Region:Middle East

Author(s):Dev

Product Code:KRAD1645

Pages:82

Published On:November 2025

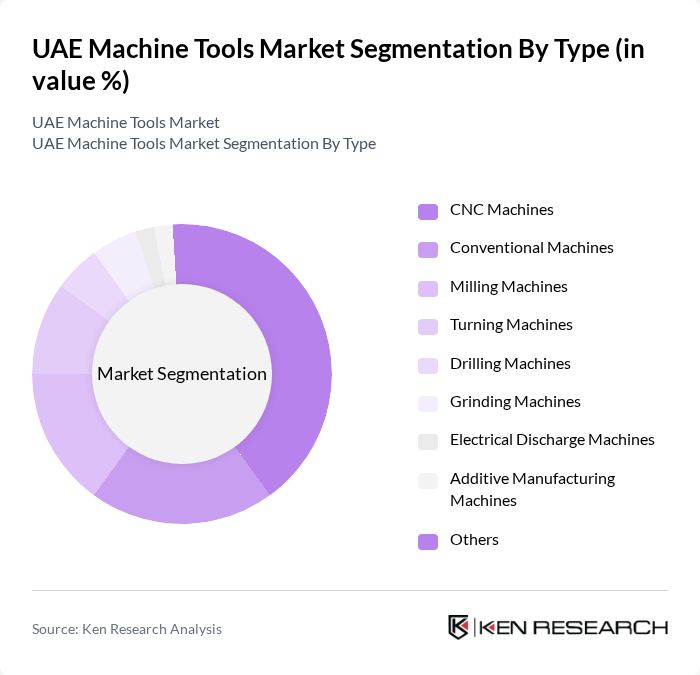

By Type:The market is segmented into various types of machine tools, including CNC Machines, Conventional Machines, Milling Machines, Turning Machines, Drilling Machines, Grinding Machines, Electrical Discharge Machines, Additive Manufacturing Machines, and Others. CNC machines lead the market due to their precision, automation capabilities, and growing adoption in high-tech industries such as automotive, aerospace, and electronics. The increasing implementation of Industry 4.0 and digital manufacturing further accelerates the demand for CNC and additive manufacturing machines .

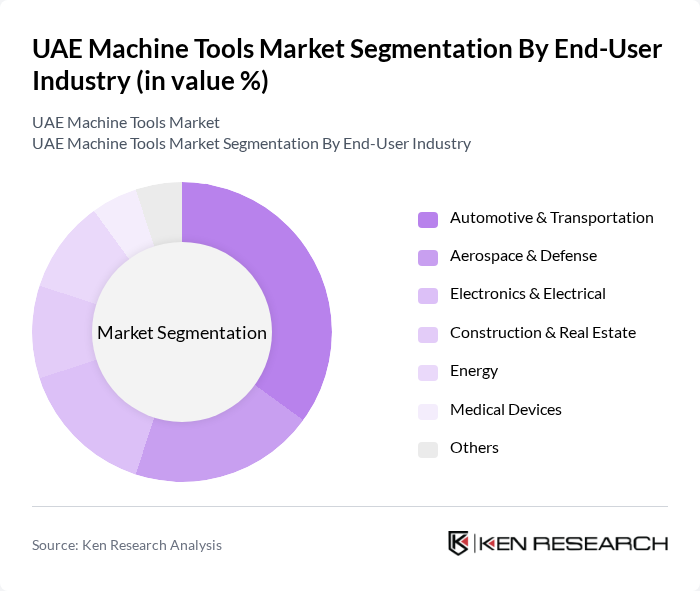

By End-User Industry:The machine tools market is also segmented by end-user industries, including Automotive & Transportation, Aerospace & Defense, Electronics & Electrical, Construction & Real Estate, Energy, Medical Devices, and Others. The automotive sector is the largest consumer of machine tools, driven by the need for high-precision components and large-scale production. Aerospace, electronics, and construction sectors are also significant contributors, reflecting the UAE's focus on industrial diversification and smart manufacturing .

The UAE Machine Tools Market is characterized by a dynamic mix of regional and international players. Leading participants such as DMG MORI, Haas Automation, Mazak, Okuma, FANUC, Siemens, Mitsubishi Electric, Hurco Companies, EMAG, Schuler Group, KUKA, TRUMPF, Tungaloy, Sandvik Coromant, Walter AG, Hexagon AB, Makino, Amada Co., Ltd., Doosan Machine Tools, Gulf Industrial Machinery Co. LLC, Al Ruqee Machine Tools Co. LLC, Al Ghurair Group (Engineering Division), Al-Futtaim Engineering, Almoayyed Commercial Services contribute to innovation, geographic expansion, and service delivery in this space.

The UAE machine tools market is poised for transformative growth, driven by advancements in smart manufacturing and the adoption of Industry 4.0 technologies. As companies increasingly integrate AI and IoT into their operations, efficiency and productivity are expected to rise significantly. Furthermore, the focus on sustainability will lead to the development of eco-friendly machine tools, aligning with global trends. The government's commitment to fostering innovation will also play a crucial role in shaping the future landscape of the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | CNC Machines Conventional Machines Milling Machines Turning Machines Drilling Machines Grinding Machines Electrical Discharge Machines Additive Manufacturing Machines Others |

| By End-User Industry | Automotive & Transportation Aerospace & Defense Electronics & Electrical Construction & Real Estate Energy Medical Devices Others |

| By Application | Metalworking Woodworking Fabrication Prototyping Others |

| By Material | Metal Plastic Composite Others |

| By Technology | Conventional Machining CNC Machining Hybrid Machining (Additive + Subtractive) Others |

| By Distribution Channel | Direct Sales Dealers & Distributors Events & Exhibitions Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Manufacturing Sector | 120 | Production Managers, Operations Directors |

| Aerospace and Defense Manufacturing | 60 | Engineering Managers, Quality Assurance Heads |

| Automotive Manufacturing | 80 | Supply Chain Managers, Procurement Specialists |

| Metal Fabrication Industry | 50 | Workshop Supervisors, Technical Directors |

| Electronics Manufacturing | 70 | Product Development Managers, R&D Engineers |

The UAE Machine Tools Market is valued at approximately USD 190 million, driven by rapid industrialization and modernization in manufacturing processes, particularly in sectors like automotive, aerospace, and electronics.