UAE Wind Power Industry Market Overview

- The UAE Wind Power Industry Market is valued at USD 400 million, based on a five-year historical analysis. This growth is primarily driven by the increasing focus on renewable energy sources, government initiatives to diversify energy portfolios, and the rising demand for sustainable energy solutions. The UAE's commitment to reducing carbon emissions and enhancing energy security has significantly contributed to the expansion of the wind power sector.

- Key players in this market include Abu Dhabi, Dubai, and Sharjah, which dominate as leading emirates in setting energy policy, hosting grid infrastructure, and attracting clean-energy investment, rather than being commercial wind developers themselves. These emirates have established themselves as hubs for renewable energy projects and innovation, especially in solar and hybrid wind-solar systems, supported by entities such as Masdar in Abu Dhabi and Dubai Electricity and Water Authority (DEWA), which increasingly assess wind resource opportunities alongside other clean technologies. Their strategic investments in transmission networks, green hydrogen pilots, and smart-grid modernization, together with favorable regulatory frameworks and long-term clean-energy targets, help create the enabling environment required for future wind power deployment.

- In 2023, the UAE government continued to advance a comprehensive clean energy strategy, building on the UAE Energy Strategy 2050 and the updated 2030 climate targets, which aim for around 50% of the power mix from clean sources (including solar, wind, nuclear, and other low-carbon technologies) by 2050 rather than 50% specifically from wind. This policy framework encompasses various incentives and support mechanisms for renewable energy projects—such as competitive tenders, green financing platforms, and streamlined permitting for priority projects—and is complemented by large-scale solar parks, the Barakah nuclear plant, and a growing portfolio of distributed and hybrid systems that may integrate wind where resource conditions are favorable. For wind specifically, the strategy focuses on continued resource mapping, pilot projects in suitable onshore and coastal areas, and integration with storage and solar to enhance system reliability and grid flexibility.

