Region:North America

Author(s):Geetanshi

Product Code:KRAA4793

Pages:96

Published On:September 2025

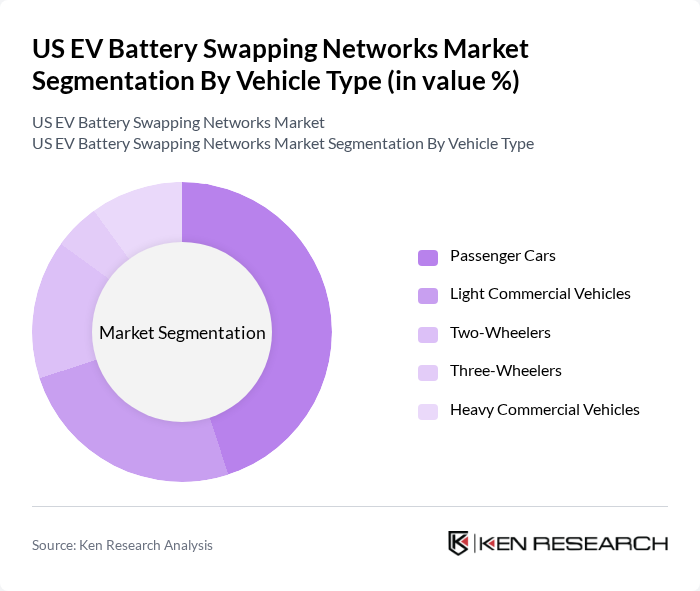

By Vehicle Type:The vehicle type segmentation includes various categories such as passenger cars, light commercial vehicles, two-wheelers, three-wheelers, and heavy commercial vehicles. Among these, passenger cars are the most dominant segment due to the increasing number of electric vehicle sales and consumer preference for personal mobility solutions. The growing trend of urbanization and the need for efficient transportation options further bolster the demand for battery swapping solutions in this segment. Battery swapping is also gaining traction in commercial fleets and shared mobility services, especially for urban delivery vehicles and ride-hailing fleets .

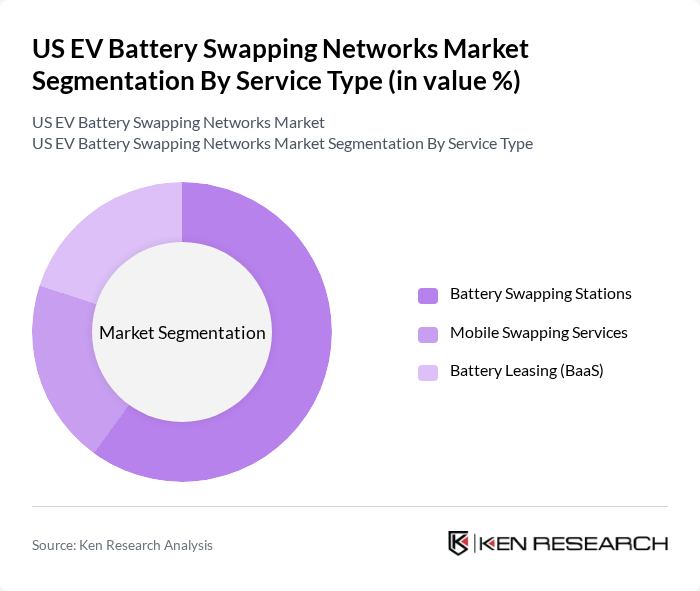

By Service Type:The service type segmentation encompasses battery swapping stations, mobile swapping services, and battery leasing (BaaS). Battery swapping stations are the leading service type, as they provide a fixed location for users to quickly exchange depleted batteries for fully charged ones. This convenience is particularly appealing to urban drivers and fleet operators who require minimal downtime for their vehicles. The adoption of Battery-as-a-Service (BaaS) models and mobile swapping services is also increasing, driven by fleet electrification and the need for flexible charging solutions .

The US EV Battery Swapping Networks Market is characterized by a dynamic mix of regional and international players. Leading participants such as NIO Inc., Ample Inc., Gogoro Inc., Better Place (historical, not currently active), Aulton New Energy Automotive Technology Co., Ltd., BAIC BluePark New Energy Technology Co., Ltd., Tesla, Inc., Shell Recharge Solutions, Blink Charging Co., EVgo Services LLC, Sun Mobility, Geely Auto Group, Swap Mobility, Karma Automotive LLC, Tritium DCFC Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the US EV battery swapping networks market appears promising, driven by increasing consumer demand for electric vehicles and supportive government policies. As battery technology continues to advance, the efficiency and convenience of battery swapping will likely attract more users. Additionally, the integration of renewable energy sources into swapping stations can enhance sustainability, making this model more appealing. Overall, the market is poised for growth as awareness and infrastructure improve, paving the way for broader adoption.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Two-Wheelers Three-Wheelers Heavy Commercial Vehicles |

| By Service Type | Battery Swapping Stations Mobile Swapping Services Battery Leasing (BaaS) |

| By Technology | Automated Swapping Systems Manual Swapping Systems |

| By Application | Urban Mobility Fleet Logistics Ride-Sharing & Taxi Services Public Transportation |

| By Station Type | Fixed Stations Mobile Stations |

| By Battery Type | Lithium-Ion Solid-State Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Battery Swapping Service Providers | 60 | CEOs, Operations Managers |

| Fleet Operators Utilizing EVs | 50 | Fleet Managers, Logistics Coordinators |

| Government Officials in Transportation | 40 | Policy Makers, Urban Planners |

| Consumers Using EVs | 100 | EV Owners, Potential EV Buyers |

| Industry Experts and Analysts | 40 | Market Analysts, Research Directors |

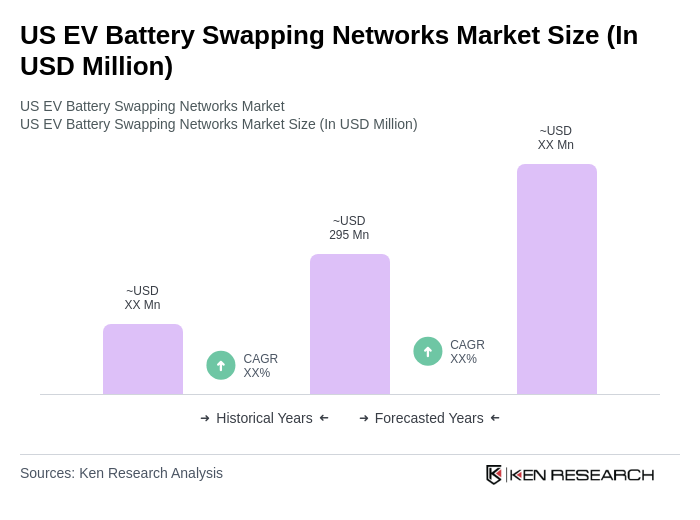

The US EV Battery Swapping Networks Market is valued at approximately USD 295 million, driven by the increasing adoption of electric vehicles and advancements in battery technology, along with government initiatives promoting sustainable transportation.