Region:Europe

Author(s):Geetanshi

Product Code:KRAA3710

Pages:100

Published On:September 2025

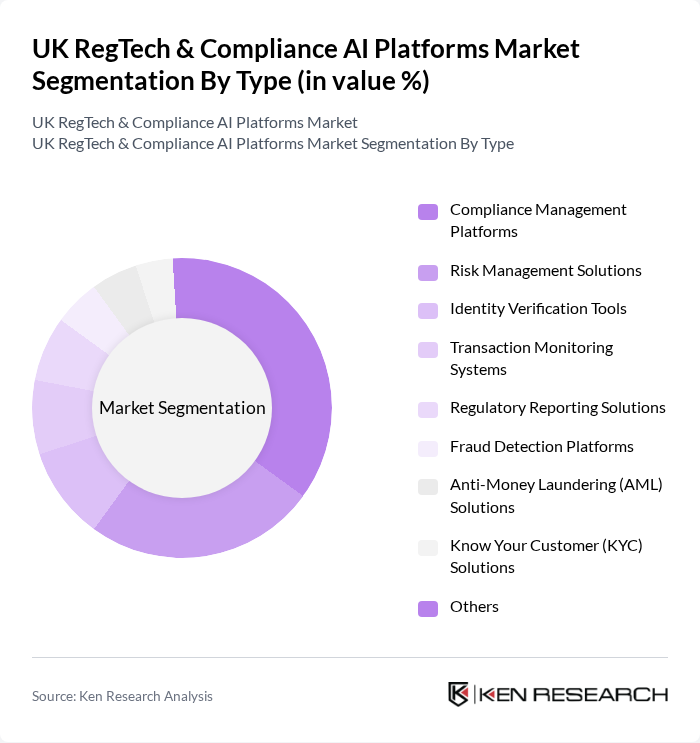

By Type:The market is segmented into various types of platforms that cater to different compliance needs. The dominant sub-segment is Compliance Management Platforms, which are essential for organizations to manage regulatory requirements effectively. Risk Management Solutions also hold a significant share, driven by the increasing need for organizations to identify and mitigate risks associated with compliance failures. Identity Verification Tools and Transaction Monitoring Systems are gaining traction due to the rise in digital transactions and the need for enhanced security measures. Cloud-based RegTech solutions and AI-driven analytics are increasingly integrated across these segments to provide scalability, automation, and real-time monitoring .

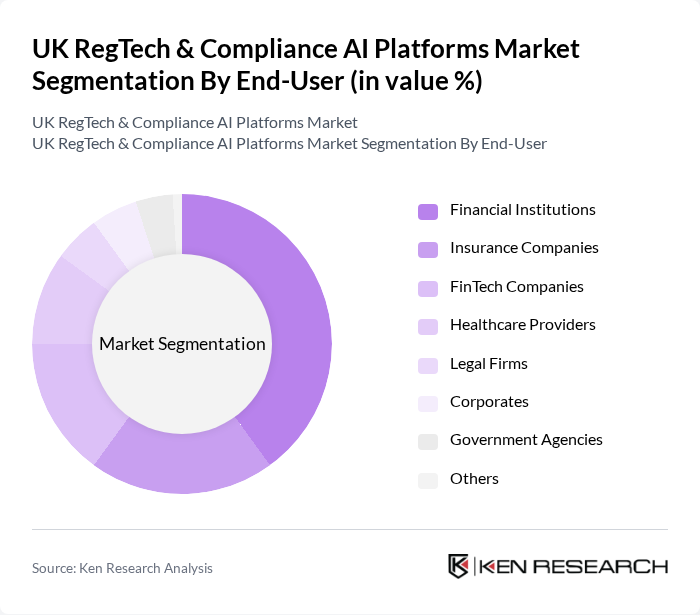

By End-User:The end-user segmentation includes various sectors that utilize RegTech solutions for compliance. Financial Institutions, including banks and asset managers, are the largest consumers due to stringent regulatory requirements. Insurance Companies and FinTech Companies also represent significant segments, driven by the need for efficient compliance processes. Legal Firms and Corporates are increasingly adopting these solutions to manage their compliance obligations effectively, while Government Agencies & Regulators are leveraging RegTech for better oversight and enforcement. The adoption of RegTech is further supported by the UK's open banking initiatives and regulatory sandboxes, which foster innovation and secure data sharing .

The UK RegTech & Compliance AI Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fenergo, ComplyAdvantage, Actico, NICE Actimize, SAS Institute, AxiomSL (now part of Adenza), Onfido, Encompass Corporation, Quantexa, Refinitiv, NorthRow, ClauseMatch, LexisNexis Risk Solutions, Elliptic, TruNarrative contribute to innovation, geographic expansion, and service delivery in this space.

The UK RegTech and Compliance AI platforms market is poised for significant evolution as organizations increasingly prioritize compliance automation and digital solutions. With the ongoing emphasis on data privacy and cybersecurity, firms are expected to invest in advanced technologies that enhance compliance efficiency. Additionally, the integration of AI and machine learning will likely drive innovation, enabling real-time compliance monitoring and reporting, which will be crucial for navigating the complex regulatory landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Platforms Risk Management Solutions Identity Verification Tools Transaction Monitoring Systems Regulatory Reporting Solutions Fraud Detection Systems Blockchain-Based Compliance Solutions Others |

| By End-User | Financial Institutions (Banks, Asset Managers, Payment Providers) Insurance Companies FinTech Companies Legal Firms Corporates (Non-Financial Enterprises) Government Agencies & Regulators Others |

| By Application | Anti-Money Laundering (AML) Know Your Customer (KYC) & Customer Due Diligence Risk Assessment & Management Regulatory Reporting & Filing Data Privacy & GDPR Compliance Transaction Monitoring & Screening Fraud Prevention Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Pricing Model | Subscription-Based Pay-Per-Use License Fee |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | England Scotland Wales Northern Ireland Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Compliance Solutions | 100 | Compliance Officers, Risk Management Executives |

| Insurance Industry RegTech Applications | 60 | Regulatory Affairs Managers, IT Compliance Specialists |

| Investment Firms' AI Compliance Tools | 50 | Portfolio Managers, Compliance Analysts |

| FinTech Startups and Regulatory Solutions | 40 | Founders, CTOs, Compliance Leads |

| Data Privacy and Protection Compliance | 50 | Data Protection Officers, Legal Advisors |

The UK RegTech & Compliance AI Platforms Market is valued at approximately USD 520 million, reflecting significant growth driven by increasing regulatory complexities and the adoption of advanced technologies like AI and machine learning in compliance processes.