Region:North America

Author(s):Shubham

Product Code:KRAC0600

Pages:82

Published On:August 2025

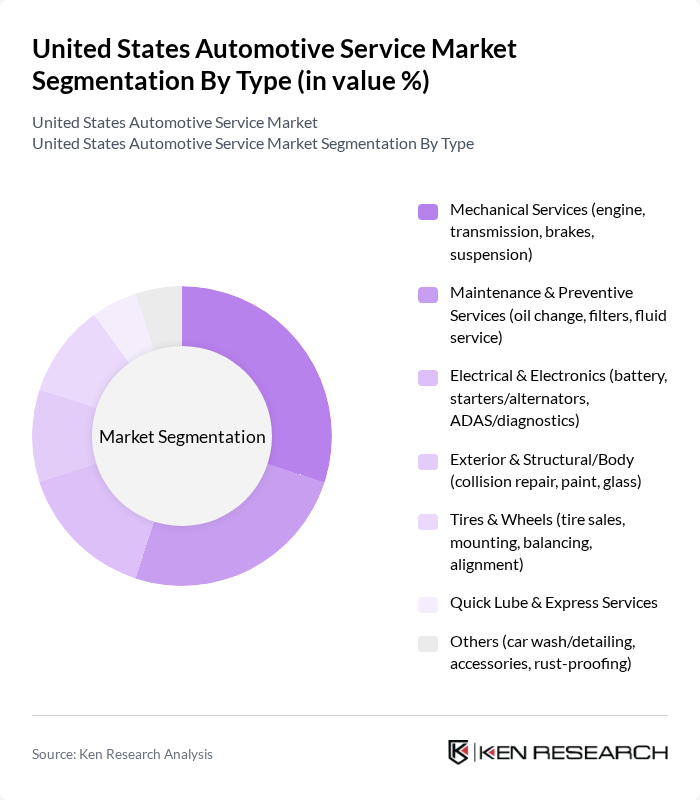

By Type:The automotive service market can be segmented into various types, including mechanical services, maintenance and preventive services, electrical and electronics, exterior and structural/body services, tires and wheels, quick lube and express services, and others. Each of these segments plays a crucial role in the overall service landscape, catering to different consumer needs and preferences. Industry sources define service scopes consistent with these segments, covering routine services (oil changes, tires) and non-routine work (collision, painting, rust-proofing) .

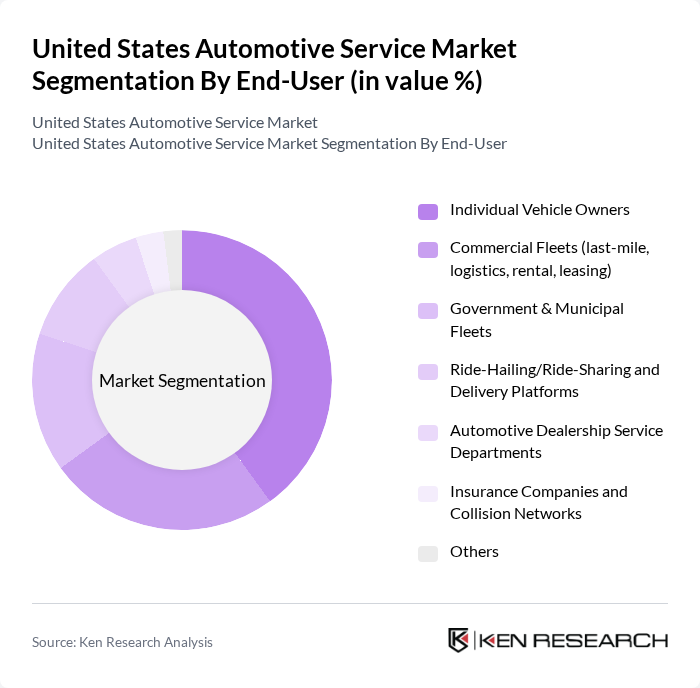

By End-User:The end-user segmentation includes individual vehicle owners, commercial fleets, government and municipal fleets, ride-hailing/ride-sharing and delivery platforms, automotive dealership service departments, insurance companies and collision networks, and others. Each segment has distinct service requirements and preferences, influencing the overall market dynamics. The aging U.S. vehicle fleet (average age reaching the highest on record) particularly sustains demand from individual owners and commercial operators, reinforcing preventive maintenance and repair intensity across these segments .

