Region:North America

Author(s):Geetanshi

Product Code:KRAA1244

Pages:84

Published On:August 2025

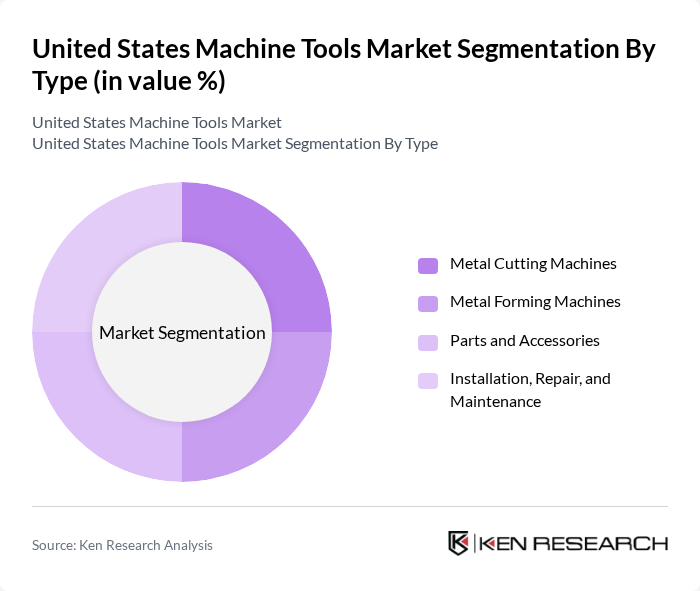

By Type:The machine tools market can be segmented into various types, including Metal Cutting Machines, Metal Forming Machines, Parts and Accessories, and Installation, Repair, and Maintenance. Among these, Metal Cutting Machines remain the most dominant due to their extensive use in precision machining applications across industries such as automotive, aerospace, and medical devices. The demand for these machines is driven by the need for high accuracy, efficiency, and the increasing adoption of digitally integrated manufacturing processes .

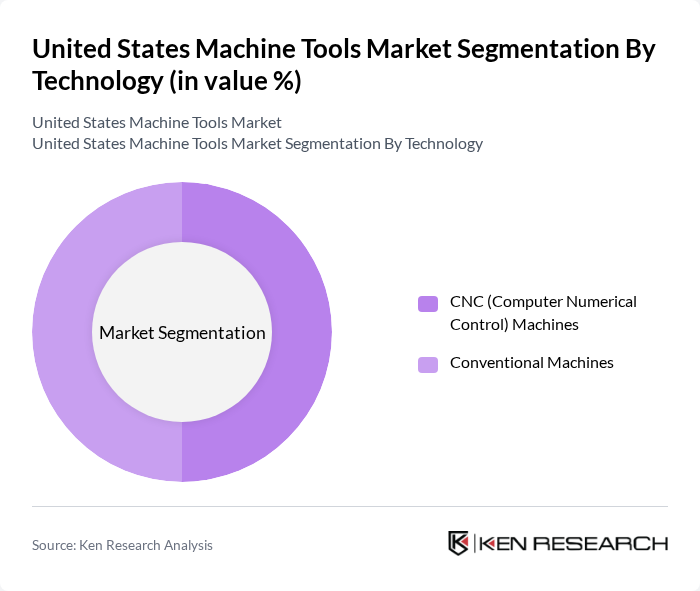

By Technology:The market is also segmented by technology into CNC (Computer Numerical Control) Machines and Conventional Machines. CNC Machines are leading the market due to their ability to automate complex machining processes, resulting in higher precision, reduced labor costs, and enhanced flexibility. The trend towards automation and smart manufacturing is driving the adoption of CNC technology, making it a key growth driver in the machine tools market .

The United States Machine Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haas Automation, Inc., Hardinge Inc., Mazak Corporation (Yamazaki Mazak Corporation), Okuma America Corporation, DMG MORI USA, Inc., Hurco Companies, Inc., JTEKT Toyoda Americas Corporation, Fives Group, Trumpf Inc., Makino Inc., Doosan Machine Tools America, FANUC America Corporation, Siemens Industry, Inc., Mitsubishi Electric Automation, Inc., and Schuler Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States machine tools market appears promising, driven by ongoing technological advancements and increasing automation across various industries. As manufacturers continue to adopt smart manufacturing solutions, the integration of AI and machine learning will enhance operational efficiency. Additionally, the focus on sustainable practices will likely lead to innovations in eco-friendly machine tools, aligning with global sustainability goals and attracting investments in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Metal Cutting Machines Metal Forming Machines Parts and Accessories Installation, Repair, and Maintenance |

| By Technology | CNC (Computer Numerical Control) Machines Conventional Machines |

| By End-User Industry | Automotive Aerospace and Defense Electrical and Electronics Fabrication and Industrial Machinery Manufacturing Precision Engineering Others |

| By Application | Precision Machining Metal Forming Surface Treatment Assembly Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Others |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| CNC Machine Tool Users | 120 | Manufacturing Engineers, Production Managers |

| EDM Technology Adoption | 60 | Technical Directors, R&D Managers |

| Traditional Machine Tool Operators | 50 | Shop Floor Supervisors, Maintenance Technicians |

| Emerging Technologies in Machine Tools | 40 | Innovation Managers, Industry Analysts |

| Market Trends and Future Outlook | 45 | Business Development Managers, Market Researchers |

The United States Machine Tools Market is valued at approximately USD 12.2 billion, reflecting a significant growth driven by advancements in manufacturing technologies, increased automation, and rising demand for precision engineering across various industries.