Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8271

Pages:84

Published On:December 2025

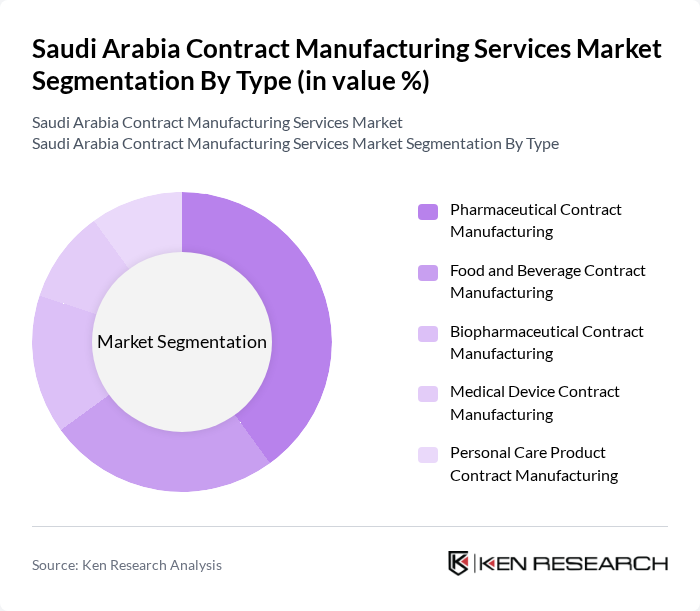

By Type:The contract manufacturing services market is segmented into various types, including Pharmaceutical Contract Manufacturing, Food and Beverage Contract Manufacturing, Biopharmaceutical Contract Manufacturing, Medical Device Contract Manufacturing, and Personal Care Product Contract Manufacturing. Among these, Pharmaceutical Contract Manufacturing is the leading segment due to the rising demand for generic drugs and the need for cost-effective production solutions.

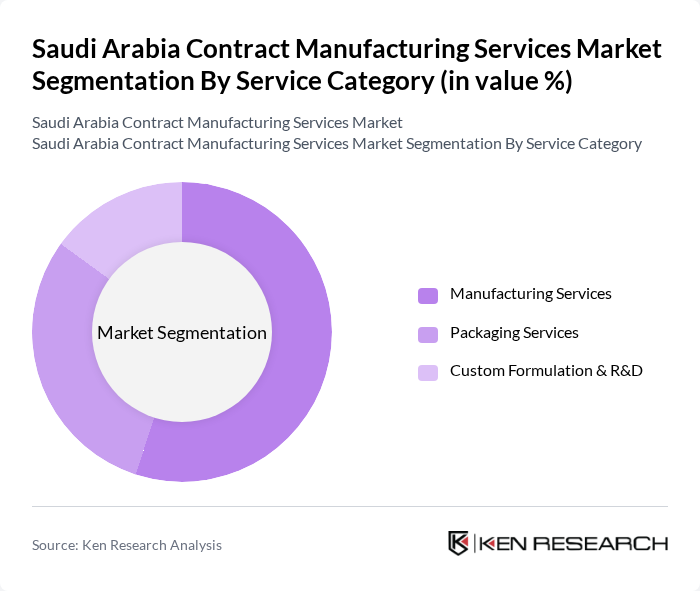

By Service Category:The market is also segmented by service categories, which include Manufacturing Services, Packaging Services, and Custom Formulation & R&D. Manufacturing Services dominate this segment as companies increasingly outsource production to focus on core competencies and reduce operational costs.

The Saudi Arabia Contract Manufacturing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zamil Food Company, Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Saudi Basic Industries Corporation (SABIC), National Industrialization Company (Tasnee), Almarai Company, Advanced Petrochemical Company, Banjara Holdings, Saudi Arabian Amiantit Company, Al-Babtain Group, Al-Muhaidib Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia contract manufacturing services market appears promising, driven by technological advancements and a focus on sustainability. As manufacturers increasingly adopt Industry 4.0 technologies, operational efficiencies are expected to improve significantly. Furthermore, the growing emphasis on eco-friendly practices will likely reshape production processes, aligning with global sustainability trends. These developments will not only enhance competitiveness but also position Saudi Arabia as a key player in the regional manufacturing landscape, attracting further investments and partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Pharmaceutical Contract Manufacturing Food and Beverage Contract Manufacturing Biopharmaceutical Contract Manufacturing Medical Device Contract Manufacturing Personal Care Product Contract Manufacturing |

| By Service Category | Manufacturing Services Packaging Services Custom Formulation & R&D |

| By End-User | Big Pharmaceuticals Small and Mid-Size Pharmaceuticals Generic Pharmaceutical Companies Dietary Supplement Manufacturers Dairy Products Manufacturers Convenience Foods Manufacturers Bakery Products Manufacturers Confectionery Manufacturers |

| By Technology | Active Pharmaceutical Ingredients (API) Manufacturing Finished Dosage Formulation (FDF) Development & Manufacturing Mammalian Cell Culture Technologies Non-Mammalian Biotech Manufacturing Advanced Manufacturing Technologies |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Vision 2030 Initiatives Tax Exemptions Regulatory Support Healthcare Expenditure Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Contract Manufacturing | 100 | Production Managers, Quality Assurance Heads |

| Electronics Assembly Services | 80 | Operations Directors, Supply Chain Managers |

| Consumer Goods Manufacturing | 90 | Product Development Managers, Procurement Officers |

| Food and Beverage Contract Services | 70 | Quality Control Managers, Regulatory Affairs Specialists |

| Automotive Component Manufacturing | 60 | Engineering Managers, Supply Chain Analysts |

The Saudi Arabia Contract Manufacturing Services Market is valued at approximately USD 12 billion, driven by the increasing demand for outsourcing manufacturing processes, particularly in the pharmaceuticals and food and beverage sectors.