Global Coated Steel Market Overview

- The Global Coated Steel Market is valued at USD 33 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for coated steel in construction, automotive, appliances, and infrastructure sectors. Key market trends include rapid urbanization, expansion of residential and commercial projects, and a growing emphasis on sustainable building materials and energy-efficient manufacturing processes. Manufacturers are investing in advanced coating technologies and eco-friendly solutions to meet evolving regulatory and consumer requirements .

- Key players in this market include countries such as China, the United States, and Germany, which dominate due to their robust industrial bases, advanced manufacturing technologies, and significant investments in infrastructure development. China leads global production and consumption, supported by integrated steel complexes and large-scale industrial projects, while the United States and Germany maintain leadership through innovation and high-value applications in automotive and construction .

- In 2023, the European Union implemented the “Regulation (EU) 2023/956 establishing a carbon border adjustment mechanism,” issued by the European Parliament and Council, which mandates that all coated steel products imported into the EU meet strict carbon emission reporting and reduction standards. This regulation is part of the EU’s broader initiative to promote sustainable practices and reduce the carbon footprint of manufacturing processes across the region, requiring importers and producers to comply with specific monitoring, reporting, and verification protocols for embedded emissions .

Global Coated Steel Market Segmentation

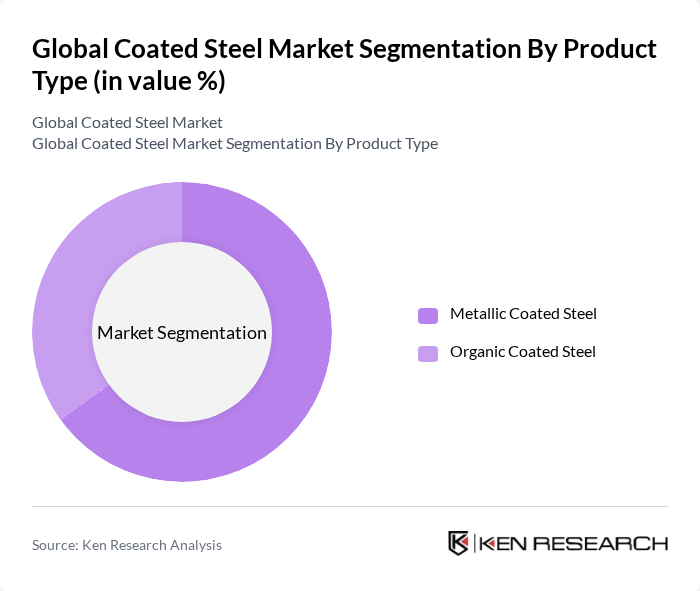

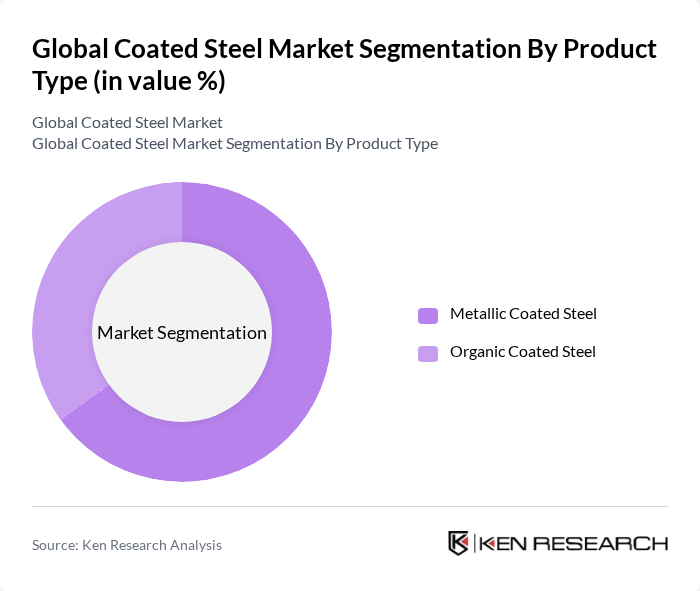

By Product Type:The product type segmentation includes Metallic Coated Steel and Organic Coated Steel. Metallic Coated Steel is widely used due to its superior corrosion resistance, durability, and recyclability, making it a preferred choice in construction, automotive, and infrastructure applications. Organic Coated Steel is gaining traction for its aesthetic appeal, versatility, and ability to provide enhanced surface protection and color options, supporting its adoption in appliances, consumer goods, and architectural projects .

