Region:North America

Author(s):Dev

Product Code:KRAA8264

Pages:81

Published On:November 2025

By Type:The market is segmented into Rigid Copper Pipes, Flexible Copper Tubes, Copper Fittings, and Others. Rigid Copper Pipes are predominantly used in plumbing and HVAC applications due to their durability, high wall thickness, and resistance to corrosion, with Type K and Type L being the most common grades. Flexible Copper Tubes are preferred for applications requiring bending and shaping, such as refrigeration and certain HVAC systems. Copper Fittings are essential for connecting pipes and ensuring leak-proof systems in both residential and commercial installations. The Others category includes specialized products such as microgroove and capillary tubes, which cater to niche applications in medical, automotive, and advanced HVAC systems.

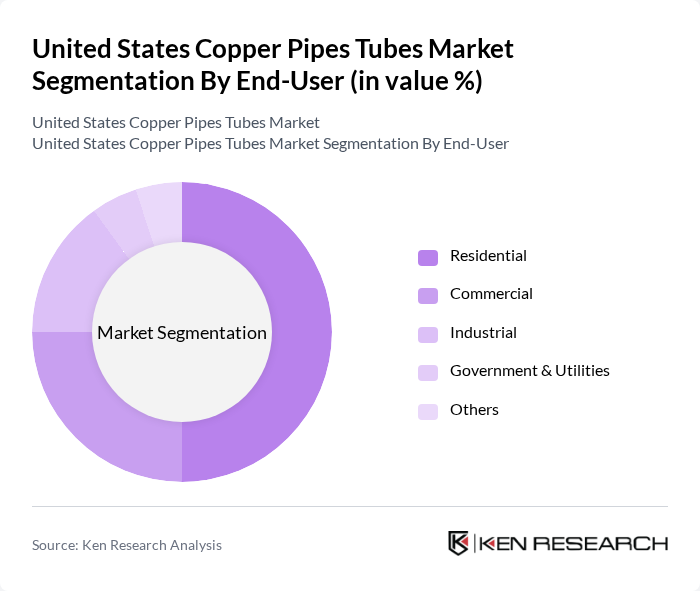

By End-User:The market is categorized into Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment is the largest, driven by ongoing demand for plumbing and HVAC installations in homes and multi-family units. The Commercial segment follows, supported by construction of office buildings, retail spaces, and hospitality infrastructure. Industrial applications contribute significantly, particularly in manufacturing, processing, and energy sectors. Government & Utilities utilize copper pipes and tubes in municipal water supply, infrastructure upgrades, and public facility renovations. The Others segment includes specialized uses in healthcare, transportation, and emerging smart city projects.

The United States Copper Pipes Tubes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mueller Industries, Cerro Flow Products LLC, Cambridge-Lee Industries LLC, Wieland Chase (Wieland Group), KME Group S.p.A., Revere Copper Products, Inc., Southwire Company, LLC, Luvata (Mitsubishi Materials Corporation), Hailiang America (Zhejiang Hailiang Co., Ltd.), MetTube (MetTube Sdn Bhd), Kobe Steel, Ltd., Olin Brass (Global Brass and Copper Holdings, Inc.), ACR Copper Tube, MM Kembla, Shanghai Metal Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the copper pipes and tubes market in the United States appears promising, driven by ongoing trends in sustainability and technological innovation. As the construction industry increasingly adopts eco-friendly practices, the demand for copper, known for its recyclability, is likely to rise. Additionally, advancements in smart home technologies will create new applications for copper pipes, enhancing their relevance in modern plumbing systems. Overall, the market is poised for growth as it adapts to evolving consumer preferences and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Copper Pipes Flexible Copper Tubes Copper Fittings Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Application | Plumbing HVAC Systems Fire Protection Systems Electrical & Electronics Industrial Heat Exchangers Renewable Energy Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Others |

| By Region | Northeast Midwest South West |

| By Manufacturing Process | Extrusion Drawing Forging Others |

| By Product Form | Coils Straight Lengths Sheets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Plumbing Market | 100 | Plumbing Contractors, Home Builders |

| Commercial HVAC Applications | 80 | HVAC Engineers, Facility Managers |

| Industrial Manufacturing Sector | 60 | Manufacturing Managers, Procurement Specialists |

| Construction Industry Insights | 90 | Construction Project Managers, Architects |

| Distribution and Retail Channels | 70 | Supply Chain Managers, Retail Buyers |

The United States Copper Pipes Tubes Market is valued at approximately USD 1.6 billion, driven by increasing demand in plumbing, HVAC systems, and electrical applications, alongside rising construction activities across the country.