Fee8.5.3 Commission-Based8.5.4 Freemium Model8.5.5 Others8.6 By Customer Segment8.6.1 Individual Clients8.6.2 Corporate Clients8.6.3 Institutional Clients8.6.4 Government Entities8.6.5 Others8.7 By Service Level8.7.1 Basic Services8.7.2 Premium Services8.7.3 Customized Solutions8.7.4 Advisory Services8.7.5 Others9. Saudi Arabia Wealth Succession Tech Market Competitive Analysis9.1 Market Share of Key Players9.2 Cross Comparison of Key Players9.2.1 Company Name9.2.2 Group Size (Large, Medium, or Small as per industry convention)9.2.3 Assets Under Management (AUM)9.2.4 Shariah-Compliant Product Penetration9.2.5 Digital Platform Adoption Rate9.2.6 Client Retention Rate9.2.7 Revenue Growth Rate9.2.8 Average Revenue Per User (ARPU)9.2.9 Return on Investment (ROI)9.2.10 Succession Planning Service Penetration9.3 SWOT Analysis of Top Players9.4 Pricing Analysis9.5 Detailed Profile of Major Companies9.5.1 Al Rajhi Bank9.5.2 Saudi National Bank (formerly National Commercial Bank)9.5.3 Riyad Bank9.5.4 Alinma Bank9.5.5 Banque Saudi Fransi9.5.6 Arab National Bank9.5.7 Saudi Investment Bank9.5.8 Gulf International Bank9.5.9 HSBC Saudi Arabia9.5.10 Morgan Stanley Saudi Arabia9.5.11 Deloitte Saudi Arabia9.5.12 PwC Saudi Arabia9.5.13 Lombard Odier (Middle East presence)9.5.14 Brookfield Asset Management (Middle East presence)9.5.15 FinTech Saudi (local fintech ecosystem enabler)10. Saudi Arabia Wealth Succession Tech Market End-User Analysis10.1 Procurement Behavior of Key Ministries10.1.1 Ministry of Finance10.1.2 Ministry of Commerce10.1.3 Ministry of Investment10.1.4 Ministry of Justice10.2 Corporate Spend on Infrastructure & Energy10.2.1 Investment in Digital Transformation10.2.2 Budget Allocation for Wealth Management10.2.3 Expenditure on Compliance and Regulation10.3 Pain Point Analysis by End-User Category10.3.1 High-Net-Worth Individuals10.3.2 Family Businesses10.3.3 Financial Institutions10.4 User Readiness for Adoption10.4.1 Awareness of Wealth Succession Technologies10.4.2 Willingness to Invest in Solutions10.4.3 Training and Support Needs10.5 Post-Deployment ROI and Use Case Expansion10.5.1 Measurement of Success Metrics10.5.2 Opportunities for Upselling10.5.3 Feedback Mechanisms for Improvement11. Saudi Arabia Wealth Succession Tech Market Future Size, 2025-203011.1 By Value11.2 By Volume11.3 By Average Selling PriceGo-To-Market Strategy Phase1. Whitespace Analysis + Business Model Canvas1.1 Market Gaps Identification1.2 Value Proposition Development1.3 Revenue Streams Analysis1.4 Customer Segmentation1.5 Key Partnerships1.6 Cost Structure Evaluation1.7 Competitive Advantage Assessment2. Marketing and Positioning Recommendations2.1 Branding Strategies2.2 Product USPs2.3 Target Audience Identification2.4 Communication Channels2.5 Marketing Budget Allocation3. Distribution Plan3.1 Urban Retail Strategies3.2 Rural NGO Tie-Ups3.3 Online Distribution Channels3.4 Partnerships with Financial Institutions4. Channel & Pricing Gaps4.1 Underserved Routes4.2 Pricing Bands Analysis4.3 Competitor Pricing Comparison5. Unmet Demand & Latent Needs5.1 Category Gaps5.2 Consumer Segments Analysis5.3 Emerging Trends Identification6. Customer Relationship6.1 Loyalty Programs6.2 After-Sales Service6.3 Customer Feedback Mechanisms7. Value Proposition7.1 Sustainability Initiatives7.2 Integrated Supply Chains7.3 Unique Selling Points8. Key Activities8.1 Regulatory Compliance8.2 Branding Efforts8.3 Distribution Setup9. Entry Strategy Evaluation9.1 Domestic Market Entry Strategy9.1.1 Product Mix Considerations9.1.2 Pricing Band Strategy9.1.3 Packaging Options9.2 Export Entry Strategy9.2.1 Target Countries9.2.2 Compliance Roadmap10. Entry Mode Assessment10.1 Joint Ventures10.2 Greenfield Investments10.3 Mergers & Acquisitions10.4 Distributor Model11. Capital and Timeline Estimation11.1 Capital Requirements11.2 Timelines for Implementation12. Control vs Risk Trade-Off12.1 Ownership vs Partnerships13. Profitability Outlook13.1 Breakeven Analysis13.2 Long-Term Sustainability14. Potential Partner List14.1 Distributors14.2 Joint Ventures14.3 Acquisition Targets15. Execution Roadmap15.1 Phased Plan for Market Entry15.1.1 Market Setup15.1.2 Market Entry15.1.3 Growth Acceleration15.1.4 Scale & Stabilize15.2 Key Activities and Milestones15.2.1 Milestone Planning15.2.2 Activity TrackingDisclaimerContact Us```