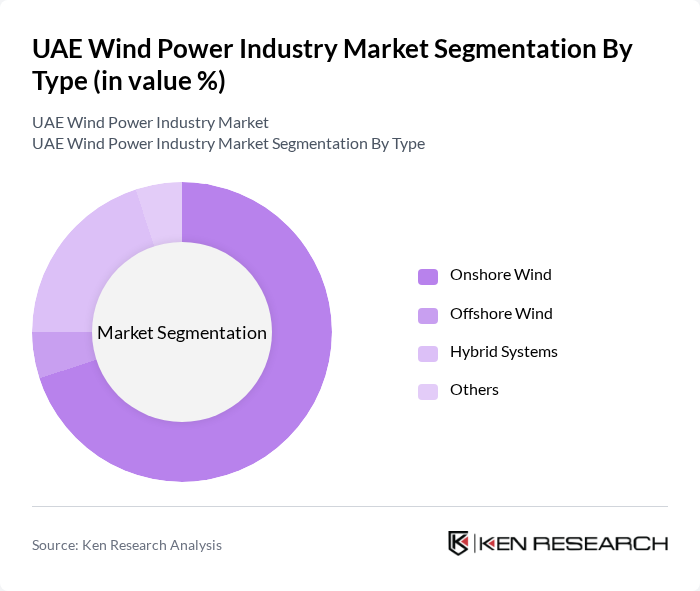

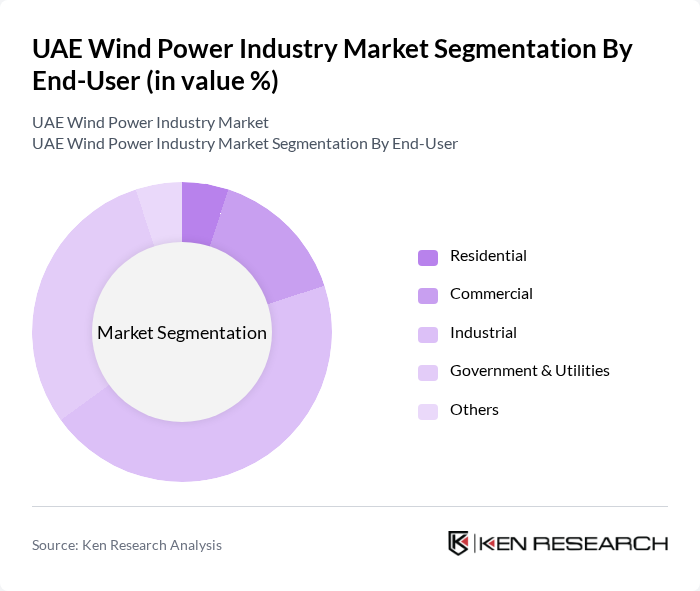

UAE Wind Power Industry Market Segmentation

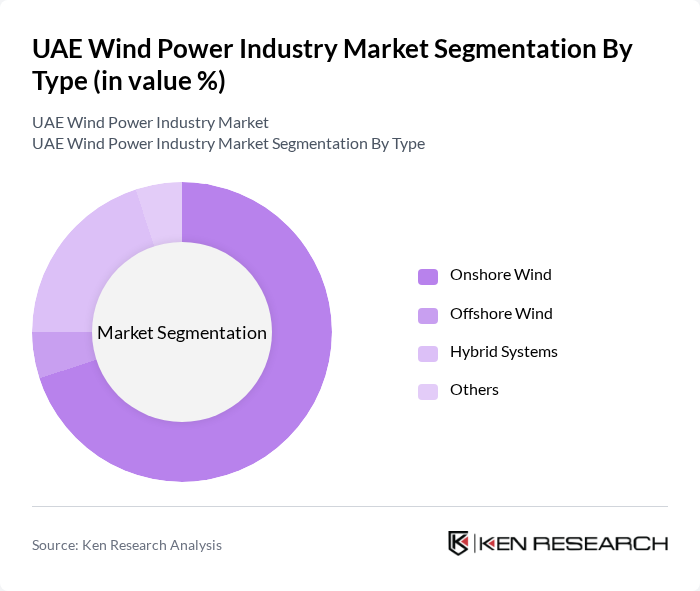

By Type:The segmentation of the wind power market by type includes Onshore Wind, Offshore Wind, Hybrid Systems, and Others. Onshore wind is currently the leading segment due to its lower installation costs and the availability of suitable land. Offshore wind is gaining traction, particularly in coastal areas, due to its higher energy yield and reduced visual impact. Hybrid systems are emerging as a viable option, combining wind with other renewable sources to enhance energy reliability.

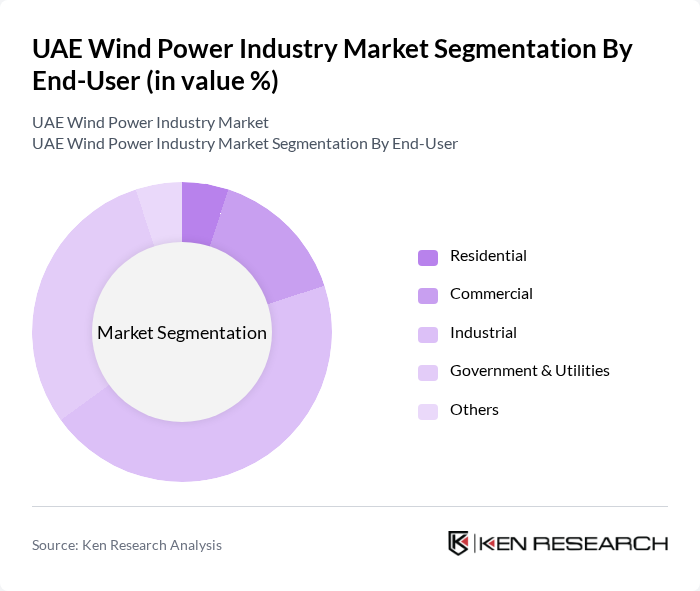

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The industrial segment is the largest potential consumer of wind-linked energy solutions in the UAE, with demand concentrated in energy-intensive sectors such as heavy industry, manufacturing, and large commercial complexes that increasingly seek long-term clean-power agreements and hybrid renewable systems to manage costs and emissions. Government and utility sectors are also significant users, as national utilities and government-backed entities lead most grid-connected renewable projects, procure equipment, and operate demonstration or pilot wind projects that build experience and data for future scaling. The residential segment is comparatively small for wind, as most households access clean energy indirectly via the grid and rooftop solar takes precedence at the building level, but interest is growing in community energy programs and green tariffs that may, over time, incorporate a share of wind power; the commercial and “Others” segments include business parks, tourism developments, and infrastructure projects that may adopt hybrid wind-solar systems as part of ESG and sustainability strategies.