The United States Automotive Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as AutoNation, Inc., Lithia Motors, Inc. (Driveway; dealer service), Asbury Automotive Group, Inc., Penske Automotive Group, Inc., O’Reilly Automotive, Inc. (Professional services program), Advance Auto Parts, Inc. (CARQUEST network), Genuine Parts Company (NAPA AutoCare), The Pep Boys – Manny, Moe & Jack, Firestone Complete Auto Care (Bridgestone Retail Operations), Jiffy Lube International, Inc., Meineke Car Care Centers, LLC, Midas, LLC, AAMCO Transmissions and Total Car Care, Valvoline Inc. (Valvoline Instant Oil Change), Goodyear Auto Service (The Goodyear Tire & Rubber Company), Monro, Inc. (Monro Auto Service & Tire Centers), Caliber Collision, Safelite Group (Safelite AutoGlass), Christian Brothers Automotive, CarMax, Inc. (Service & reconditioning), Tire Kingdom/NTB (TBC Corporation), Big O Tires, LLC, AAA Car Care Centers (AAA), Tesla, Inc. (Service Centers and Mobile Service), Rivian Automotive, LLC (Service & mobile fleet) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United States automotive service market appears promising, driven by technological advancements and evolving consumer preferences. As electric vehicle adoption continues to rise, service providers will need to invest in specialized training and equipment. Additionally, the integration of digital platforms for service booking is expected to streamline operations and enhance customer engagement. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves for sustained growth in a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mechanical Services (engine, transmission, brakes, suspension) Maintenance & Preventive Services (oil change, filters, fluid service) Electrical & Electronics (battery, starters/alternators, ADAS/diagnostics) Exterior & Structural/Body (collision repair, paint, glass) Tires & Wheels (tire sales, mounting, balancing, alignment) Quick Lube & Express Services Others (car wash/detailing, accessories, rust-proofing) |

| By End-User | Individual Vehicle Owners Commercial Fleets (last-mile, logistics, rental, leasing) Government & Municipal Fleets Ride-Hailing/Ride-Sharing and Delivery Platforms Automotive Dealership Service Departments Insurance Companies and Collision Networks Others |

| By Service Channel | OEM-Authorized/Dealer Service Centers Independent Repair Shops (general repair, specialty) National Chains/Franchises Mobile Service Providers Online-to-Offline Platforms/Marketplaces Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles (BEV) Hybrid & Plug-in Hybrid Vehicles (HEV/PHEV) Two-Wheelers (limited, niche services) Others |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas Others |

| By Pricing Model | Fixed Pricing/Menu Pricing Hourly Labor Rates Subscription & Service Plans (maintenance contracts) Performance- or Warranty-Based Billing Others |

| By Service Frequency | Scheduled/Regular Maintenance On-Demand Services Emergency & Roadside Repairs Predictive/Connected Vehicle Maintenance Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Repair Shops | 120 | Shop Owners, Service Managers |

| Vehicle Maintenance Services | 100 | Technicians, Customer Service Representatives |

| Aftermarket Parts Suppliers | 80 | Procurement Managers, Sales Directors |

| Fleet Management Services | 70 | Fleet Managers, Operations Supervisors |

| Consumer Vehicle Owners | 150 | Car Owners, Vehicle Maintenance Decision Makers |

The United States Automotive Service Market is valued at approximately USD 190 billion, reflecting growth in the service and aftermarket sector as the vehicle parc increases and vehicles remain operational for longer periods, driving demand for maintenance and repair services.