Region:North America

Author(s):Rebecca

Product Code:KRAB4744

Pages:93

Published On:October 2025

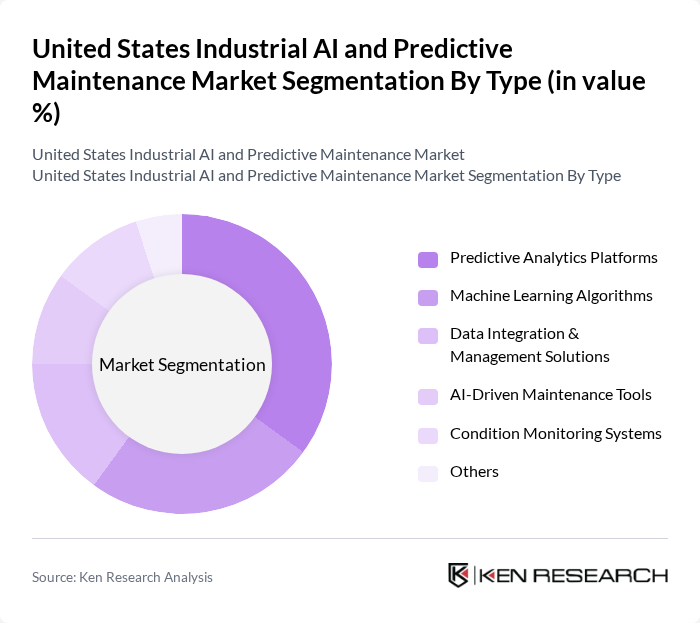

By Type:The market is segmented into Predictive Analytics Platforms, Machine Learning Algorithms, Data Integration & Management Solutions, AI-Driven Maintenance Tools, Condition Monitoring Systems, and Others. Among these, Predictive Analytics Platforms lead the market due to their ability to process large volumes of operational data and deliver actionable insights for maintenance scheduling and operational efficiency. The growing reliance on data-driven decision-making and the adoption of integrated solutions that combine real-time analytics, automated reporting, and predictive capabilities are accelerating demand for these platforms .

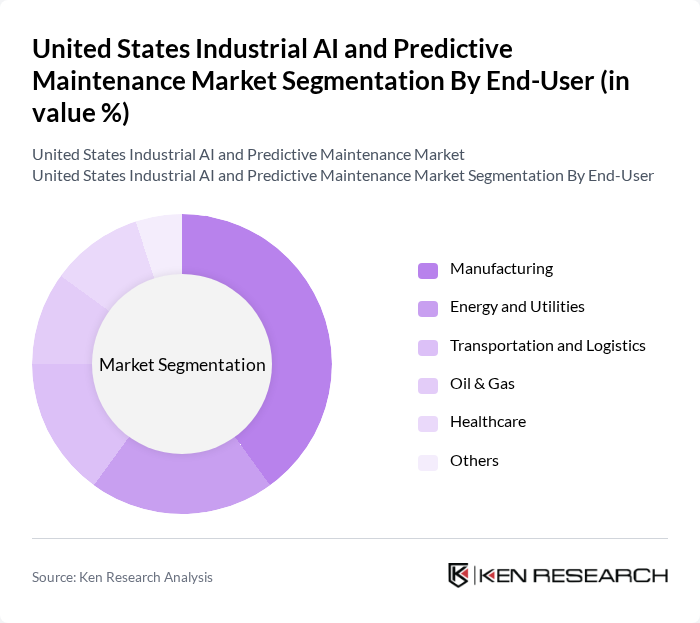

By End-User:The end-user segmentation includes Manufacturing, Energy and Utilities, Transportation and Logistics, Oil & Gas, Healthcare, and Others. The Manufacturing sector remains the dominant end-user, driven by the imperative to increase productivity, reduce unplanned downtime, and lower operational costs. The adoption of predictive maintenance solutions in manufacturing is further propelled by the need to optimize asset utilization, enhance equipment lifespan, and ensure compliance with safety standards .

The United States Industrial AI and Predictive Maintenance Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Siemens AG, General Electric Company, Honeywell International Inc., Microsoft Corporation, PTC Inc., Rockwell Automation, Inc., SAP SE, Schneider Electric SE, Oracle Corporation, Uptake Technologies, Inc., C3.ai, Inc., Augury Inc., SparkCognition, Inc., and Senseye Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United States industrial AI and predictive maintenance market appears promising, driven by technological advancements and increasing demand for efficiency. As industries continue to embrace digital transformation, the integration of AI with IoT will enhance predictive capabilities, leading to improved operational performance. Furthermore, the focus on sustainability will drive innovation in predictive maintenance solutions, enabling organizations to reduce waste and energy consumption while optimizing resource utilization. This evolving landscape presents significant opportunities for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Platforms Machine Learning Algorithms Data Integration & Management Solutions AI-Driven Maintenance Tools Condition Monitoring Systems Others |

| By End-User | Manufacturing Energy and Utilities Transportation and Logistics Oil & Gas Healthcare Others |

| By Application | Equipment Condition Monitoring Predictive Maintenance Scheduling Asset Performance Management Quality & Process Optimization Failure & Downtime Prediction Others |

| By Component | Software Solutions Hardware Devices (Sensors, Gateways, etc.) Services (Consulting, Integration, Support) Others |

| By Sales Channel | Direct Sales Distributors & System Integrators Online Platforms Others |

| By Industry Vertical | Automotive Aerospace & Defense Food and Beverage Pharmaceuticals Chemicals Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Edge Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector AI Adoption | 100 | CTOs, AI Implementation Managers |

| Predictive Maintenance in Automotive | 60 | Maintenance Managers, Operations Directors |

| Aerospace Industry Predictive Analytics | 40 | Engineering Managers, Quality Assurance Leads |

| Energy Sector AI Solutions | 50 | Plant Managers, Data Analysts |

| General Manufacturing Predictive Maintenance | 50 | Production Supervisors, IT Managers |

The United States Industrial AI and Predictive Maintenance Market is valued at approximately USD 7 billion, driven by the adoption of AI and IoT technologies in manufacturing, operational efficiency needs, and predictive maintenance solutions to minimize downtime and optimize costs.