Region:North America

Author(s):Geetanshi

Product Code:KRAB0108

Pages:95

Published On:August 2025

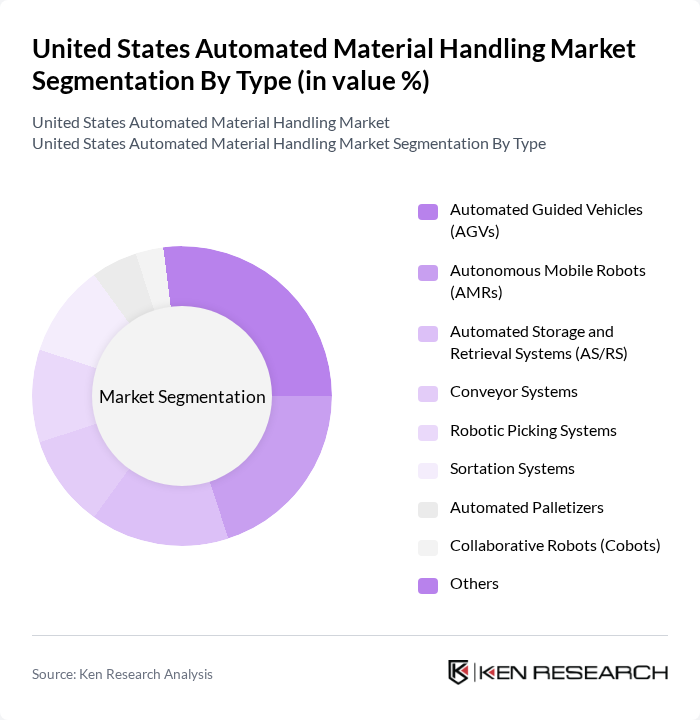

By Type:The market is segmented into various types of automated material handling solutions, including Automated Guided Vehicles (AGVs), Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (AS/RS), Conveyor Systems, Robotic Picking Systems, Sortation Systems, Automated Palletizers, Collaborative Robots (Cobots), and Others. Each of these sub-segments plays a crucial role in enhancing operational efficiency, reducing labor costs, and improving accuracy in material movement and inventory management. AGVs and AMRs are increasingly adopted for flexible, scalable operations, while AS/RS and conveyor systems remain essential for high-throughput environments. Collaborative robots (Cobots) are gaining traction for their ability to safely work alongside human operators in dynamic settings .

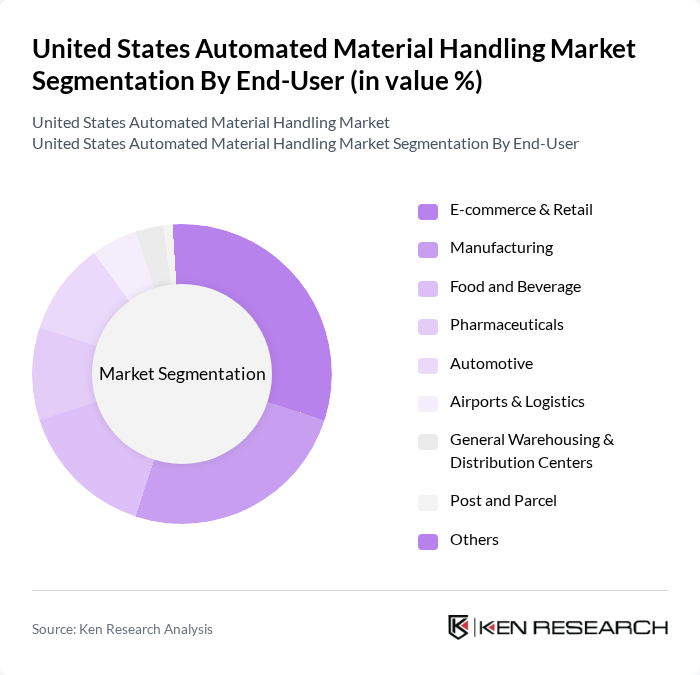

By End-User:The end-user segmentation includes various industries such as E-commerce & Retail, Manufacturing, Food and Beverage, Pharmaceuticals, Automotive, Airports & Logistics, General Warehousing & Distribution Centers, Post and Parcel, and Others. Each sector has unique requirements for automated material handling solutions, driving the demand for tailored systems that enhance operational efficiency, speed, and accuracy. E-commerce and retail lead adoption due to high order volumes and the need for rapid fulfillment, while manufacturing and automotive sectors prioritize automation for process optimization and cost reduction. Food and beverage, pharmaceuticals, and logistics require specialized systems to meet stringent safety and traceability standards .

The United States Automated Material Handling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dematic Corporation, Honeywell Intelligrated, Siemens Logistics LLC, KION Group AG, Vanderlande Industries Inc., Swisslog Holding AG, Murata Machinery, Ltd., SSI Schaefer Group, Jungheinrich AG, Interroll Holding AG, Bastian Solutions, LLC, Daifuku North America Holding Company, MHS Global, Toyota Material Handling, Inc., Hyster-Yale Materials Handling, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automated material handling market in the United States appears promising, driven by ongoing technological innovations and increasing demand for efficiency. As companies continue to face labor shortages and rising operational costs, the shift towards automation is expected to accelerate. Furthermore, advancements in AI and robotics will likely enhance the capabilities of automated systems, making them more accessible and effective. This evolution will create a more resilient supply chain, positioning businesses to better respond to market fluctuations and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicles (AGVs) Autonomous Mobile Robots (AMRs) Automated Storage and Retrieval Systems (AS/RS) Conveyor Systems Robotic Picking Systems Sortation Systems Automated Palletizers Collaborative Robots (Cobots) Others |

| By End-User | E-commerce & Retail Manufacturing Food and Beverage Pharmaceuticals Automotive Airports & Logistics General Warehousing & Distribution Centers Post and Parcel Others |

| By Application | Warehousing Distribution Centers Assembly Lines Packaging Order Fulfillment Cross-Docking Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | B2B B2C C2C |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Automation Solutions | 80 | Logistics Directors, Warehouse Operations Managers |

| Manufacturing Automation Systems | 60 | Production Managers, Supply Chain Analysts |

| E-commerce Fulfillment Automation | 70 | eCommerce Operations Managers, IT Directors |

| Healthcare Material Handling Systems | 40 | Facility Managers, Procurement Officers |

| Automotive Parts Handling Solutions | 50 | Logistics Coordinators, Quality Control Managers |

The United States Automated Material Handling Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing demand for efficiency in logistics and warehousing operations, particularly due to the rapid expansion of e-commerce.