Region:North America

Author(s):Geetanshi

Product Code:KRAD0009

Pages:86

Published On:August 2025

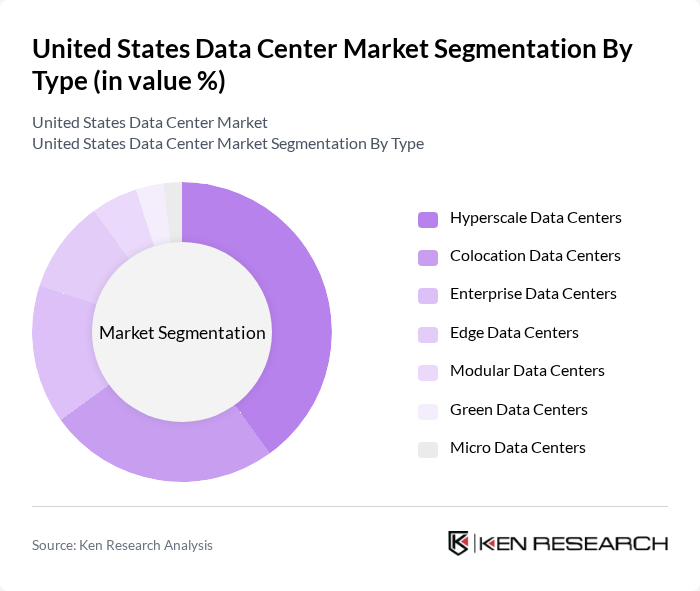

By Type:The data center market is segmented into Hyperscale Data Centers, Colocation Data Centers, Enterprise Data Centers, Edge Data Centers, Modular Data Centers, Green Data Centers, and Micro Data Centers. Hyperscale Data Centers are leading the market due to their ability to scale rapidly and efficiently meet the demands of large cloud service providers and enterprises. The increasing reliance on cloud computing, artificial intelligence, and big data analytics has driven the demand for these large-scale facilities, which offer significant cost advantages, operational efficiencies, and advanced energy management solutions .

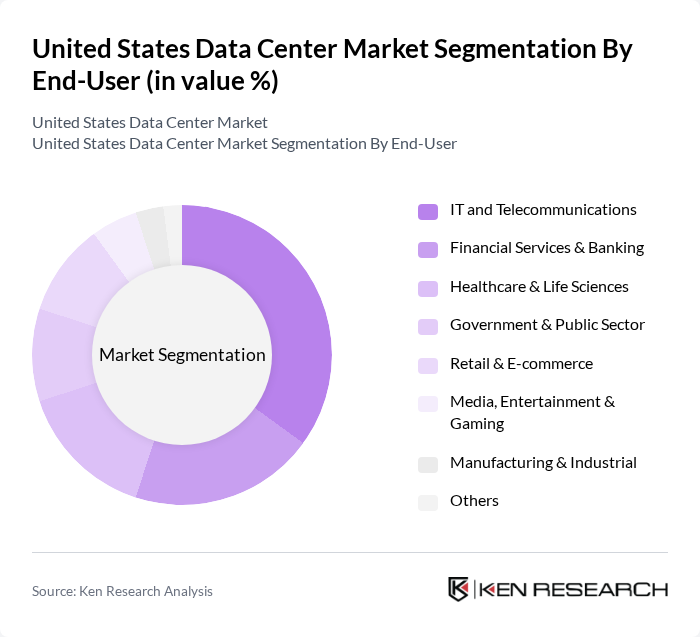

By End-User:The end-user segmentation includes IT and Telecommunications, Financial Services & Banking, Healthcare & Life Sciences, Government & Public Sector, Retail & E-commerce, Media, Entertainment & Gaming, Manufacturing & Industrial, and Others. The IT and Telecommunications sector is the dominant end-user, driven by the increasing demand for data storage, processing capabilities, and secure cloud migration. Financial Services & Banking and Healthcare & Life Sciences are also major contributors, leveraging data centers for regulatory compliance, data security, and real-time analytics .

The United States Data Center Market is characterized by a dynamic mix of regional and international players. Leading participants such as Equinix, Inc., Digital Realty Trust, Inc., CyrusOne Inc., NTT Global Data Centers Americas, Inc., CoreSite Realty Corporation (an American Tower company), Iron Mountain Incorporated, QTS Realty Trust, Inc. (a Blackstone portfolio company), Rackspace Technology, Inc., Switch, Inc., Flexential Corp., Microsoft Azure, Amazon Web Services, Inc., Google Cloud Platform, IBM Cloud, Oracle Cloud contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. data center market is poised for transformative growth, driven by technological advancements and evolving consumer demands. As organizations increasingly adopt hybrid cloud solutions, data centers will need to adapt to support diverse workloads. Furthermore, the integration of AI and machine learning into operations will enhance efficiency and decision-making. Sustainability will remain a priority, with a focus on renewable energy and energy-efficient practices shaping the industry's landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hyperscale Data Centers Colocation Data Centers Enterprise Data Centers Edge Data Centers Modular Data Centers Green Data Centers Micro Data Centers |

| By End-User | IT and Telecommunications Financial Services & Banking Healthcare & Life Sciences Government & Public Sector Retail & E-commerce Media, Entertainment & Gaming Manufacturing & Industrial Others |

| By Application | Cloud Computing Data Storage & Backup Disaster Recovery & Business Continuity Big Data Analytics Internet of Things (IoT) Artificial Intelligence & Machine Learning Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Managed Services Colocation Services Others |

| By Ownership Model | Owner-Operated Data Centers Third-Party/Colocation Data Centers Cloud Service Provider Data Centers Others |

| By Location | Urban Areas Suburban Areas Rural Areas Edge Locations Others |

| By Energy Source | Renewable Energy Non-Renewable Energy Hybrid Energy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Colocation Services | 100 | Data Center Managers, IT Directors |

| Hyperscale Data Centers | 60 | Cloud Architects, Operations Managers |

| Energy Efficiency Solutions | 50 | Sustainability Officers, Facility Engineers |

| Disaster Recovery Services | 40 | Business Continuity Planners, IT Security Managers |

| Edge Computing Deployments | 45 | Network Engineers, Product Managers |

The United States Data Center Market is valued at approximately USD 215 billion, reflecting significant growth driven by the increasing demand for cloud services, AI workloads, and IoT applications, alongside substantial investments in data center infrastructure.