Region:Middle East

Author(s):Geetanshi

Product Code:KRAE7604

Pages:101

Published On:December 2025

By Type:The flooring market can be segmented into various types, including resilient flooring, non-resilient flooring, carpets and rugs, artificial grass, carpet tiles, parquet flooring, and others. Among these, resilient flooring, which includes vinyl, LVT, and linoleum, is gaining traction due to its durability, waterproofing, and ease of maintenance. Non-resilient flooring, such as ceramic tiles and hardwood, remains popular for its aesthetic appeal and variety. The demand for carpets and rugs is also significant, particularly in residential settings.

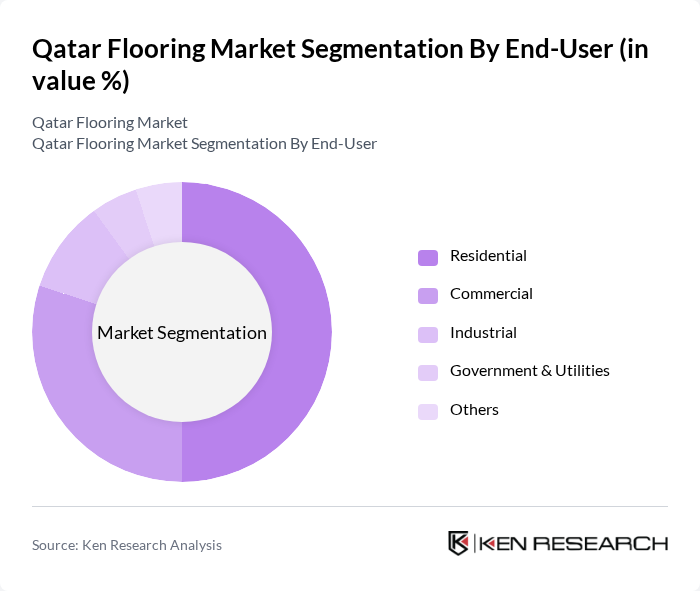

By End-User:The flooring market is segmented by end-user into residential, commercial, industrial, government & utilities, and others. The residential segment is the largest, driven by increasing home renovations and new constructions. The commercial sector is also significant, with businesses investing in high-quality flooring solutions to enhance their work environments. Government projects contribute to the industrial segment, focusing on durable and cost-effective flooring options.

The Qatar Flooring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Flooring Company, Al Jazeera Paints, Qatar National Cement Company, Gulf Floor Covering, Al Mufeed Trading, Qatar Marble and Granite, Al Mufeed Group, Qatar Building Company, Al Jazeera Flooring, Qatar Wood Industries, Al Mufeed Flooring, Qatar Interior Design, Qatar Construction Company, Al Mufeed Carpets, Qatar Flooring Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar flooring market is poised for significant growth, driven by urbanization and a shift towards sustainable practices. As the construction sector expands, innovative flooring solutions will gain traction, particularly in smart home technologies and eco-friendly materials. The increasing focus on aesthetic appeal and functionality will further shape consumer preferences. Additionally, the government's commitment to infrastructure development will create a favorable environment for flooring manufacturers, ensuring a dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Resilient Flooring (Vinyl, LVT, Linoleum) Non-Resilient Flooring (Ceramic Tiles, Hardwood, Laminate) Carpet and Rugs Artificial Grass Carpet Tiles Parquet Flooring Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | Doha Al Rayyan Al Wakrah Al Khor Others |

| By Application | Residential Buildings Commercial Spaces Industrial Facilities Hospitality Sector Others |

| By Material | Polypropylene Polyester Natural Fibers Others |

| By Installation Type | Glue-Down Floating Nail-Down Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Flooring Installations | 150 | Homeowners, Interior Designers |

| Commercial Flooring Projects | 100 | Facility Managers, Architects |

| Hospitality Sector Flooring | 80 | Hotel Managers, Procurement Officers |

| Retail Flooring Solutions | 70 | Store Owners, Retail Managers |

| Public Infrastructure Flooring | 60 | Government Officials, Project Managers |

The Qatar Flooring Market is valued at approximately USD 1.1 billion, driven by rapid urbanization, increasing construction activities, and rising demand for residential and commercial spaces, particularly in Doha, Al Rayyan, and Al Wakrah.