## Validation and Updates

### Section 8: Market Segmentation

- **No structural changes needed.** The segmentation is comprehensive and relevant for the Saudi wealth succession tech market, covering types, end-users, applications, distribution channels, pricing models, customer segments, and service levels.

- **Recommendation:** Consider adding “Family Offices” as a distinct end-user segment, given their growing role in Saudi wealth management and succession planning[1].

- **Recommendation:** Under “By Type,” consider adding “Family Office Management Platforms” to reflect the institutionalization of family wealth structures[1].

### Section 9.2: KPIs for Cross Comparison of Key Players

- **Original KPIs were generic.** For the Saudi wealth succession tech market, investor-relevant, measurable KPIs should reflect local market dynamics, digital adoption, and regulatory compliance.

- **Updated KPIs:**

- **Assets Under Management (AUM):** Critical for comparing scale and market influence[6].

- **Shariah-Compliant Product Penetration:** Over 95% of mutual funds are Shariah-compliant; this is a key differentiator in Saudi Arabia[2].

- **Digital Platform Adoption Rate:** Measures tech integration, a major growth driver[3].

- **Client Retention Rate:** Indicates service quality and loyalty in a relationship-driven market.

- **Revenue Growth Rate:** Standard for benchmarking performance.

- **Average Revenue Per User (ARPU):** Reflects monetization and client value.

- **Return on Investment (ROI):** Essential for investor decision-making.

- **Succession Planning Service Penetration:** Measures how deeply firms are embedded in the succession planning value chain.

- **Removed less relevant KPIs** (e.g., Customer Acquisition Cost, Churn Rate, Pricing Strategy) as they are less central to institutional and HNWI wealth management in this context.

### Section 9.5: List of Major Companies

- **Corrected and updated company names** for accuracy and relevance to the Saudi wealth succession tech ecosystem.

- **Added leading international and advisory firms** with a Saudi presence, reflecting the market’s increasing sophistication and global integration[2].

- **Included FinTech Saudi** as a key ecosystem enabler, given its role in digital transformation and fintech adoption[3].

- **Removed outdated or less relevant names** (e.g., Samba Financial Group merged into Saudi National Bank; Alawwal Bank merged into Saudi National Bank; Emirates NBD is UAE-based and less central to Saudi succession tech).

- **Ensured all names render correctly in UTF-8** (no garbled characters).

**Rationale for company selection:**

The list now covers major Saudi banks (core wealth managers), global banks with Saudi operations, top advisory/audit firms, international asset managers with a Saudi footprint, and a leading local fintech ecosystem player—all of whom are active in wealth management, succession planning, and digital transformation in Saudi Arabia[1][2][3].

---

**All other sections, tags, and structure remain unchanged as per your instructions.**

**No other sections were truncated or removed.**

**All corrections are directl