Region:Europe

Author(s):Dev

Product Code:KRAA3574

Pages:81

Published On:September 2025

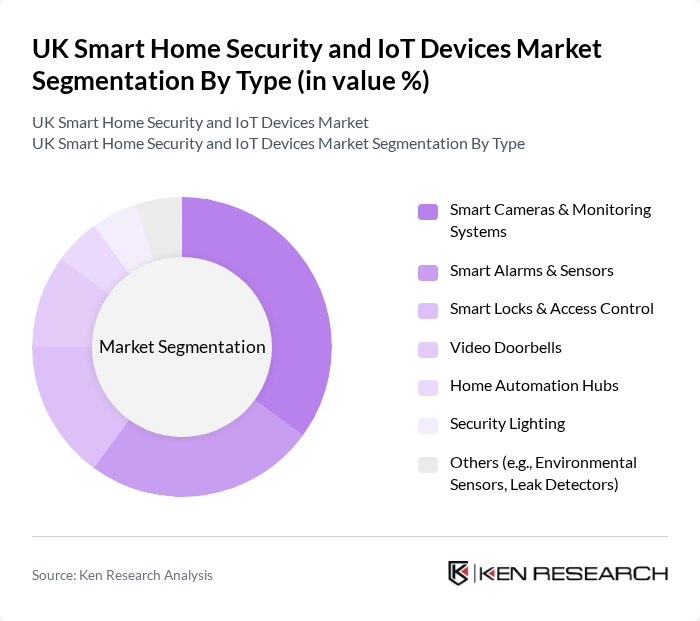

By Type:The market is segmented into various types of smart home security and IoT devices, including Smart Cameras & Monitoring Systems, Smart Alarms & Sensors, Smart Locks & Access Control, Video Doorbells, Home Automation Hubs, Security Lighting, and Others (e.g., Environmental Sensors, Leak Detectors). Among these, Smart Cameras & Monitoring Systems are leading the market due to their increasing popularity among consumers for real-time surveillance and monitoring capabilities. The demand for these devices is driven by the need for enhanced security and the ability to monitor homes remotely through mobile applications. Hardware remains the largest revenue-generating segment, while software is the fastest-growing component as consumers seek more integrated and intelligent solutions.

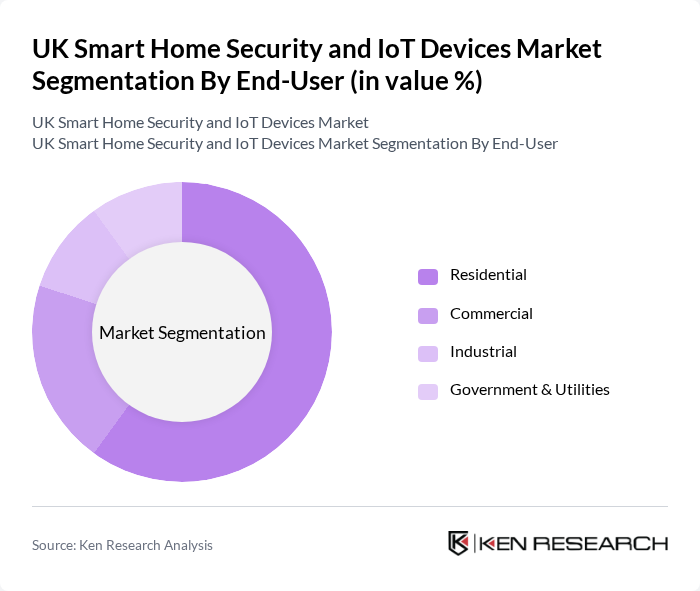

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment dominates the market, driven by the increasing trend of home automation and the growing awareness of security among homeowners. Consumers are increasingly investing in smart home technologies to enhance their living environments, leading to a significant rise in the adoption of smart security solutions in residential settings. The commercial segment is also growing, supported by demand for integrated security and energy management in offices and retail spaces.

The UK Smart Home Security and IoT Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banham Security, Yale (Assa Abloy), Ring LLC (Amazon), Arlo Technologies, Inc., SimpliSafe, Inc., Netatmo S.A.S., Google Nest (Alphabet Inc.), Hive (Centrica plc), Somfy Group, TP-Link Technologies Co., Ltd., Samsung SmartThings, Eufy (Anker Innovations), Control4 (Snap One Holdings), Bold Security Group, Smart Home Innovation Systems Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK smart home security and IoT devices market appears promising, driven by technological advancements and increasing consumer demand for integrated solutions. As more households adopt smart technologies, the market is likely to witness a shift towards more user-friendly and affordable products. Additionally, the integration of AI and machine learning will enhance security features, making systems more efficient. Companies that focus on addressing privacy concerns and providing seamless user experiences will likely thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Cameras & Monitoring Systems Smart Alarms & Sensors Smart Locks & Access Control Video Doorbells Home Automation Hubs Security Lighting Others (e.g., Environmental Sensors, Leak Detectors) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Sales Channel | Online Retail Offline Retail (Specialty Stores, Electronics Chains) Direct Sales Distributors & Installers |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms Retail Chains |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels |

| By Customer Segment | First-Time Buyers Repeat Customers Tech-Savvy Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Smart Home Security | 100 | Homeowners, Renters |

| Adoption Rates of IoT Devices | 80 | Tech-savvy Consumers, Early Adopters |

| Perceptions of Security Features | 60 | Families, Individuals Living Alone |

| Willingness to Pay for Smart Security Solutions | 90 | Middle-income Households, High-income Households |

| Feedback on User Experience with Existing Products | 70 | Current Users of Smart Home Devices |

The UK Smart Home Security and IoT Devices Market is valued at approximately USD 2.4 billion, reflecting significant growth driven by consumer demand for enhanced security solutions and technological advancements in IoT devices.