Region:Middle East

Author(s):Rebecca

Product Code:KRAC0167

Pages:98

Published On:August 2025

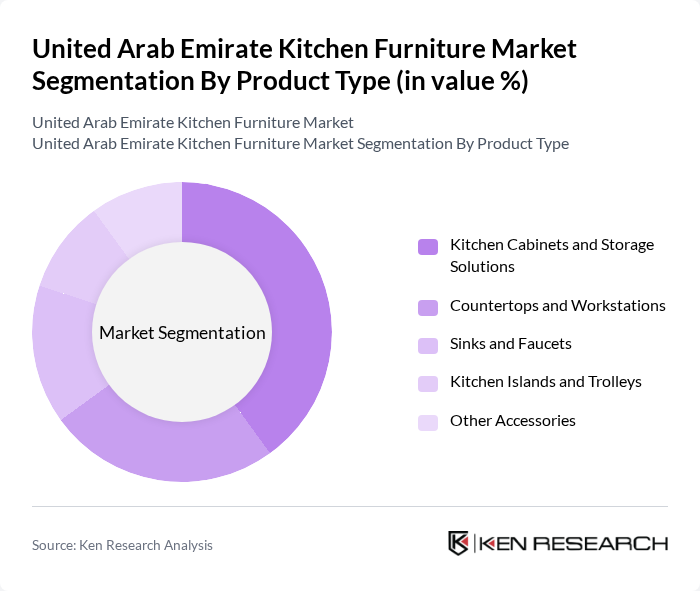

By Product Type:The product type segmentation includes Kitchen Cabinets and Storage Solutions, Countertops and Workstations, Sinks and Faucets, Kitchen Islands and Trolleys, and Other Accessories. Kitchen Cabinets and Storage Solutions hold the largest market share, reflecting their essential role in kitchen organization and aesthetics. Consumers increasingly favor modular and customizable options that maximize space and functionality, driving demand for innovative storage solutions and bespoke designs .

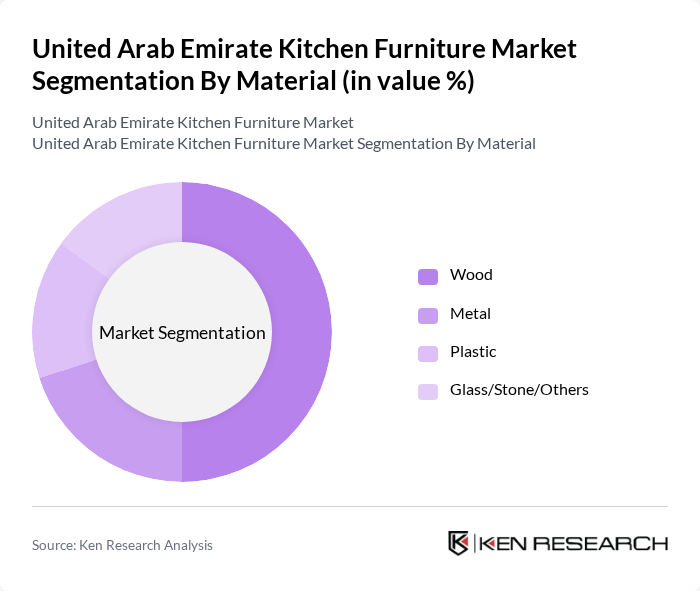

By Material:The material segmentation includes Wood, Metal, Plastic, and Glass/Stone/Others. Wood is the leading material in the kitchen furniture market, valued for its durability, aesthetic appeal, and versatility. Consumers are increasingly choosing solid wood and engineered wood products that combine style and functionality, with a growing emphasis on environmentally sustainable options. Metal and glass/stone materials are also gaining popularity for their modern look and ease of maintenance, while plastic remains a cost-effective choice for basic kitchen furniture .

The United Arab Emirate Kitchen Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Home Centre, Pan Emirates, Danube Home, Royal Furniture, Al Huzaifa Furniture, United Furniture, Interiors, Marina Home Interiors, The One, Chattels & More, BoConcept, Al Abbar Group, Al Gurg Living, Casa Tua contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE kitchen furniture market appears promising, driven by technological advancements and evolving consumer preferences. As smart kitchen technologies gain traction, manufacturers are likely to integrate IoT devices into their products, enhancing functionality and convenience. Additionally, the trend towards minimalist designs will continue to shape product offerings, appealing to consumers seeking simplicity and elegance in their kitchen spaces. These developments will create a dynamic market environment, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Kitchen Cabinets and Storage Solutions Countertops and Workstations Sinks and Faucets Kitchen Islands and Trolleys Other Accessories |

| By Material | Wood Metal Plastic Glass/Stone/Others |

| By Price Range | Economy Mid-Range Luxury |

| By Distribution Channel | Offline (Specialty Stores, Home Improvement Centers, Furniture Retailers) Online (E-commerce Platforms, Company Websites) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Kitchen Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Kitchen Installations | 60 | Restaurant Owners, Facility Managers |

| Retail Trends in Kitchen Furniture | 50 | Retail Managers, Sales Executives |

| Consumer Preferences for Kitchen Designs | 90 | Home Renovators, Architects |

| Market Insights from Trade Shows | 40 | Exhibitors, Industry Experts |

The United Arab Emirates kitchen furniture market is valued at approximately USD 1.2 billion, driven by urbanization, rising disposable incomes, and a trend towards modern kitchen designs. This growth reflects the increasing demand for high-quality kitchen furnishings in both residential and commercial sectors.