Region:North America

Author(s):Rebecca

Product Code:KRAA6957

Pages:83

Published On:September 2025

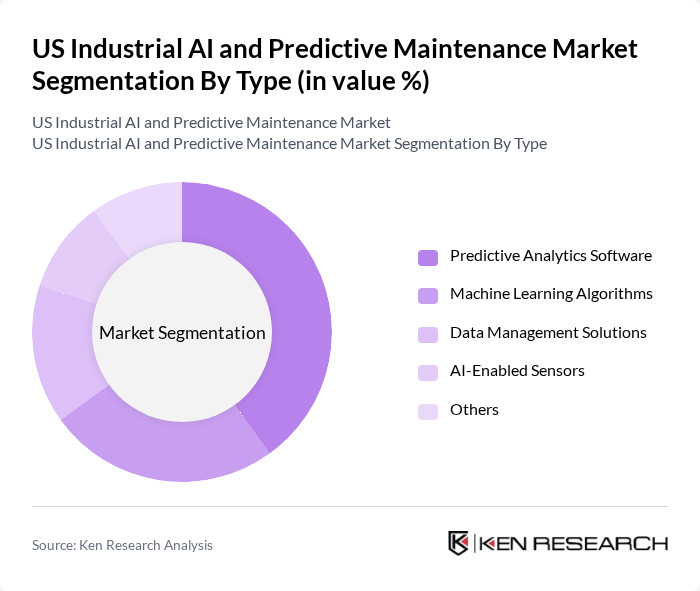

By Type:The market is segmented into various types, including Predictive Analytics Software, Machine Learning Algorithms, Data Management Solutions, AI-Enabled Sensors, and Others. Among these, Predictive Analytics Software is leading due to its ability to analyze vast amounts of data and provide actionable insights, which is crucial for effective predictive maintenance strategies. The increasing reliance on data-driven decision-making in industries is propelling the demand for this sub-segment.

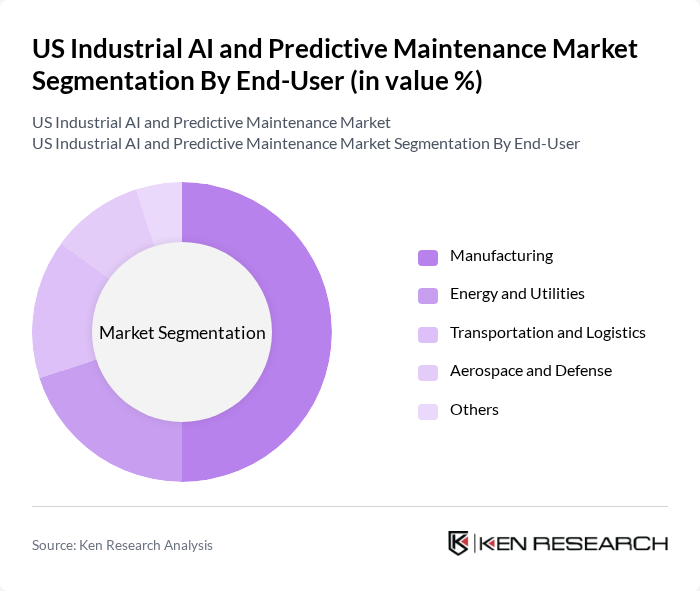

By End-User:The end-user segmentation includes Manufacturing, Energy and Utilities, Transportation and Logistics, Aerospace and Defense, and Others. The Manufacturing sector is the dominant end-user, driven by the need for efficiency and cost reduction. Industries are increasingly adopting predictive maintenance solutions to enhance equipment reliability and reduce operational disruptions, making this segment a key player in the market.

The US Industrial AI and Predictive Maintenance Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Siemens AG, General Electric Company, Honeywell International Inc., Microsoft Corporation, PTC Inc., SAP SE, Rockwell Automation, Inc., Schneider Electric SE, Oracle Corporation, Altair Engineering, Inc., Ansys, Inc., Aspen Technology, Inc., C3.ai, Inc., Uptake Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US Industrial AI and Predictive Maintenance market appears promising, driven by technological advancements and increasing adoption across various sectors. As industries prioritize operational efficiency and sustainability, the demand for AI-driven solutions is expected to rise. Furthermore, the integration of advanced analytics and IoT technologies will enhance predictive capabilities, enabling organizations to optimize maintenance schedules and reduce costs. This trend will likely foster innovation and collaboration among technology providers, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Software Machine Learning Algorithms Data Management Solutions AI-Enabled Sensors Others |

| By End-User | Manufacturing Energy and Utilities Transportation and Logistics Aerospace and Defense Others |

| By Application | Equipment Monitoring Predictive Maintenance Scheduling Asset Management Quality Control Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector AI Implementation | 150 | Plant Managers, AI Project Leads |

| Energy Sector Predictive Maintenance | 100 | Maintenance Directors, Operations Managers |

| Transportation Industry AI Solutions | 80 | Fleet Managers, IT Directors |

| Utilities Sector Maintenance Strategies | 70 | Asset Managers, Reliability Engineers |

| Healthcare Equipment Predictive Analytics | 60 | Biomedical Engineers, Facility Managers |

The US Industrial AI and Predictive Maintenance Market is valued at approximately USD 10 billion, driven by the increasing adoption of AI technologies in manufacturing and the demand for predictive maintenance solutions to reduce downtime and maintenance costs.