Region:North America

Author(s):Rebecca

Product Code:KRAC3981

Pages:87

Published On:October 2025

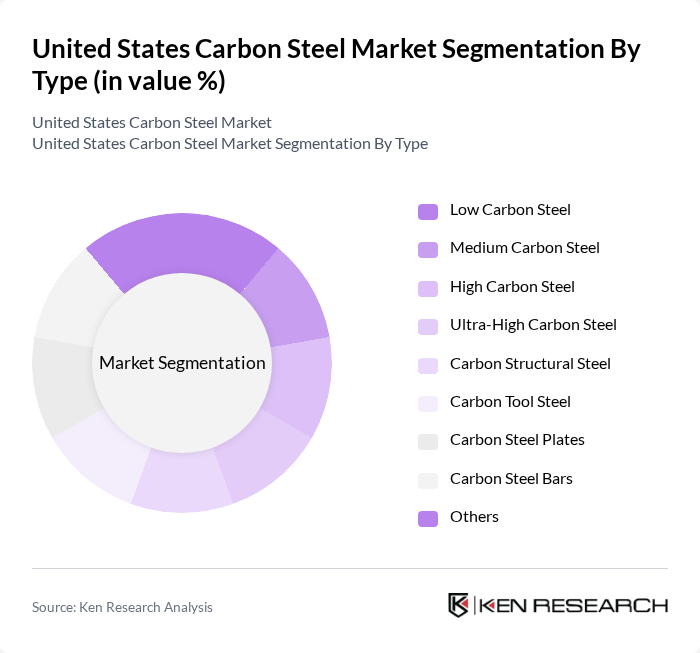

By Type:The carbon steel market can be segmented into various types, including Low Carbon Steel, Medium Carbon Steel, High Carbon Steel, Ultra-High Carbon Steel, Carbon Structural Steel, Carbon Tool Steel, Carbon Steel Plates, Carbon Steel Bars, and Others. Among these, Low Carbon Steel is the most widely used due to its excellent ductility and weldability, making it ideal for construction and automotive applications. The demand for Low Carbon Steel is driven by its cost-effectiveness and versatility, leading to its dominance in the market.

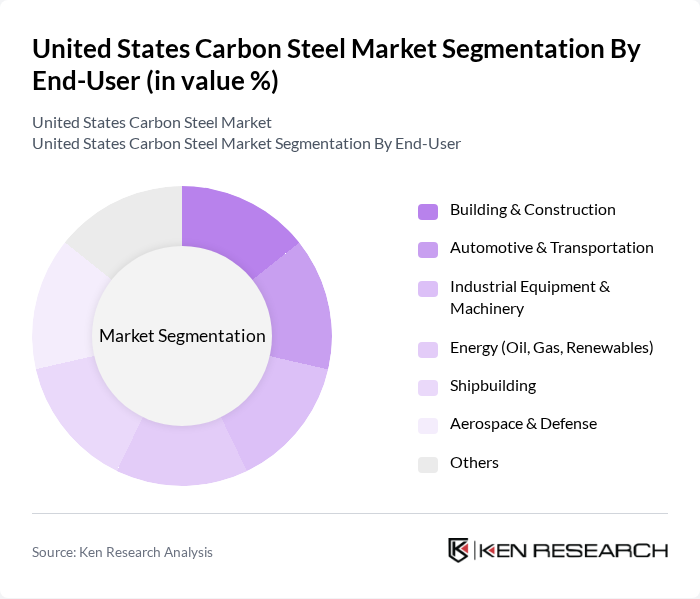

By End-User:The carbon steel market is segmented by end-user industries, including Building & Construction, Automotive & Transportation, Industrial Equipment & Machinery, Energy (Oil, Gas, Renewables), Shipbuilding, Aerospace & Defense, and Others. The Building & Construction sector is the leading end-user, driven by ongoing infrastructure projects and housing developments across the United States. The demand for carbon steel in this sector is fueled by its strength and durability, making it a preferred choice for structural applications.

The United States Carbon Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nucor Corporation, Steel Dynamics, Inc., United States Steel Corporation, Cleveland-Cliffs Inc., Commercial Metals Company (CMC), ArcelorMittal USA (now part of Cleveland-Cliffs Inc.), TimkenSteel Corporation, Gerdau Ameristeel Corporation, Worthington Industries, Inc., Republic Steel, SSAB Americas, Ryerson Holding Corporation, Allegheny Technologies Incorporated (ATI), JFE Shoji Steel America, Inc., Outokumpu Americas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the carbon steel market in the United States appears promising, driven by ongoing investments in infrastructure and a shift towards sustainable practices. As the construction and automotive sectors continue to expand, demand for high-quality carbon steel will likely increase. Additionally, advancements in production technologies and recycling methods will enhance efficiency and reduce environmental impact, positioning the industry favorably in a competitive landscape. Strategic partnerships will also play a crucial role in navigating challenges and seizing growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Low Carbon Steel Medium Carbon Steel High Carbon Steel Ultra-High Carbon Steel Carbon Structural Steel Carbon Tool Steel Carbon Steel Plates Carbon Steel Bars Others |

| By End-User | Building & Construction Automotive & Transportation Industrial Equipment & Machinery Energy (Oil, Gas, Renewables) Shipbuilding Aerospace & Defense Others |

| By Application | Structural Applications Mechanical Components Electrical Applications Tooling & Cutting Instruments Others |

| By Distribution Channel | Direct Sales Distributors & Service Centers Online Sales Others |

| By Price Range | Low Price Mid Price High Price Others |

| By Quality Grade | Standard Quality High Quality Premium Quality Others |

| By Region | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Industry Carbon Steel Usage | 50 | Procurement Managers, Product Engineers |

| Construction Sector Steel Demand | 60 | Project Managers, Supply Chain Coordinators |

| Manufacturing Applications of Carbon Steel | 70 | Operations Managers, Quality Control Supervisors |

| Steel Distribution and Logistics | 60 | Logistics Managers, Warehouse Supervisors |

| Market Trends and Innovations in Carbon Steel | 60 | Industry Analysts, R&D Managers |

The United States Carbon Steel Market is valued at approximately USD 73 billion, reflecting a steady growth driven by demand from the construction and automotive sectors, as well as a resurgence in manufacturing activities.