Region:North America

Author(s):Dev

Product Code:KRAB3743

Pages:90

Published On:October 2025

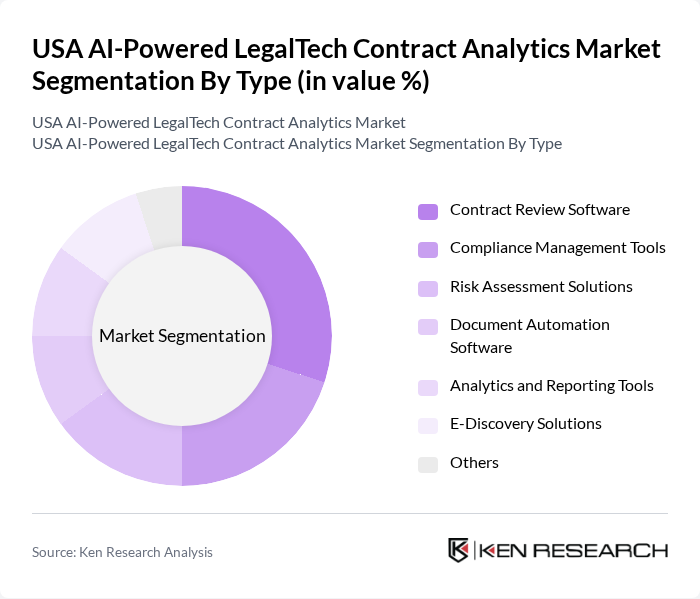

By Type:The market is segmented into various types of solutions that cater to different aspects of contract analytics. The primary subsegments include Contract Review Software, Compliance Management Tools, Risk Assessment Solutions, Document Automation Software, Analytics and Reporting Tools, E-Discovery Solutions, and Others. Each of these subsegments plays a crucial role in enhancing the efficiency and effectiveness of legal processes.

The leading subsegment in this category is Contract Review Software, which is gaining traction due to its ability to automate the review process, significantly reducing the time and effort required by legal professionals. As organizations increasingly seek to streamline their contract management processes, the demand for such software is expected to rise. The trend towards digital transformation in the legal sector further supports the growth of this subsegment, as firms look to leverage technology for competitive advantage.

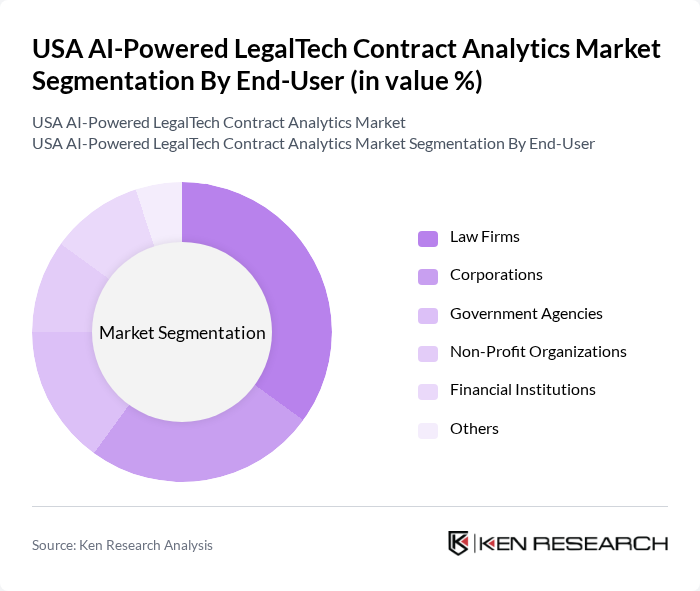

By End-User:The market is segmented based on the end-users of AI-powered legal tech solutions. The primary subsegments include Law Firms, Corporations, Government Agencies, Non-Profit Organizations, Financial Institutions, and Others. Each end-user category has unique requirements and challenges that these solutions aim to address.

Law Firms dominate the market as they are the primary users of contract analytics solutions, leveraging these tools to enhance their service offerings and improve client outcomes. The increasing complexity of legal contracts and the need for compliance with various regulations drive law firms to adopt advanced analytics solutions. Additionally, the competitive landscape in the legal sector compels firms to utilize technology to improve efficiency and reduce costs, further solidifying their position as the leading end-user segment.

The USA AI-Powered LegalTech Contract Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thomson Reuters, LexisNexis, Kira Systems, LawGeex, Luminance, ContractPodAi, Everlaw, iManage, Zapproved, Onit, LegalSifter, ROSS Intelligence, Evisort, Brightflag, ContractWorks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA AI-Powered LegalTech Contract Analytics market appears promising, driven by ongoing digital transformation and the increasing integration of AI technologies. As law firms continue to adapt to remote work environments, the demand for cloud-based solutions is expected to rise. Furthermore, the focus on ethical AI practices will shape the development of new technologies, ensuring compliance with emerging regulations. This evolving landscape presents opportunities for innovation and collaboration within the legal sector, fostering a more efficient and transparent legal process.

| Segment | Sub-Segments |

|---|---|

| By Type | Contract Review Software Compliance Management Tools Risk Assessment Solutions Document Automation Software Analytics and Reporting Tools E-Discovery Solutions Others |

| By End-User | Law Firms Corporations Government Agencies Non-Profit Organizations Financial Institutions Others |

| By Application | Contract Lifecycle Management Compliance Monitoring Risk Management Legal Research Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Legal Departments | 150 | General Counsels, Contract Managers |

| Law Firms Utilizing AI Tools | 100 | Partners, IT Directors |

| Legal Technology Vendors | 80 | Product Managers, Sales Executives |

| Compliance and Risk Management | 70 | Compliance Officers, Risk Managers |

| Academic Institutions Researching LegalTech | 50 | Legal Scholars, Research Analysts |

The USA AI-Powered LegalTech Contract Analytics Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of AI technologies in legal processes, enhancing efficiency and accuracy in contract management.