Region:North America

Author(s):Geetanshi

Product Code:KRAD7143

Pages:97

Published On:December 2025

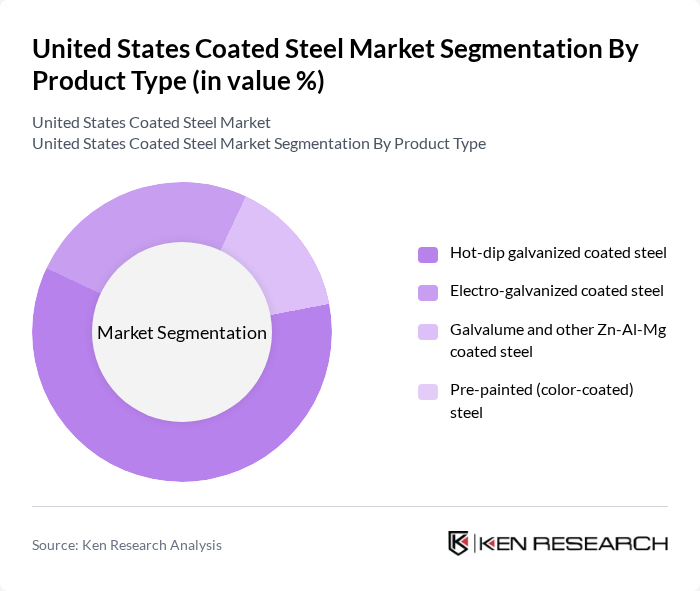

By Product Type:The product type segmentation includes various forms of coated steel, each catering to specific applications and industries. The dominant sub-segment is hot-dip galvanized coated steel, which is widely used in construction and automotive applications due to its excellent corrosion resistance and durability. Electro-galvanized coated steel is also significant, particularly in the appliance sector, while pre-painted steel is gaining traction for aesthetic applications. Galvalume and other Zn-Al-Mg coated steel are emerging due to their superior performance in harsh environments.

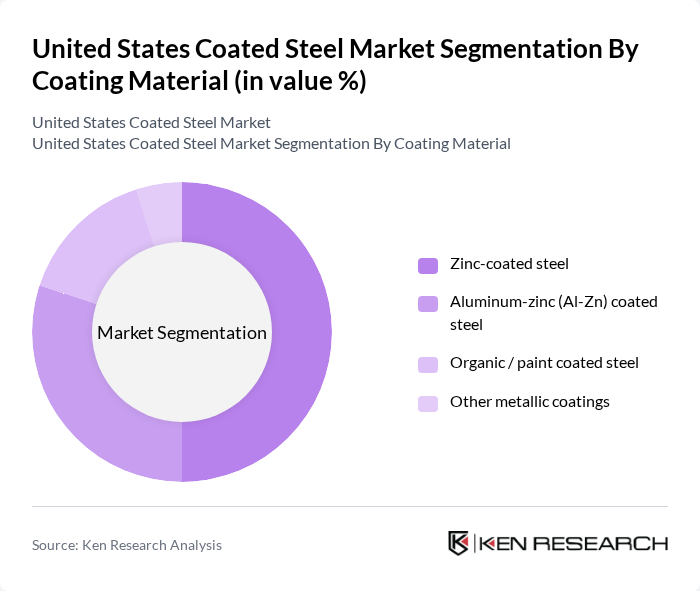

By Coating Material:The coating material segmentation highlights the various materials used in the coating process, with zinc-coated steel being the most prevalent due to its cost-effectiveness and protective qualities. Aluminum-zinc coated steel is also gaining popularity for its enhanced corrosion resistance. Organic/paint coated steel is increasingly used for aesthetic applications, while other metallic coatings are utilized in specialized applications requiring unique properties.

The United States Coated Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nucor Corporation, Steel Dynamics, Inc., United States Steel Corporation (U. S. Steel), Cleveland-Cliffs Inc. (including former AK Steel operations), ArcelorMittal Dofasco / ArcelorMittal North America, Commercial Metals Company, Worthington Enterprises, Inc., Reliance Steel & Aluminum Co., Olympic Steel, Inc., Steel Technologies LLC, BlueScope Steel North America (including Steelscape and Butler), SSAB Americas, POSCO America Corporation, Tata Steel Americas (including Tata Steel Plating), Voestalpine High Performance Metals Corp. (North America) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coated steel market in the United States appears promising, driven by ongoing technological advancements and increasing demand from various sectors. As sustainability becomes a priority, manufacturers are likely to invest in eco-friendly coatings and processes. Additionally, the anticipated growth in construction and infrastructure projects will further bolster demand. Strategic partnerships with construction firms will also play a crucial role in enhancing market penetration and expanding product offerings, ensuring a dynamic and competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hot-dip galvanized coated steel Electro-galvanized coated steel Galvalume and other Zn-Al-Mg coated steel Pre-painted (color-coated) steel |

| By Coating Material | Zinc-coated steel Aluminum-zinc (Al-Zn) coated steel Organic / paint coated steel Other metallic coatings |

| By End-Use Industry | Building & construction Automotive & transportation Appliances and consumer durables Industrial & agricultural equipment Others |

| By Application | Roofing, cladding and siding Structural components and framing HVAC ducts and systems Automotive body panels and parts Packaging and containers Others |

| By Coating Technology | Continuous coil coating Batch / piece coating Electro-deposition and other advanced technologies |

| By Thickness | Below 0.5 mm mm – 1.0 mm Above 1.0 mm |

| By Distribution Channel | Direct sales to OEMs Service centers and steel processors Distributors and stockists Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Usage | 120 | Project Managers, Procurement Officers |

| Automotive Manufacturing Insights | 100 | Supply Chain Managers, Production Supervisors |

| Appliance Sector Demand | 80 | Product Development Managers, Quality Assurance Leads |

| Coated Steel Distribution Channels | 70 | Distributors, Sales Managers |

| Market Trends and Innovations | 90 | Industry Analysts, R&D Directors |

The United States Coated Steel Market is valued at approximately USD 32 billion, driven by increasing demand from the construction and automotive sectors, as well as a rise in infrastructure projects and aesthetic steel products.