Region:North America

Author(s):Shubham

Product Code:KRAB3293

Pages:84

Published On:October 2025

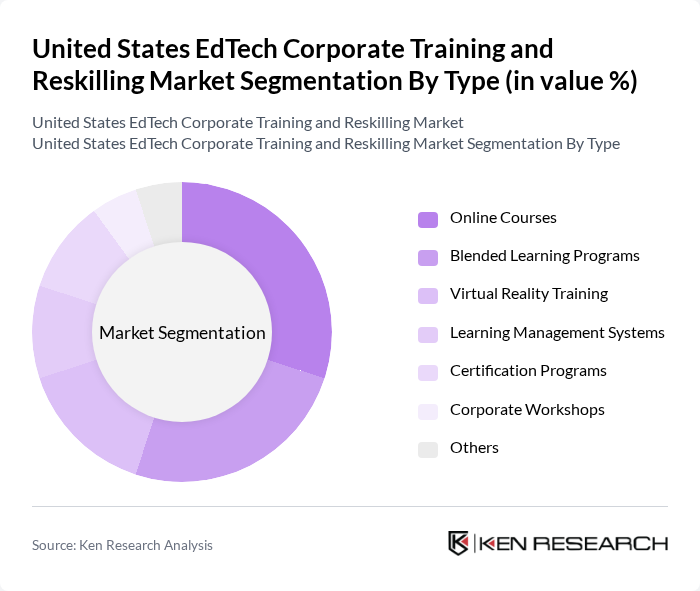

By Type:The market is segmented into various types of training solutions, including Online Courses, Blended Learning Programs, Virtual Reality Training, Learning Management Systems, Certification Programs, Corporate Workshops, and Others. Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to engage at their own pace. Blended Learning Programs combine traditional classroom methods with online learning, catering to diverse learning preferences. Virtual Reality Training is emerging as a cutting-edge solution, providing immersive experiences that enhance skill acquisition. Learning Management Systems facilitate the organization and delivery of educational content, while Certification Programs validate skills and knowledge, making them highly sought after in the job market. Corporate Workshops and other training formats also contribute to the market's growth by offering tailored solutions for specific organizational needs.

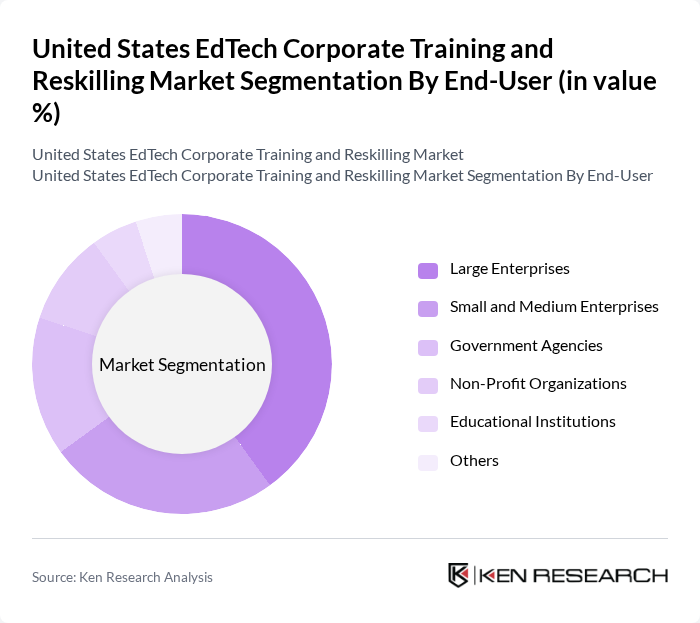

By End-User:The EdTech Corporate Training and Reskilling Market is also segmented by end-users, which include Large Enterprises, Small and Medium Enterprises, Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Large Enterprises dominate the market due to their substantial budgets for employee training and development, often investing in comprehensive training programs to enhance workforce capabilities. Small and Medium Enterprises are increasingly adopting EdTech solutions to remain competitive, while Government Agencies leverage these tools to improve public sector skills. Non-Profit Organizations and Educational Institutions also play a vital role in promoting reskilling initiatives, often focusing on community development and workforce readiness.

The United States EdTech Corporate Training and Reskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera Inc., Udacity Inc., LinkedIn Learning, Pluralsight Inc., Skillsoft Corporation, EdX Inc., Degreed Inc., Khan Academy, General Assembly, Simplilearn Solutions, Grovo, TalentLMS, LearnSmart, Mindflash, BizLibrary contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. EdTech corporate training and reskilling market appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly embrace digital learning, the integration of AI and personalized learning experiences will become critical. Furthermore, the emphasis on soft skills training and data analytics will shape training strategies, ensuring that employees are equipped with both technical and interpersonal skills necessary for success in a dynamic job market.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Blended Learning Programs Virtual Reality Training Learning Management Systems Certification Programs Corporate Workshops Others |

| By End-User | Large Enterprises Small and Medium Enterprises Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Industry | Technology Healthcare Finance Manufacturing Retail Others |

| By Learning Format | Synchronous Learning Asynchronous Learning Hybrid Learning Self-Paced Learning Others |

| By Delivery Method | Instructor-Led Training Online Learning Platforms Mobile Learning Applications On-the-Job Training Others |

| By Certification Type | Professional Certifications Technical Certifications Compliance Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | Training Managers, Learning & Development Directors |

| Reskilling Initiatives in Tech Firms | 100 | HR Executives, Talent Development Specialists |

| EdTech Solution Providers | 80 | Product Managers, Sales Directors |

| Employee Feedback on Training Effectiveness | 120 | Employees from various sectors undergoing training |

| Government Workforce Development Programs | 70 | Policy Makers, Program Coordinators |

The United States EdTech Corporate Training and Reskilling Market is valued at approximately USD 55 billion, reflecting significant growth driven by the demand for upskilling and reskilling in a rapidly evolving job market.