Region:North America

Author(s):Geetanshi

Product Code:KRAB4647

Pages:98

Published On:October 2025

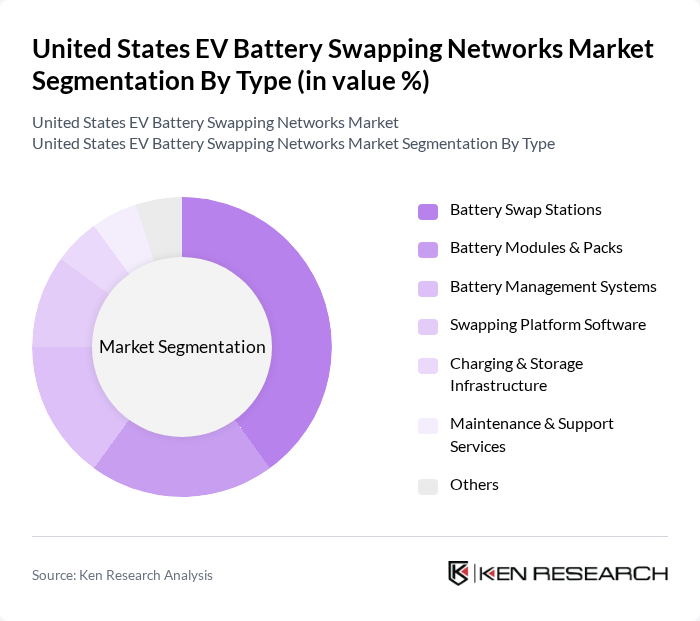

By Type:The market can be segmented into various types, including Battery Swap Stations, Battery Modules & Packs, Battery Management Systems, Swapping Platform Software, Charging & Storage Infrastructure, Maintenance & Support Services, and Others. Among these, Battery Swap Stations are gaining significant traction due to their essential role in facilitating quick battery exchanges for electric vehicles, thus enhancing user convenience and reducing downtime. The integration of AI and IoT in Battery Swap Stations is further improving operational efficiency and user experience .

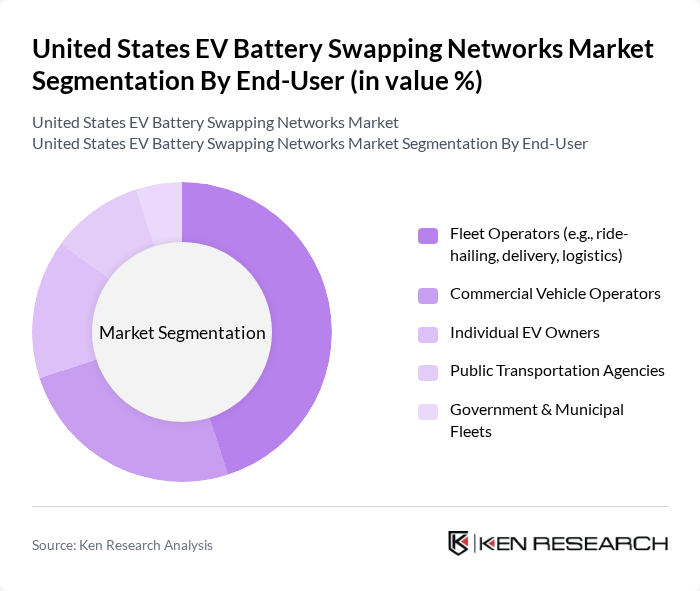

By End-User:The end-user segmentation includes Fleet Operators (e.g., ride-hailing, delivery, logistics), Commercial Vehicle Operators, Individual EV Owners, Public Transportation Agencies, and Government & Municipal Fleets. Fleet Operators are currently leading this segment due to their high demand for efficient and rapid battery swapping solutions, which help minimize operational downtime and enhance service delivery. The adoption of battery swapping is particularly strong in urban logistics and ride-hailing, where maximizing vehicle uptime is critical .

The United States EV Battery Swapping Networks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ample Inc., Tesla, Inc., Land Moto, Liberty Battery, Stellantis N.V., NIO Inc., Gogoro Inc., Shell Recharge Solutions, EVgo Services LLC, Blink Charging Co., ChargePoint, Inc., Greenlots (Shell Group), Aulton Technology Co., Ltd., Better Place (legacy), Contemporary Amperex Technology Co. Limited (CATL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the EV battery swapping market in the United States appears promising, driven by increasing investments in infrastructure and technological advancements. As urbanization continues, the demand for efficient energy solutions will rise, prompting further development of battery swapping stations. Collaborations between automotive manufacturers and battery swapping companies are expected to enhance service offerings, while the integration of renewable energy sources will support sustainability goals, positioning the market for significant growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Swap Stations Battery Modules & Packs Battery Management Systems Swapping Platform Software Charging & Storage Infrastructure Maintenance & Support Services Others |

| By End-User | Fleet Operators (e.g., ride-hailing, delivery, logistics) Commercial Vehicle Operators Individual EV Owners Public Transportation Agencies Government & Municipal Fleets |

| By Application | Urban Mobility (e.g., taxis, rideshare) Last-Mile Delivery & Logistics Public Transit (buses, shuttles) Two-Wheeler & Micro-mobility Long-Distance/Intercity Travel |

| By Distribution Channel | Direct to Fleet/Commercial Customers OEM Partnerships Third-Party Operators Online Platform Integration |

| By Pricing Model | Subscription-Based Pay-Per-Swap Membership/Prepaid Plans Revenue-Sharing with Partners |

| By Region | Northeast Midwest South West |

| By Policy Support | Federal Grants State Incentives Tax Credits Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Swapping Station Operators | 100 | Operations Managers, Business Development Executives |

| Electric Vehicle Manufacturers | 70 | Product Managers, R&D Directors |

| Fleet Management Companies | 60 | Fleet Managers, Logistics Coordinators |

| Government Policy Makers | 40 | Energy Policy Analysts, Transportation Officials |

| EV Users and Consumers | 120 | General Consumers, EV Enthusiasts |

The United States EV Battery Swapping Networks Market is valued at approximately USD 1.8 billion, driven by the increasing adoption of electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation.