UK Online Classifieds and Market Overview

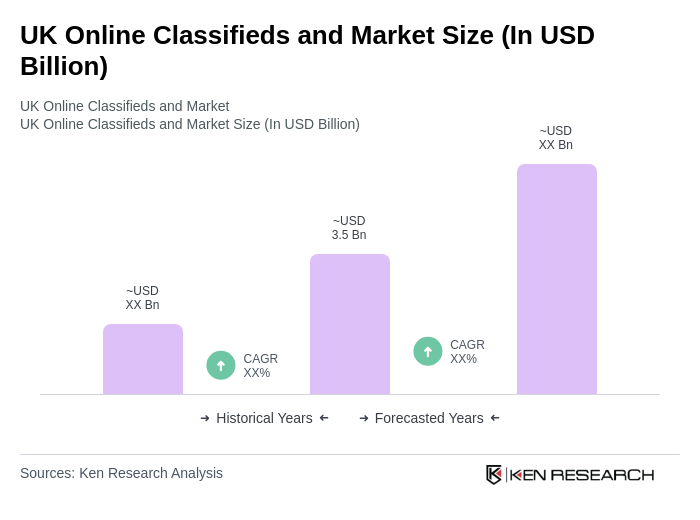

- The UK Online Classifieds and Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet, the rise of mobile commerce, and changing consumer behaviors favoring online transactions over traditional methods. The convenience of accessing a wide range of products and services from the comfort of home has significantly contributed to the market's expansion.

- Key cities dominating this market include London, Manchester, and Birmingham. London, as the capital, serves as a hub for various industries, attracting a diverse population that drives demand for online classifieds. Manchester and Birmingham also contribute significantly due to their large urban populations and vibrant local economies, making them attractive markets for both buyers and sellers.

- In 2023, the UK government implemented regulations to enhance consumer protection in online marketplaces. This includes the introduction of the Online Safety Bill, which aims to ensure that platforms take responsibility for user-generated content and protect consumers from fraud and scams. The regulation mandates stricter verification processes for sellers and improved reporting mechanisms for users, fostering a safer online trading environment.

UK Online Classifieds and Market Segmentation

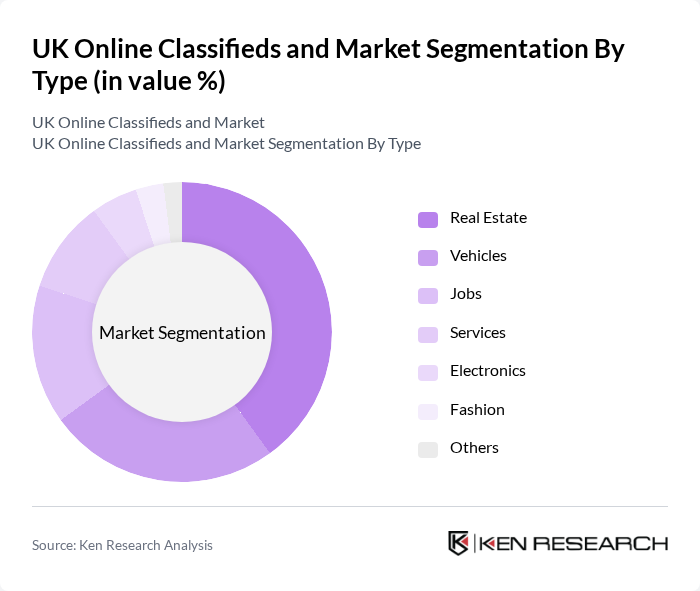

By Type:

The online classifieds market is segmented into various types, including Real Estate, Vehicles, Jobs, Services, Electronics, Fashion, and Others. Among these, the Real Estate segment is currently dominating the market due to the increasing demand for housing and rental properties, particularly in urban areas. The trend of remote working has also led to a surge in interest in suburban and rural properties, further driving this segment's growth. The Vehicles segment follows closely, fueled by the growing popularity of online platforms for buying and selling cars, motorcycles, and other vehicles.

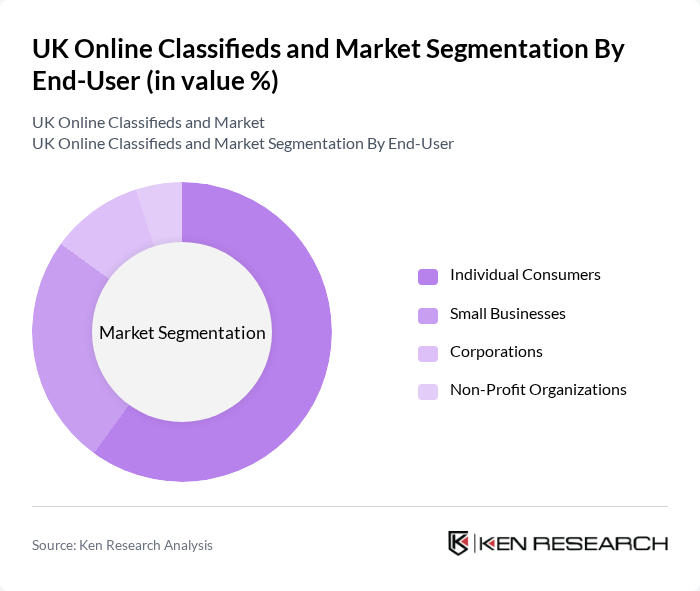

By End-User:

The end-user segmentation includes Individual Consumers, Small Businesses, Corporations, and Non-Profit Organizations. Individual Consumers dominate this market segment, driven by the increasing trend of online shopping and the convenience of accessing a wide range of products and services. Small Businesses also play a significant role, utilizing online classifieds to reach potential customers without the high costs associated with traditional advertising. Corporations and Non-Profit Organizations are gradually increasing their presence in this space, leveraging online platforms for recruitment and fundraising.

UK Online Classifieds and Market Competitive Landscape

The UK Online Classifieds and Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gumtree, eBay UK, Facebook Marketplace, Preloved, Shpock, Craigslist UK, AutoTrader, Rightmove, Zoopla, Vinted, Depop, LettingaProperty.com, OnTheMarket, SpareRoom, Freeads contribute to innovation, geographic expansion, and service delivery in this space.

UK Online Classifieds and Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:The UK has seen a significant rise in internet penetration, reaching approximately 99% in future, according to the Office for National Statistics. This widespread access facilitates online classifieds, allowing users to engage in buying and selling activities seamlessly. The growing number of internet users, estimated at 68 million, supports the expansion of digital marketplaces, driving increased transactions and user engagement in the online classifieds sector.

- Shift Towards Digital Transactions:The UK’s e-commerce sector is projected to surpass £210 billion in future, reflecting a robust shift towards digital transactions. This trend is fueled by consumer preferences for convenience and efficiency, with 87% of consumers opting for online shopping. As more users embrace digital payment methods, online classifieds platforms are benefiting from increased transaction volumes, enhancing their market presence and revenue potential in the competitive landscape.

- Rise of Mobile Commerce:Mobile commerce in the UK is expected to account for over £110 billion in sales by future, driven by the proliferation of smartphones and mobile applications. With 82% of internet users accessing online classifieds via mobile devices, platforms are optimizing their services for mobile use. This shift not only enhances user experience but also increases engagement, leading to higher transaction rates and a more dynamic online classifieds market.

Market Challenges

- Intense Competition:The UK online classifieds market is characterized by fierce competition, with over 210 platforms vying for market share. Major players like Gumtree and Facebook Marketplace dominate, making it challenging for new entrants to establish a foothold. This saturation leads to price wars and reduced profit margins, compelling companies to innovate continuously to differentiate their offerings and retain customer loyalty in a crowded marketplace.

- Trust and Safety Concerns:Trust issues remain a significant challenge in the online classifieds sector, with 32% of users expressing concerns about scams and fraudulent listings. High-profile incidents have raised awareness about safety, prompting platforms to invest in verification processes and user education. Addressing these concerns is crucial for maintaining user confidence and ensuring sustained growth in a market where trust is paramount for transaction success.

UK Online Classifieds and Market Future Outlook

The future of the UK online classifieds market appears promising, driven by technological advancements and evolving consumer behaviors. As platforms increasingly integrate artificial intelligence and machine learning, user experiences will become more personalized, enhancing engagement. Additionally, the growing emphasis on sustainability will likely influence market dynamics, with consumers favoring platforms that promote eco-friendly practices. These trends suggest a transformative period ahead, where innovation and consumer-centric strategies will shape the competitive landscape.

Market Opportunities

- Expansion into Niche Markets:There is a significant opportunity for online classifieds to expand into niche markets, such as eco-friendly products and local artisan goods. With a growing consumer base interested in sustainable options, platforms can cater to these specific needs, potentially increasing user engagement and transaction volumes in underserved segments of the market.

- Integration of AI and Machine Learning:The integration of AI and machine learning technologies presents a substantial opportunity for enhancing user experience in online classifieds. By leveraging data analytics, platforms can offer personalized recommendations and improve search functionalities, leading to higher user satisfaction and increased transaction rates, ultimately driving revenue growth in the competitive landscape.