Region:North America

Author(s):Rebecca

Product Code:KRAB3505

Pages:94

Published On:October 2025

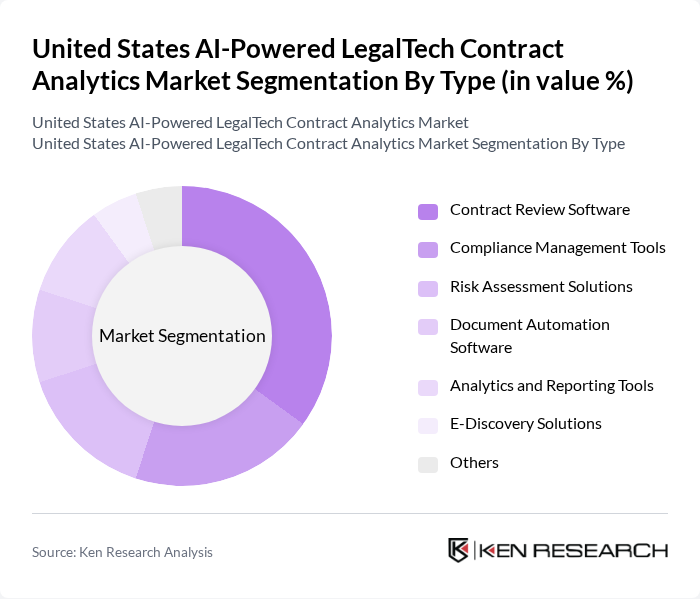

By Type:The market is segmented into various types of AI-powered legal tech solutions, including Contract Review Software, Compliance Management Tools, Risk Assessment Solutions, Document Automation Software, Analytics and Reporting Tools, E-Discovery Solutions, and Others. Among these, Contract Review Software is currently the leading subsegment due to its critical role in streamlining contract analysis and reducing manual errors. The increasing complexity of contracts, the need for rapid review processes, and the adoption of generative AI for clause extraction and risk flagging are driving law firms and corporations to adopt these solutions extensively .

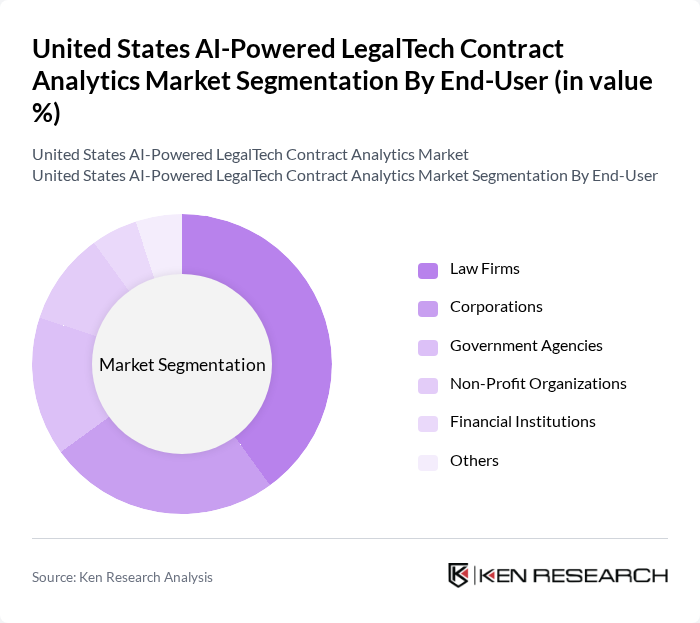

By End-User:The end-user segmentation includes Law Firms, Corporations, Government Agencies, Non-Profit Organizations, Financial Institutions, and Others. Law Firms are the dominant end-user segment, driven by the need for efficient contract management and compliance solutions. The increasing volume of legal documents, the demand for faster turnaround times, and the pressure to reduce operational costs are compelling law firms to invest in AI-powered contract analytics tools .

The United States AI-Powered LegalTech Contract Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thomson Reuters, LexisNexis (a RELX Group company), Kira Systems (now part of Litera), LawGeex, Luminance, ContractPodAi, Everlaw, iManage, Zapproved, Onit, LegalSifter, Evisort, Brightflag, ContractWorks (an Affinity company), Seal Software (now part of DocuSign), ThoughtTrace, Exari (now part of Conga), LinkSquares, Ironclad, Conga contribute to innovation, geographic expansion, and service delivery in this space.

The future of the AI-powered LegalTech contract analytics market in the U.S. appears promising, driven by technological advancements and increasing digital transformation. As firms continue to embrace cloud-based solutions, the integration of AI with existing legal software will enhance operational efficiency. Furthermore, the focus on ethical AI practices will shape the development of new tools, ensuring compliance with evolving regulations. This landscape will likely foster innovation, leading to more tailored solutions that meet the specific needs of legal professionals.

| Segment | Sub-Segments |

|---|---|

| By Type | Contract Review Software Compliance Management Tools Risk Assessment Solutions Document Automation Software Analytics and Reporting Tools E-Discovery Solutions Others |

| By End-User | Law Firms Corporations Government Agencies Non-Profit Organizations Financial Institutions Others |

| By Application | Contract Lifecycle Management Compliance Monitoring Risk Management Legal Research Document Management Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Pricing Model | Subscription-Based Pricing One-Time License Fee Pay-Per-Use |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Legal Departments | 120 | General Counsels, Contract Managers |

| Law Firms (Small to Medium) | 100 | Partners, Legal Technology Specialists |

| Legal Tech Startups | 80 | Founders, Product Managers |

| Compliance and Risk Management | 70 | Compliance Officers, Risk Managers |

| Academic Institutions (Law Schools) | 50 | Professors, Legal Researchers |

The United States AI-Powered LegalTech Contract Analytics Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by the increasing adoption of AI technologies in legal processes and the demand for automation in contract management.