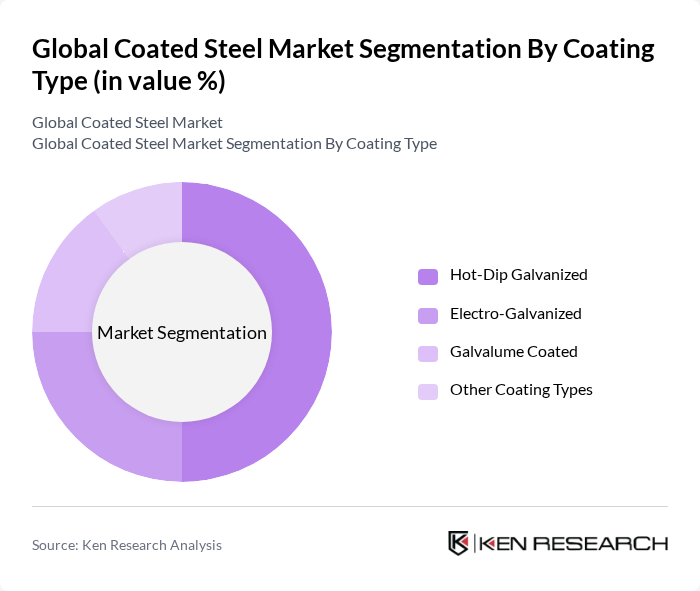

By Coating Type:The coating type segmentation includes Hot-Dip Galvanized, Electro-Galvanized, Galvalume Coated, and Other Coating Types. Hot-Dip Galvanized steel remains the most dominant due to its excellent corrosion resistance and extensive use in construction, automotive, and infrastructure sectors. Electro-Galvanized steel is preferred for applications requiring a smooth finish and precision, such as electronics and appliances. Galvalume Coated steel is recognized for its durability, heat resistance, and suitability for roofing and exterior panels. Other coating types address niche requirements in packaging, electrical, and specialty engineering applications .

Global Coated Steel Market Competitive Landscape

The Global Coated Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as ArcelorMittal, Nucor Corporation, Tata Steel, United States Steel Corporation, JSW Steel Ltd., POSCO Holdings Inc., Cleveland-Cliffs Inc., thyssenkrupp AG, Steel Dynamics, Inc., PAO Severstal, Baosteel Group Corporation, China Steel Corporation, Essar Steel (now AM/NS India), Nippon Steel Corporation, Hyundai Steel Company contribute to innovation, geographic expansion, and service delivery in this space.

Global Coated Steel Market Industry Analysis

Growth Drivers

- Increasing Demand from Construction Sector:The construction sector is projected to contribute significantly to the coated steel market, with global construction spending expected to reach $10 trillion in future. This growth is driven by urbanization and infrastructure development, particularly in emerging economies. For instance, the Asian Development Bank estimates that Asia alone will require $26 trillion in infrastructure investments from 2016 to 2030, creating a robust demand for coated steel products.

- Technological Advancements in Coating Processes:Innovations in coating technologies are enhancing the performance and durability of coated steel. For example, advancements in electroplating and powder coating techniques have improved corrosion resistance and aesthetic appeal. The global market for advanced coating technologies is expected to grow to $20 billion in future, indicating a strong trend towards adopting these technologies in the coated steel industry, thereby driving market growth.

- Expansion of Automotive Industry:The automotive industry is a major consumer of coated steel, with global vehicle production projected to reach 100 million units in future. This growth is fueled by rising disposable incomes and demand for lightweight materials that enhance fuel efficiency. The International Organization of Motor Vehicle Manufacturers reported that coated steel is increasingly used in vehicle manufacturing, contributing to a projected increase in coated steel consumption by 15 million tons in the automotive sector alone.

Market Challenges

- Fluctuating Raw Material Prices:The coated steel market faces challenges from volatile raw material prices, particularly for steel and coatings. In future, the price of hot-rolled steel fluctuated between $700 and $900 per ton, impacting production costs. This volatility can lead to unpredictable pricing for coated steel products, making it difficult for manufacturers to maintain profit margins and pricing strategies, ultimately affecting market stability.

- Environmental Regulations and Compliance Costs:Stricter environmental regulations are increasing compliance costs for coated steel manufacturers. In future, the European Union is expected to implement new regulations that could raise production costs by up to 20% for companies that do not meet environmental standards. This regulatory pressure can hinder market growth, as companies may struggle to balance compliance with profitability while investing in sustainable practices.

Global Coated Steel Market Future Outlook

The future of the coated steel market appears promising, driven by increasing demand from various sectors, particularly construction and automotive. As technological advancements continue to enhance product performance, manufacturers are likely to invest in innovative coating solutions. Additionally, the shift towards sustainable practices will encourage the development of eco-friendly coatings, aligning with global environmental goals. Overall, the market is poised for growth, supported by robust demand and ongoing innovations in coating technologies.

Market Opportunities

- Growth in Renewable Energy Sector:The renewable energy sector is rapidly expanding, with investments projected to exceed $2 trillion in future. Coated steel is essential for constructing wind turbines and solar panels, presenting significant opportunities for manufacturers to supply durable and corrosion-resistant materials, thereby tapping into this growing market segment.

- Emerging Markets Demand:Emerging markets, particularly in Asia and Africa, are experiencing rapid industrialization and urbanization. The World Bank estimates that these regions will see a strong annual growth rate in construction activities in future. This trend creates substantial opportunities for coated steel suppliers to meet the increasing demand for infrastructure and housing projects in these markets.