Region:Central and South America

Author(s):Rebecca

Product Code:KRAC0299

Pages:80

Published On:August 2025

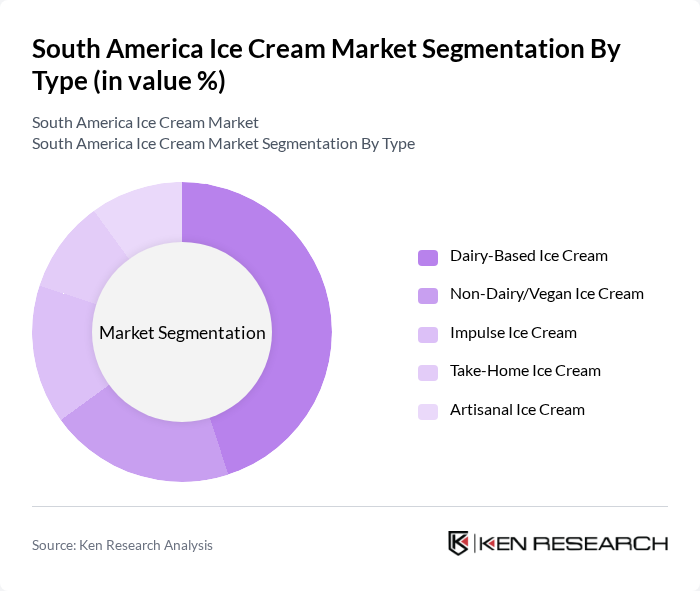

By Type:The ice cream market in South America is segmented into Dairy-Based Ice Cream, Non-Dairy/Vegan Ice Cream, Impulse Ice Cream, Take-Home Ice Cream, and Artisanal Ice Cream. Dairy-Based Ice Cream remains the most dominant segment, driven by traditional preferences and a wide range of flavors. Non-Dairy/Vegan Ice Cream is gaining traction due to the rising health consciousness and dietary restrictions among consumers. Impulse Ice Cream, often sold in convenient formats, caters to on-the-go consumers, while Take-Home Ice Cream appeals to families and gatherings. Artisanal Ice Cream, with its unique flavors and premium positioning, attracts niche markets.

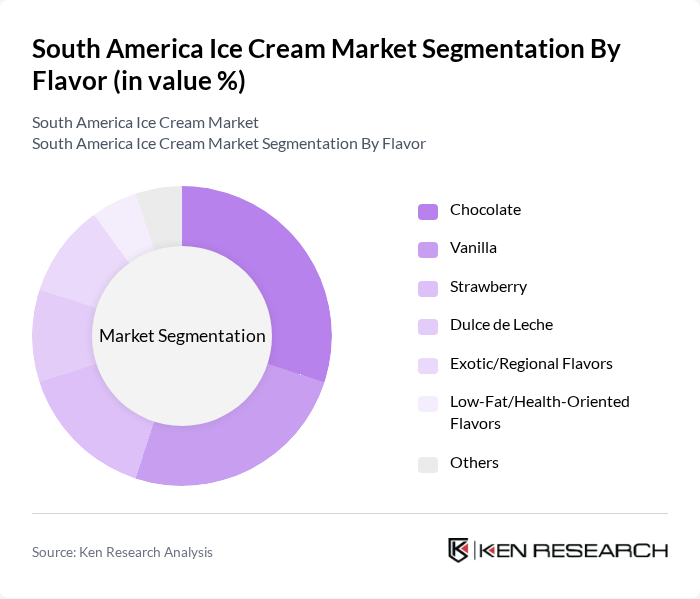

By Flavor:The flavor segmentation of the ice cream market includes Chocolate, Vanilla, Strawberry, Dulce de Leche, Exotic/Regional Flavors, Low-Fat/Health-Oriented Flavors, and Others. Chocolate remains the most popular flavor, appealing to a broad audience due to its rich taste. Vanilla follows closely, often used as a base for various toppings and mix-ins. Dulce de Leche, a regional favorite, is particularly popular in countries like Argentina. Exotic flavors are gaining popularity as consumers seek unique experiences, while health-oriented options are on the rise due to increasing health awareness.

The South America Ice Cream Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilever (Kibon, Pinguino), Nestlé, Arcor, Heladería Grido, Frutos do Brasil, Danone, Häagen-Dazs, Ben & Jerry's, Sorvete Itália, Gelato & Co., La Fama, Freddo, D'Onofrio, Cremolatti, Los Paleteros contribute to innovation, geographic expansion, and service delivery in this space.

The South American ice cream market is poised for dynamic growth, driven by evolving consumer preferences and increasing health consciousness. As the trend towards premium and artisanal products continues, brands will likely focus on innovative flavors and healthier options. Additionally, the rise of e-commerce will facilitate greater market access, allowing companies to reach untapped demographics. Sustainability will also play a crucial role, with brands adopting eco-friendly practices to appeal to environmentally conscious consumers, shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Dairy-Based Ice Cream Non-Dairy/Vegan Ice Cream Impulse Ice Cream Take-Home Ice Cream Artisanal Ice Cream |

| By Flavor | Chocolate Vanilla Strawberry Dulce de Leche Exotic/Regional Flavors Low-Fat/Health-Oriented Flavors Others |

| By Category | Premium Economy Mid-Range |

| By Packaging Type | Cups Cones Bars Tubs Pints Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Specialty Stores Online Retail Others |

| By End-User | Retail Consumers Food Service Industry Institutional Buyers Others |

| By Region | Brazil Argentina Chile Colombia Peru Rest of South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Ice Cream | 120 | General Consumers, Ice Cream Enthusiasts |

| Retailer Insights on Ice Cream Sales | 60 | Store Managers, Retail Buyers |

| Manufacturers' Production Insights | 40 | Production Managers, Quality Control Officers |

| Distribution Channel Effectiveness | 50 | Logistics Managers, Supply Chain Coordinators |

| Market Trends and Innovations | 45 | Product Development Managers, Marketing Executives |

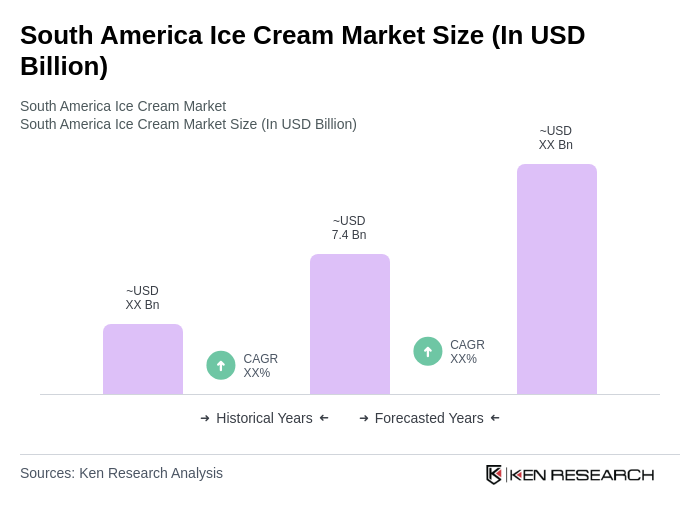

The South America Ice Cream Market is valued at approximately USD 7.4 billion, reflecting a significant growth trend driven by increasing disposable incomes, urbanization, and a rising preference for indulgent treats among consumers.