United Kingdom Business Intelligence Market Overview

- The United Kingdom Business Intelligence Market is valued at USD 4.3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for data-driven decision-making, widespread adoption of cloud-based BI solutions, and the need for real-time insights across various industries. Organizations are increasingly adopting BI tools to enhance operational efficiency, improve customer experiences, and gain a competitive edge in a rapidly digitizing economy .

- Key cities dominating the market include London, Manchester, and Birmingham. London stands out due to its status as a financial hub, attracting numerous tech companies and startups focused on data analytics. Manchester and Birmingham are also significant due to their growing tech ecosystems and investments in digital transformation initiatives, making them attractive locations for BI solutions .

- In 2023, the UK government advanced the Data Protection and Digital Information Bill, aiming to enhance data governance and security. This regulation emphasizes the importance of data privacy and encourages organizations to adopt robust BI solutions that comply with data protection standards, thereby fostering trust and transparency in data usage .

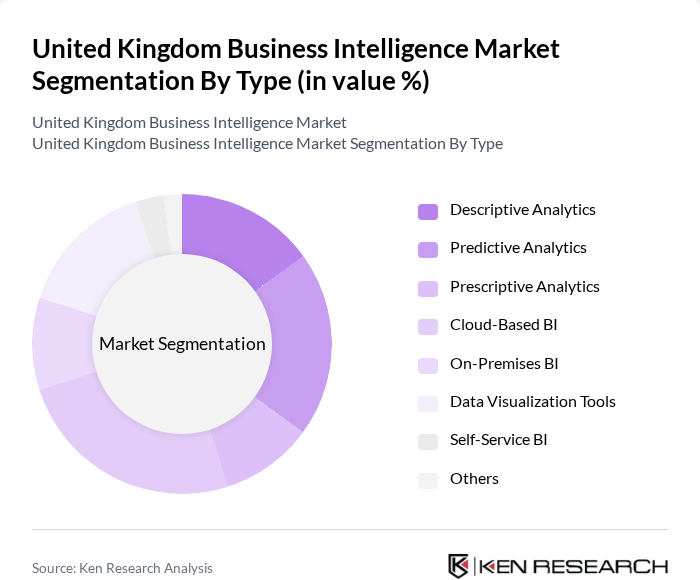

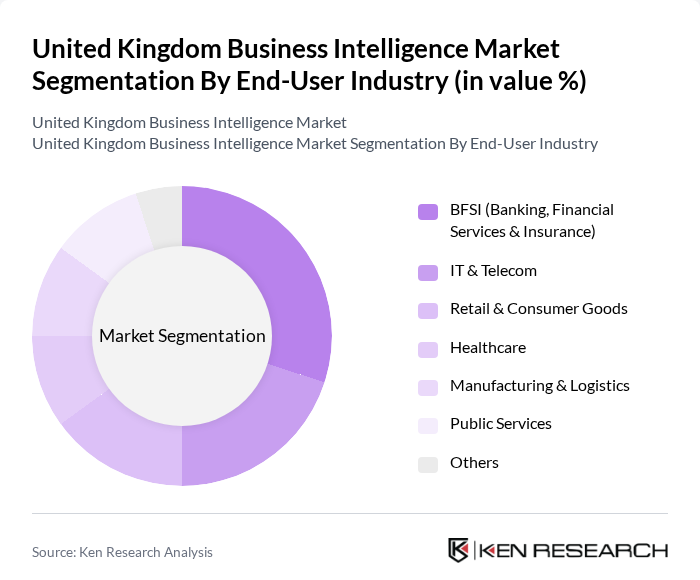

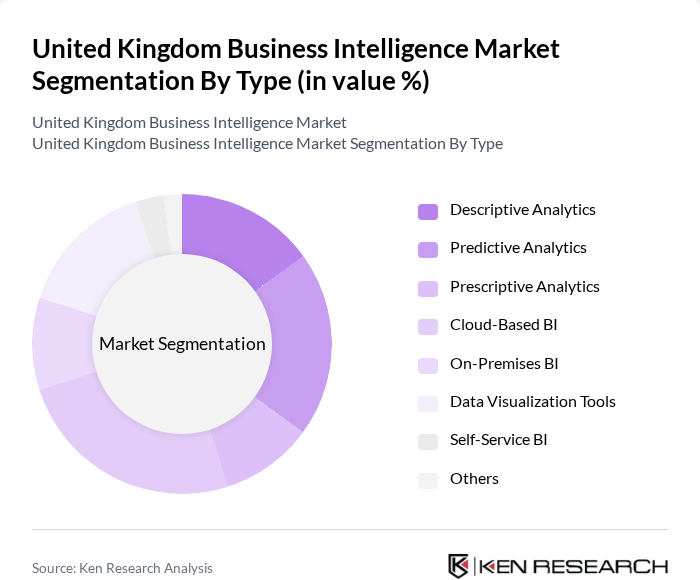

United Kingdom Business Intelligence Market Segmentation

By Type:The market is segmented into various types of business intelligence solutions, including descriptive analytics, predictive analytics, prescriptive analytics, cloud-based BI, on-premises BI, data visualization tools, self-service BI, and others. Among these, cloud-based BI and data visualization tools are gaining significant traction due to their flexibility, scalability, and user-friendly interfaces, enabling organizations to derive insights quickly and efficiently. The adoption of self-service BI is also rising, empowering business users to perform analytics independently of IT departments .

