Region:North America

Author(s):Shubham

Product Code:KRAA1720

Pages:88

Published On:August 2025

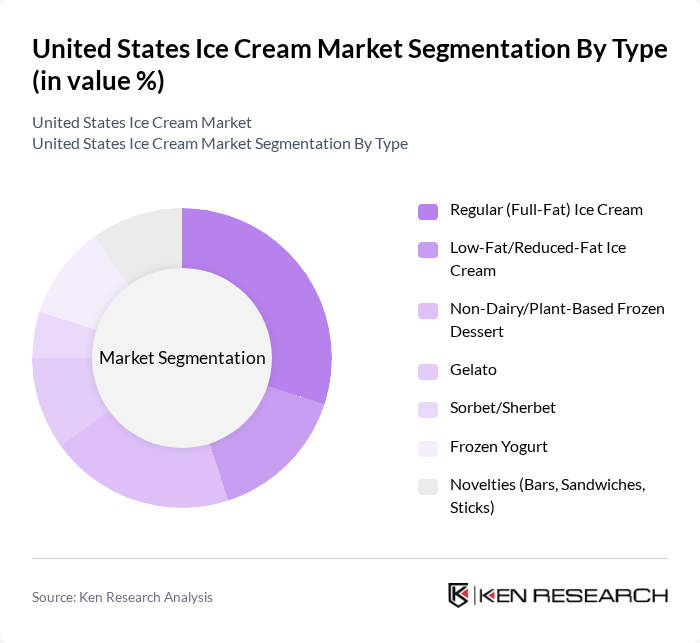

By Type:The ice cream market can be segmented into various types, including Regular (Full-Fat) Ice Cream, Low-Fat/Reduced-Fat Ice Cream, Non-Dairy/Plant-Based Frozen Dessert, Gelato, Sorbet/Sherbet, Frozen Yogurt, and Novelties (Bars, Sandwiches, Sticks). Each of these subsegments caters to different consumer preferences and dietary needs, with Regular Ice Cream being the most traditional choice, while Non-Dairy options are gaining traction among health-conscious consumers.

By Flavor:The flavor segmentation includes Vanilla, Chocolate, Strawberry, Mint/Mint Chocolate Chip, Cookies & Cream, Seasonal & Limited-Time Flavors, and Others. Vanilla remains the most popular flavor, appealing to a broad audience, while innovative and seasonal flavors are increasingly sought after by adventurous consumers looking for unique taste experiences.

The United States Ice Cream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever (Ben & Jerry’s, Talenti, Breyers, Magnum), Nestlé S.A. (Edy’s/Dreyer’s legacy, Häagen-Dazs brand owner), Froneri U.S. (Häagen-Dazs U.S. licensee; Dreyer’s Grand Ice Cream), Wells Enterprises, Inc. (Blue Bunny, Halo Top), Blue Bell Creameries, L.P., General Mills, Inc. (Yoplait Go-Gurt Novelties; licensing), Mars, Incorporated (Snickers, M&M’s, Dove ice cream bars), Baskin-Robbins (Inspire Brands), Jeni’s Splendid Ice Creams, Turkey Hill Dairy, Tillamook County Creamery Association (Tillamook), Hudsonville Ice Cream (Little Debbie collaboration), The Kroger Co. (Private Label), Albertsons Companies (Private Label), Salt & Straw contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. ice cream market appears promising, driven by evolving consumer preferences towards healthier and more sustainable options. Innovations in flavor profiles and the introduction of low-calorie products are expected to attract health-conscious consumers. Additionally, the trend towards eco-friendly packaging will likely gain momentum, as brands seek to align with consumer values on sustainability. The market is poised for growth as companies adapt to these trends and explore new distribution channels.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular (Full-Fat) Ice Cream Low-Fat/Reduced-Fat Ice Cream Non-Dairy/Plant-Based Frozen Dessert Gelato Sorbet/Sherbet Frozen Yogurt Novelties (Bars, Sandwiches, Sticks) |

| By Flavor | Vanilla Chocolate Strawberry Mint/Mint Chocolate Chip Cookies & Cream Seasonal & Limited-Time Flavors Others |

| By Packaging Type | Bars Cones Cups Pints (473 ml) Tubs/Cartons (Multi-serve) Multi-pack Novelties Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Foodservice/On-premise (QSRs, Cafés, Restaurants) Specialty Ice Cream Parlors Others |

| By Price Range | Premium/Super-Premium Mid-Range Value/Economy Private Label/Store Brand |

| By End-User | Households (Take-Home) Foodservice (Restaurants, QSRs, Catering) Institutional (Canteens, Schools, Hospitals) Others |

| By Product Format (Industry Convention) | Take-Home Impulse Artisanal |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences Survey | 120 | Ice Cream Consumers, Age 18-65 |

| Retailer Insights | 80 | Ice Cream Shop Owners, Retail Managers |

| Manufacturer Interviews | 60 | Production Managers, Marketing Directors |

| Distributor Feedback | 70 | Supply Chain Managers, Logistics Coordinators |

| Health Trends Impact | 90 | Nutritional Experts, Health Coaches |

The United States Ice Cream Market is valued at approximately USD 18 billion, reflecting a significant growth trend driven by consumer demand for premium, artisanal, and healthier ice cream options.