Region:North America

Author(s):Geetanshi

Product Code:KRAA1268

Pages:83

Published On:August 2025

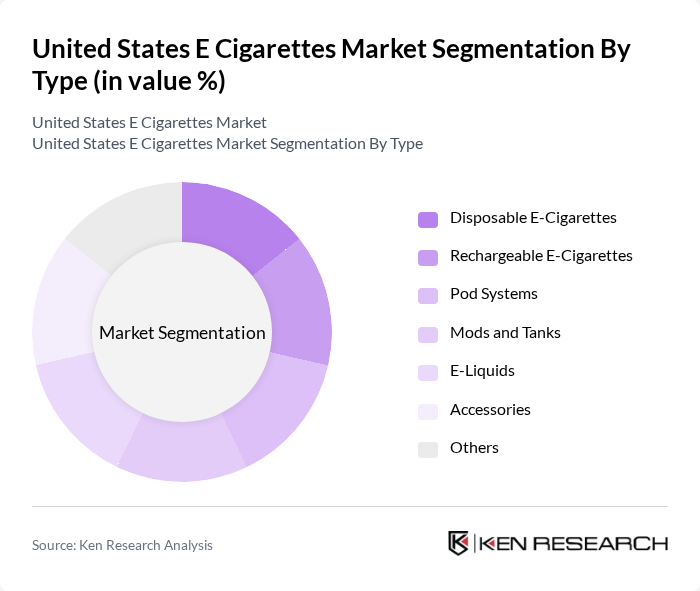

By Type:The market is segmented into Disposable E-Cigarettes, Rechargeable E-Cigarettes, Pod Systems, Mods and Tanks, E-Liquids, Accessories, and Others. Disposable E-Cigarettes have gained significant traction due to their convenience and ease of use, appealing particularly to new users and those seeking a hassle-free vaping experience. Rechargeable E-Cigarettes and Pod Systems also hold substantial market shares, driven by their cost-effectiveness, customizable options, and appeal to more experienced users. The market has seen a notable shift toward next-generation devices, including pod-based systems and advanced mods, reflecting consumer demand for personalization, portability, and enhanced nicotine delivery .

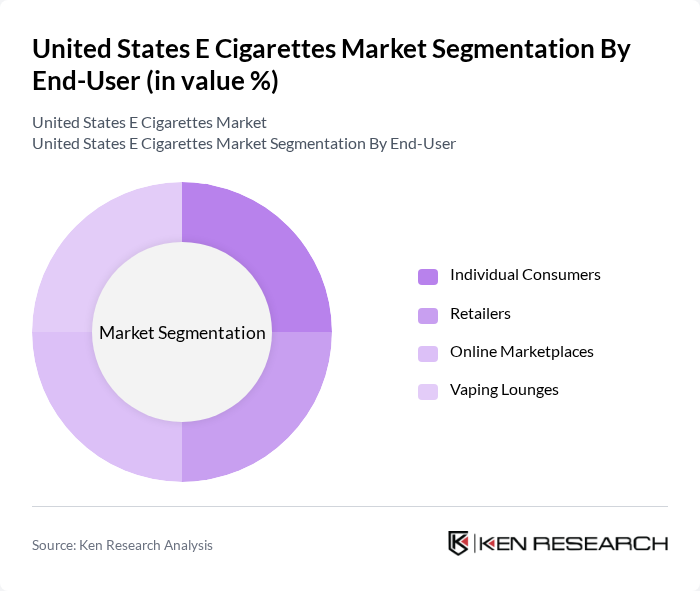

By End-User:The end-user segmentation includes Individual Consumers, Retailers, Online Marketplaces, and Vaping Lounges. Individual Consumers dominate the market, driven by the growing trend of vaping among younger demographics and adults seeking alternatives to traditional tobacco products. Retailers and Online Marketplaces play crucial roles in distribution, providing consumers with easy access to a wide range of products, while Vaping Lounges, though smaller in market share, contribute to community building and brand loyalty among enthusiasts. The proliferation of online sales channels and specialty vape shops has further expanded consumer access and product variety .

The United States E Cigarettes Market is characterized by a dynamic mix of regional and international players. Leading participants such as JUUL Labs, Inc., British American Tobacco plc (Vuse), Philip Morris International Inc. (IQOS), Altria Group, Inc., NJOY, LLC (Altria Group), Logic Technology Development LLC (Japan Tobacco International), Smoore Technology Limited (Vaporesso, GeekVape), Shenzhen IVPS Technology Co., Ltd. (SMOK), Innokin Technology Co., Ltd., Eonsmoke LLC, RELX Technology Inc., Suorin (Shenzhen Youme Information Technology Co., Ltd.), Elf Bar (Heaven Gifts International Ltd.), Vaporesso (Smoore Technology Limited), and other emerging brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. e-cigarette market appears promising, driven by ongoing innovations and evolving consumer preferences. As health-conscious consumers increasingly seek alternatives to traditional smoking, the demand for e-cigarettes is expected to rise. Additionally, the market is likely to see a surge in product diversification, with companies focusing on unique flavors and customizable options. Strategic partnerships with retailers and the expansion of online sales channels will further enhance market accessibility, positioning the industry for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable E-Cigarettes Rechargeable E-Cigarettes Pod Systems Mods and Tanks E-Liquids Accessories Others |

| By End-User | Individual Consumers Retailers Online Marketplaces Vaping Lounges |

| By Distribution Channel | Specialty Vape Shops Convenience Stores Online Retail Supermarkets and Hypermarkets Tobacconists Others |

| By Flavor | Tobacco Flavors Menthol Flavors Fruit Flavors Dessert Flavors Beverage Flavors Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Users |

| By Packaging Type | Single-Use Packaging Multi-Pack Packaging Refillable Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail E-Cigarette Sales | 100 | Store Managers, Sales Representatives |

| Consumer Usage Patterns | 150 | Regular E-Cigarette Users, Occasional Users |

| Distribution Channel Insights | 80 | Distributors, Wholesalers |

| Regulatory Impact Assessment | 60 | Public Health Officials, Policy Makers |

| Market Trend Analysis | 100 | Market Analysts, Industry Experts |

The United States E Cigarettes Market is valued at approximately USD 13.7 billion, reflecting significant growth driven by consumer preferences for vaping as a less harmful alternative to traditional smoking and the introduction of innovative products and flavors.