Region:Europe

Author(s):Rebecca

Product Code:KRAB0264

Pages:86

Published On:August 2025

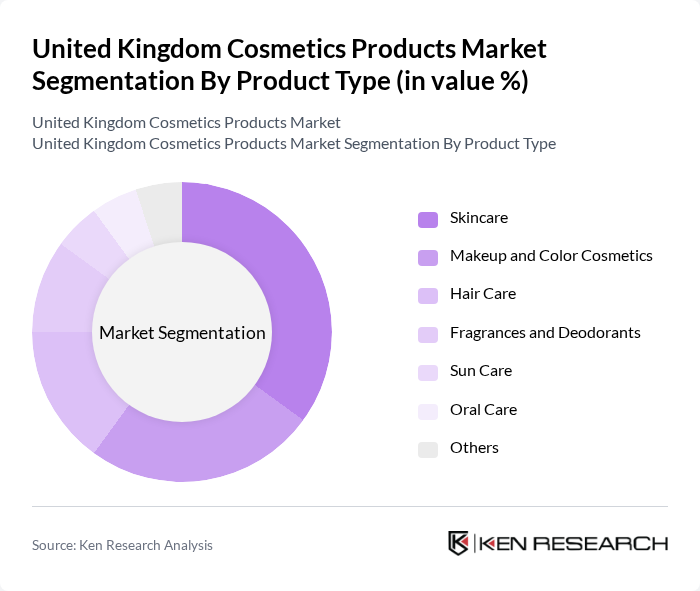

By Product Type:The cosmetics market is segmented into various product types, including skincare, makeup and color cosmetics, hair care, fragrances and deodorants, sun care, oral care, and others. Among these, skincare products have gained significant traction due to increasing awareness of skin health, demand for anti-aging and moisturizing products, and the influence of social media and beauty influencers. Makeup and color cosmetics also hold a substantial share, driven by evolving beauty and fashion trends, product innovation, and the popularity of new color palettes and finishes .

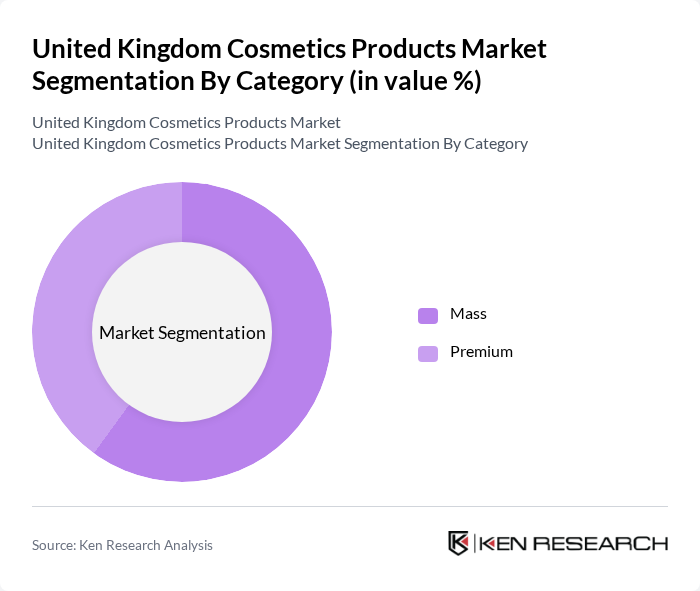

By Category:The market is further divided into mass and premium categories. The mass category dominates the market due to its affordability, accessibility, and broad appeal across diverse consumer segments. However, the premium segment is witnessing robust growth as consumers increasingly invest in high-quality, innovative, and personalized beauty products, reflecting a trend towards luxury, self-expression, and experiential beauty .

The United Kingdom Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever PLC, L'Oréal S.A., Procter & Gamble Co., Estée Lauder Companies Inc., Coty Inc., Revlon Inc., Shiseido Company, Limited, Avon Products, Inc., Beiersdorf AG, Johnson & Johnson, Mary Kay Inc., Oriflame Holding AG, Natura &Co, Henkel AG & Co. KGaA, Boots UK Limited, The Body Shop International Limited, Superdrug Stores plc, Space NK Limited, Charlotte Tilbury Beauty Ltd, PZ Cussons plc contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UK cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and ethical practices is likely to shape product development, with brands prioritizing eco-friendly formulations and packaging. Additionally, the integration of augmented reality and artificial intelligence in shopping experiences is expected to enhance consumer engagement. As the market adapts to these trends, companies that innovate and align with consumer values will likely thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skincare Makeup and Color Cosmetics Hair Care Fragrances and Deodorants Sun Care Oral Care Others |

| By Category | Mass Premium |

| By End-User | Women Men Unisex |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Pharmacy and Drug Stores Online Retail Stores Convenience Stores Other Distribution Channels |

| By Price Range | Premium Mass |

| By Region | England Wales Scotland Northern Ireland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Insights | 100 | Product Managers, Brand Strategists |

| Makeup Trends and Preferences | 90 | Retail Buyers, Marketing Executives |

| Haircare Product Usage | 80 | Salon Owners, Consumer Insights Analysts |

| Consumer Attitudes towards Natural Products | 60 | Health and Wellness Influencers, Eco-conscious Consumers |

| Online Shopping Behavior for Cosmetics | 50 | E-commerce Managers, Digital Marketing Specialists |

The United Kingdom cosmetics products market is valued at approximately USD 13.4 billion, reflecting a significant growth driven by consumer demand for beauty and personal care products, influenced by social media trends and a focus on self-care and wellness.