Region:Middle East

Author(s):Geetanshi

Product Code:KRAE7605

Pages:92

Published On:December 2025

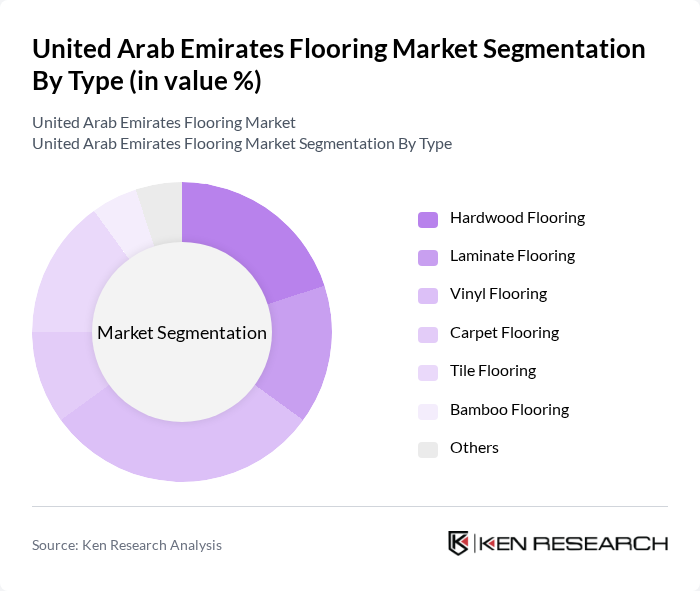

By Type:The flooring market can be segmented into various types, including hardwood flooring, laminate flooring, vinyl flooring, carpet flooring, tile flooring, bamboo flooring, resilient flooring, non-resilient flooring, and others. Each type caters to different consumer preferences and applications, with specific advantages such as durability, aesthetics, and cost-effectiveness. Among these, vinyl flooring has gained significant traction due to its versatility and affordability, making it a popular choice for both residential and commercial spaces.

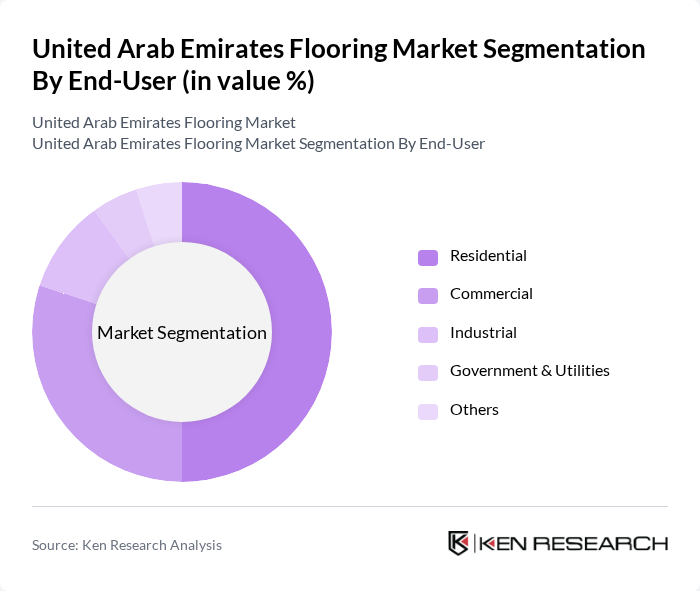

By End-User:The flooring market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment is the largest due to the increasing number of housing projects and renovations. Consumers are increasingly opting for stylish and durable flooring options that enhance the aesthetic appeal of their homes. The commercial segment is also significant, driven by the growth of retail and office spaces requiring high-quality flooring solutions.

The United Arab Emirates Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ain Flooring, Dubai Flooring Company, Emirates Flooring, Gulf Flooring Solutions, Abu Dhabi Flooring, Floorworld, Interfloor, Royal Flooring, Al-Futtaim Engineering, Mohd. Al-Mojil Group, Al-Habtoor Group, Al-Mansoori Specialized Engineering, Al-Jazira Group, Al-Muhaidib Group, Al-Qudra Holding contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE flooring market appears promising, driven by ongoing urbanization and a growing emphasis on sustainability. As the construction sector continues to expand, innovative flooring solutions integrating smart technology are likely to gain traction. Additionally, the increasing focus on eco-friendly materials will shape consumer preferences, leading to a more diverse product offering. Companies that adapt to these trends and invest in research and development will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardwood Flooring Laminate Flooring Vinyl Flooring Carpet Flooring Tile Flooring Bamboo Flooring Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | New Construction Renovation Maintenance Others |

| By Material | Natural Materials Synthetic Materials Composite Materials Others |

| By Design | Traditional Designs Modern Designs Custom Designs Others |

| By Installation Type | Glue-Down Installation Floating Installation Nail-Down Installation Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Preferences | 120 | Homeowners, Interior Designers |

| Commercial Flooring Solutions | 95 | Facility Managers, Architects |

| Hospitality Sector Flooring Trends | 75 | Hotel Managers, Interior Decorators |

| Retail Flooring Choices | 65 | Store Owners, Retail Managers |

| Construction Industry Flooring Specifications | 85 | Contractors, Project Managers |

The United Arab Emirates flooring market is valued at approximately USD 4.4 billion, driven by factors such as urbanization, construction growth, and increasing consumer demand for durable and aesthetically pleasing flooring solutions.