Region:North America

Author(s):Shubham

Product Code:KRAD4719

Pages:99

Published On:December 2025

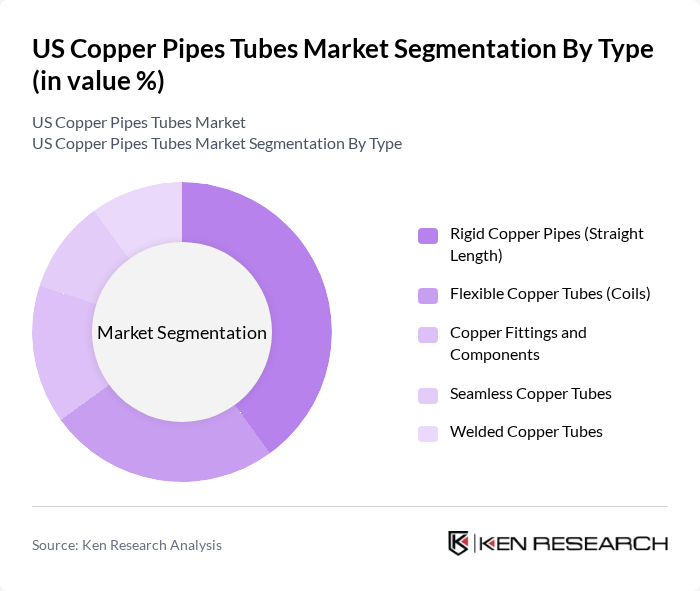

By Type:The market is segmented into various types of copper pipes and tubes, including Rigid Copper Pipes (Straight Length), Flexible Copper Tubes (Coils), Copper Fittings and Components, Seamless Copper Tubes, and Welded Copper Tubes. Among these, Rigid Copper Pipes are widely used in plumbing and HVAC applications due to their durability and resistance to corrosion. Flexible Copper Tubes are gaining traction in applications requiring bending and shaping, while Copper Fittings and Components are essential for connecting different pipe sections. The demand for Seamless and Welded Copper Tubes is also significant in industrial applications, where strength and reliability are crucial.

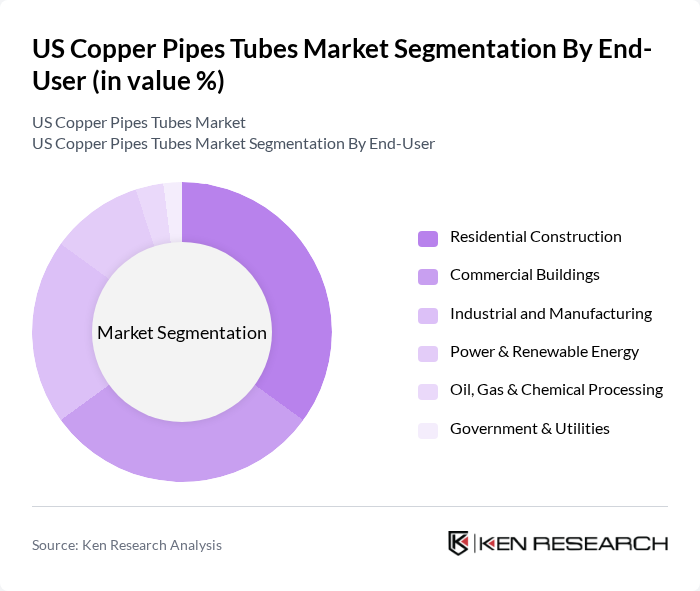

By End-User:The end-user segmentation includes Residential Construction, Commercial Buildings, Industrial and Manufacturing, Power & Renewable Energy, Oil, Gas & Chemical Processing, and Government & Utilities. The Residential Construction sector is the largest consumer of copper pipes and tubes, driven by the increasing number of housing projects and renovations. Commercial Buildings also contribute significantly, as businesses invest in energy-efficient plumbing and HVAC systems. The Industrial and Manufacturing sector utilizes copper pipes for various applications, including heat exchangers and process piping, while the Power & Renewable Energy sector is witnessing growth due to the rising demand for sustainable energy solutions.

The US Copper Pipes Tubes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mueller Industries Inc., Cerro Flow Products LLC (Cerro Copper), Cambridge-Lee Industries LLC, Wieland Group (Including Former Wolverine Tube Operations), KME Group S.p.A., Hailiang (America) Corporation, NIBCO INC., Viega LLC, Zurn Elkay Water Solutions Corporation, Uponor Corporation, Parker Hannifin Corporation, Southwire Company LLC, ACR Copper Tube Division (Selected Regional Producers), United Pipe & Steel (A Merfish United Company), Copper Development Association Inc. (Industry Association) contribute to innovation, geographic expansion, and service delivery in this space.

The US copper pipes and tubes market is poised for growth, driven by increasing investments in infrastructure and a shift towards sustainable manufacturing practices. As the demand for energy-efficient solutions rises, manufacturers are likely to focus on developing innovative products that meet regulatory standards. Additionally, the integration of IoT technologies in plumbing systems is expected to enhance product functionality, creating new avenues for market expansion. Overall, the market is set to adapt to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Copper Pipes (Straight Length) Flexible Copper Tubes (Coils) Copper Fittings and Components Seamless Copper Tubes Welded Copper Tubes |

| By End-User | Residential Construction Commercial Buildings Industrial and Manufacturing Power & Renewable Energy Oil, Gas & Chemical Processing Government & Utilities |

| By Application | Plumbing & Potable Water Systems HVAC & Refrigeration Fire Protection & Sprinkler Systems Industrial Heat Exchangers Medical Gas & Specialty Fluids |

| By Diameter | ? 1/2 inch (Small Diameter) > 1/2 to 2 inches (Medium Diameter) > 2 inches (Large Diameter) |

| By Coating / Finish Type | Bare / Uncoated Copper PVC-Coated Copper Tubes Insulated (Pre-Insulated) Copper Tubes Tin-Plated and Other Specialty Coatings |

| By Distribution Channel | Direct Sales to OEMs Wholesale Distributors Retail & Trade Counters Online & E-commerce Platforms |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Plumbing Contractors | 120 | Project Managers, Lead Plumbers |

| HVAC System Installers | 100 | Installation Supervisors, Technical Directors |

| Manufacturers of Copper Pipes | 80 | Production Managers, Quality Control Engineers |

| Distributors and Wholesalers | 120 | Sales Managers, Supply Chain Coordinators |

| End-Users in Construction | 90 | Construction Managers, Procurement Officers |

The US Copper Pipes Tubes Market is valued at approximately USD 6.35 billion, driven by increasing demand in plumbing, HVAC systems, and renewable energy applications, alongside rising construction activities across various sectors.