Region:North America

Author(s):Rebecca

Product Code:KRAB3465

Pages:85

Published On:October 2025

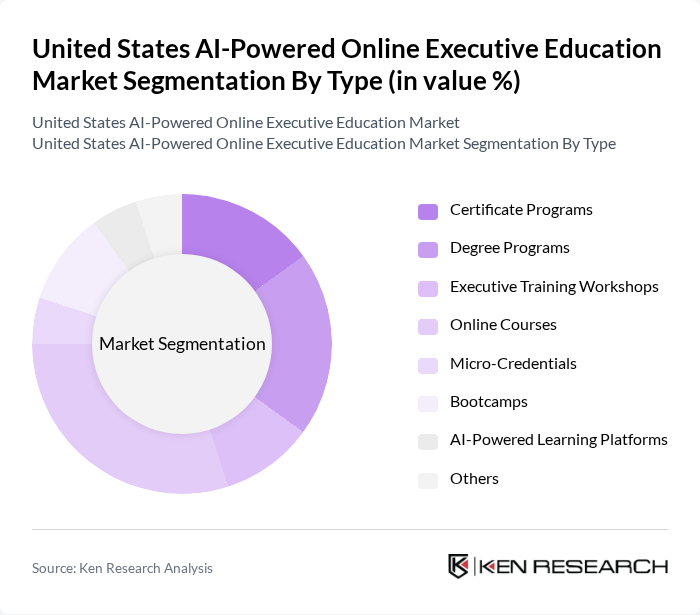

By Type:The market is segmented into various types of educational offerings, including Certificate Programs, Degree Programs, Executive Training Workshops, Online Courses, Micro-Credentials, Bootcamps, AI-Powered Learning Platforms, and Others. Among these, Online Courses have emerged as the dominant segment due to their accessibility and flexibility, catering to a wide range of learners from busy professionals to corporate teams. The increasing trend of self-paced learning and the integration of AI technologies in course delivery have further fueled the popularity of this segment.

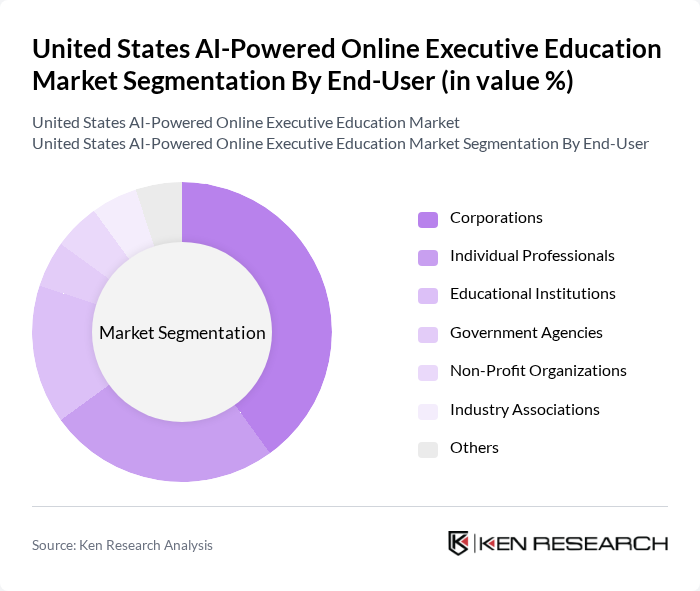

By End-User:The end-user segmentation includes Corporations, Individual Professionals, Educational Institutions, Government Agencies, Non-Profit Organizations, Industry Associations, and Others. Corporations are the leading end-user segment, driven by the need for upskilling employees to keep pace with technological advancements and market demands. The increasing investment in employee training programs and the shift towards digital learning solutions have solidified the position of corporations as the primary consumers of AI-powered online executive education.

The United States AI-Powered Online Executive Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera Inc., edX LLC (a 2U, Inc. brand), LinkedIn Learning (Microsoft Corporation), Udacity, Inc., Skillsoft Corporation, Harvard Business Publishing (Harvard Business School), Wharton Online (University of Pennsylvania), MIT Sloan School of Management, Stanford Online (Stanford University), Columbia Business School Executive Education, FutureLearn Ltd., Pluralsight, Inc., Khan Academy, General Assembly (Adept Group), OpenClassrooms contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. AI-powered online executive education market appears promising, driven by technological advancements and evolving learner preferences. As organizations increasingly prioritize upskilling, the demand for innovative, personalized learning experiences will grow. Additionally, the integration of data analytics will enhance educational outcomes, allowing institutions to tailor programs effectively. The focus on lifelong learning will further propel the market, as professionals seek continuous development to remain competitive in a dynamic job landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Degree Programs Executive Training Workshops Online Courses Micro-Credentials Bootcamps AI-Powered Learning Platforms Others |

| By End-User | Corporations Individual Professionals Educational Institutions Government Agencies Non-Profit Organizations Industry Associations Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning AI-Driven Adaptive Learning Others |

| By Subject Area | Leadership and Management Data Science and Analytics Marketing and Sales Finance and Accounting Information Technology Artificial Intelligence and Machine Learning Digital Transformation Others |

| By Duration | Short-Term Courses (Less than 3 months) Medium-Term Courses (3 to 6 months) Long-Term Courses (More than 6 months) Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Freemium/Trial Access Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Development Units (PDUs) Digital Badges & Micro-Credentials Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | Training Managers, Learning & Development Directors |

| AI-Powered Executive Courses | 90 | Program Directors, Course Instructors |

| Participant Feedback on Online Learning | 60 | Recent Graduates, Current Students |

| Industry Trends in Executive Education | 100 | HR Executives, Business Leaders |

| Technology Adoption in Education | 70 | IT Managers, Educational Technology Specialists |

The United States AI-Powered Online Executive Education Market is valued at approximately USD 128 billion, reflecting significant growth driven by the demand for flexible learning solutions and the integration of artificial intelligence in educational tools.