UAE Wind Power Industry Market Competitive Landscape

The UAE Wind Power Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Gamesa, Vestas Wind Systems, GE Renewable Energy, Nordex SE, Enel Green Power, Acciona Energy, Suzlon Energy, Ørsted, EDP Renewables, Brookfield Renewable Partners, TotalEnergies, First Solar, Canadian Solar, JinkoSolar, RWE Renewables contribute to innovation, geographic expansion, and service delivery in this space.

UAE Wind Power Industry Market Industry Analysis

Growth Drivers

- Increasing Demand for Renewable Energy:The UAE's energy consumption reached approximately 1,200 terawatt-hours (TWh) in the future, with a projected increase to 1,300 TWh in the future. This rising demand is driving the shift towards renewable energy sources, including wind power. The UAE government aims to generate 50% of its energy from renewables by 2050, highlighting the urgency for wind energy projects to meet this target and reduce reliance on fossil fuels.

- Government Initiatives and Investments:The UAE government allocated AED 600 billion (approximately USD 163 billion) for renewable energy projects by 2050. Initiatives like the Mohammed bin Rashid Al Maktoum Solar Park and the Abu Dhabi Renewable Energy Company are pivotal in promoting wind energy. These investments are expected to create over 100,000 jobs in the renewable sector, further stimulating economic growth and attracting foreign investments in wind power.

- Technological Advancements in Wind Turbines:The UAE is witnessing significant advancements in wind turbine technology, with turbine capacities increasing from 2 MW to 4 MW on average. This improvement enhances energy efficiency and reduces the cost of wind energy production. The integration of smart technologies in turbine design is expected to lower operational costs by 15% in the future, making wind power more competitive against traditional energy sources.

Market Challenges

- High Initial Capital Investment:The initial capital required for wind power projects in the UAE can exceed AED 1 billion (approximately USD 272 million) for large-scale installations. This high upfront cost poses a significant barrier for new entrants and can deter investment. Additionally, the long payback period, often exceeding 10 years, further complicates financing and investment decisions in the wind power sector.

- Land Acquisition Issues:Securing land for wind farms in the UAE can be challenging due to regulatory restrictions and competition for land use. Approximately 30% of proposed wind project sites face land acquisition hurdles, which can delay project timelines. The need for extensive environmental assessments and community consultations adds complexity, potentially increasing project costs and timelines significantly.

UAE Wind Power Industry Market Future Outlook

The future of the UAE wind power industry appears promising, driven by a strong commitment to renewable energy and technological advancements. In the future, the integration of smart grid technologies is expected to enhance energy management and efficiency. Additionally, the expansion of offshore wind projects is anticipated to attract significant investments, further diversifying the energy mix. As urban areas continue to grow, the demand for clean energy solutions will likely accelerate, positioning wind power as a key player in the UAE's energy landscape.

Market Opportunities

- Expansion of Offshore Wind Projects:The UAE has identified potential offshore wind sites capable of generating over 1,000 MW of energy. This expansion presents a lucrative opportunity for investment and development, with expected project costs around AED 3 billion (approximately USD 816 million). Offshore wind farms can significantly contribute to the UAE's renewable energy targets while providing job opportunities in coastal regions.

- Technological Innovations in Energy Storage:The development of advanced energy storage solutions, such as lithium-ion batteries, is projected to grow by 20% annually. This innovation will enhance the reliability of wind energy by addressing intermittency issues. With investments in energy storage expected to reach AED 1.5 billion (approximately USD 408 million) in the future, this sector presents a significant opportunity for synergy with wind power projects.