Region:Middle East

Author(s):Dev

Product Code:KRAA4465

Pages:97

Published On:January 2026

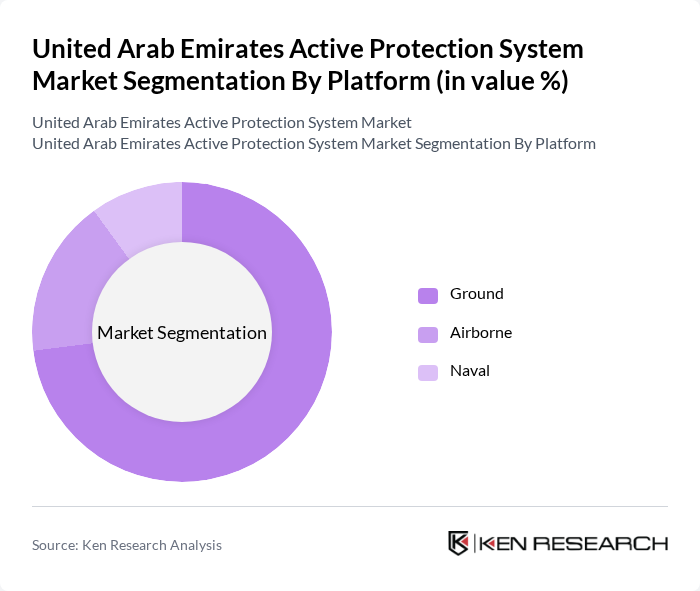

By Platform:The segmentation by platform includes Ground, Airborne, and Naval systems. The Ground segment is currently leading the market due to the high demand for armored vehicles equipped with active protection systems. The Airborne segment is also gaining traction as military forces seek to enhance the survivability of aircraft against advanced threats. The Naval segment, while smaller, is crucial for protecting naval vessels in increasingly contested maritime environments.

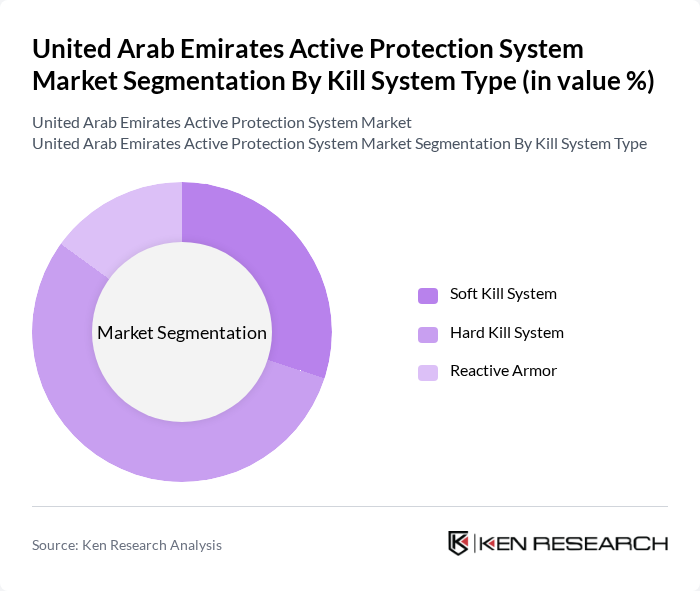

By Kill System Type:The market is segmented into Soft Kill System, Hard Kill System, and Reactive Armor. The Hard Kill System is currently the dominant segment, as it provides direct countermeasures against incoming threats, making it essential for modern military operations. The Soft Kill System is also significant, offering electronic countermeasures to disrupt enemy targeting systems. Reactive Armor, while a smaller segment, is critical for enhancing the survivability of armored vehicles.

The United Arab Emirates Active Protection System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rafael Advanced Defense Systems, Elbit Systems, Northrop Grumman, Thales Group, BAE Systems, Leonardo S.p.A., Saab AB, General Dynamics, Rheinmetall AG, MBDA, Kongsberg Gruppen, L3Harris Technologies, QinetiQ Group, Hanwha Defense, and Oshkosh Defense contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE's active protection system market appears promising, driven by ongoing investments in military modernization and technological innovation. As the UAE continues to enhance its defense capabilities, the integration of advanced technologies such as artificial intelligence and autonomous systems will play a crucial role. Furthermore, strategic partnerships with global defense firms are expected to facilitate knowledge transfer and local manufacturing, ultimately strengthening the UAE's defense ecosystem and ensuring long-term sustainability in the market.

| Segment | Sub-Segments |

|---|---|

| By Platform | Ground Airborne Naval |

| By Kill System Type | Soft Kill System Hard Kill System Reactive Armor |

| By End User | Defense Homeland Security |

| By Technology | Radar-Based Infrared Laser Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| UAE Military Procurement | 80 | Procurement Officers, Defense Analysts |

| Defense Contractors' Insights | 50 | Project Managers, Technical Directors |

| Military Technology Experts | 50 | Defense Consultants, R&D Specialists |

| Government Defense Policy Makers | 70 | Policy Advisors, Strategic Planners |

| Industry Analysts and Researchers | 30 | Market Researchers, Defense Economists |

The United Arab Emirates Active Protection System market is valued at approximately USD 45 million, reflecting a five-year historical analysis driven by increased defense budgets, regional security concerns, and military modernization efforts.