By End-User Industry:The business intelligence market is further segmented by end-user industries, including BFSI, IT & Telecom, Retail & Consumer Goods, Healthcare, Manufacturing & Logistics, Public Services, and others. The BFSI sector is particularly dominant due to its reliance on data analytics for risk management, customer insights, and regulatory compliance, driving significant investments in BI solutions. Healthcare is also a rapidly growing segment, leveraging predictive analytics and AI-driven BI platforms for patient care optimization and operational efficiency .

United Kingdom Business Intelligence Market Competitive Landscape

The United Kingdom Business Intelligence Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft (Power BI), SAP SE (SAP BusinessObjects), Oracle Corporation (Oracle BI), IBM Corporation (IBM Cognos), SAS Institute Inc., Tableau Software (Salesforce, Inc.), QlikTech International AB, MicroStrategy Incorporated, TIBCO Software Inc., Sisense Inc., Domo, Inc., Looker (Google LLC), Zoho Corporation (Zoho Analytics), Yellowfin BI, Birst (Infor, Inc.) contribute to innovation, geographic expansion, and service delivery in this space .

United Kingdom Business Intelligence Market Industry Analysis

Growth Drivers

- Increasing Demand for Data-Driven Decision Making:The United Kingdom's business landscape is increasingly prioritizing data-driven decision-making, with 70% of organizations reporting that data analytics significantly enhances their operational efficiency. The UK government has invested approximately £1.6 billion in digital transformation initiatives, fostering a culture where data insights are crucial for strategic planning. This trend is expected to continue, as businesses recognize the competitive advantage that data-driven strategies provide in optimizing performance and driving growth.

- Rise of Cloud-Based BI Solutions:The adoption of cloud-based business intelligence solutions in the UK has surged, with the market expected to reach £3.5 billion in future. This growth is driven by the flexibility and scalability that cloud solutions offer, allowing businesses to access real-time data analytics without significant upfront investments. Additionally, 60% of UK companies are migrating to cloud platforms, which enhances collaboration and data accessibility, further propelling the demand for cloud-based BI tools.

- Expansion of Big Data Technologies:The UK is witnessing a rapid expansion in big data technologies, with the market projected to grow to £6.0 billion in future. This growth is fueled by the increasing volume of data generated, with estimates suggesting that the UK produces over 2.5 quintillion bytes of data daily. Companies are leveraging big data analytics to gain insights into consumer behavior, optimize operations, and enhance customer experiences, driving the demand for advanced BI solutions.

Market Challenges

- Data Privacy and Security Concerns:Data privacy and security remain significant challenges for the UK business intelligence market, particularly with the implementation of GDPR regulations. In recent periods, 45% of UK businesses reported concerns about data breaches, which can lead to substantial financial penalties and reputational damage. As organizations increasingly rely on data analytics, ensuring compliance with stringent data protection laws is critical to maintaining consumer trust and safeguarding sensitive information.

- High Implementation Costs:The high costs associated with implementing business intelligence solutions pose a barrier for many UK organizations. On average, companies spend around £250,000 on BI software and infrastructure, which can be prohibitive for small to medium-sized enterprises. This financial burden often leads to delayed adoption of BI technologies, hindering their ability to compete effectively in a data-driven market environment where timely insights are essential for success.

United Kingdom Business Intelligence Market Future Outlook

The future of the United Kingdom business intelligence market appears promising, driven by technological advancements and evolving consumer expectations. As organizations increasingly prioritize data analytics, the integration of artificial intelligence and machine learning into BI tools will enhance predictive capabilities and streamline decision-making processes. Furthermore, the growing emphasis on real-time analytics will enable businesses to respond swiftly to market changes, fostering a more agile and competitive landscape in the coming years.

Market Opportunities

- Increasing Investment in AI and Machine Learning:The UK is witnessing a surge in investments in artificial intelligence and machine learning technologies, projected to reach £1.5 billion in future. This investment will enhance the capabilities of business intelligence tools, enabling organizations to derive deeper insights from their data and automate decision-making processes, ultimately driving efficiency and innovation across various sectors.

- Development of Mobile BI Solutions:The demand for mobile business intelligence solutions is on the rise, with the market expected to grow to £900 million in future. As remote work becomes more prevalent, organizations are seeking mobile BI tools that provide real-time access to data analytics, empowering employees to make informed decisions on the go and enhancing overall productivity and responsiveness to market dynamics.