Region:North America

Author(s):Shubham

Product Code:KRAC0782

Pages:93

Published On:August 2025

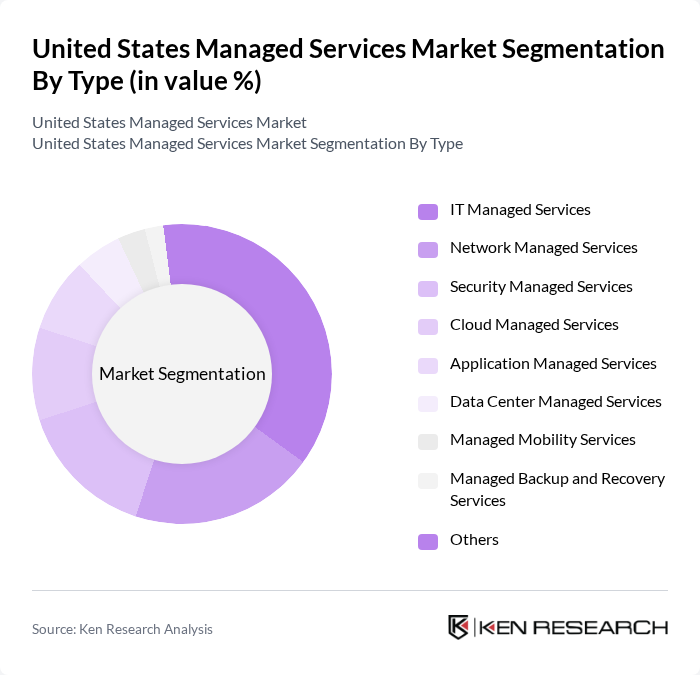

By Type:The managed services market is segmented into IT Managed Services, Network Managed Services, Security Managed Services, Cloud Managed Services, Application Managed Services, Data Center Managed Services, Managed Mobility Services, Managed Backup and Recovery Services, and Others. Among these,IT Managed Servicesremains the leading segment, driven by the increasing reliance on complex IT infrastructure and the need for businesses to optimize operations and ensure business continuity. The growing sophistication of cyber threats, adoption of hybrid cloud environments, and demand for specialized expertise further reinforce the dominance of this segment.

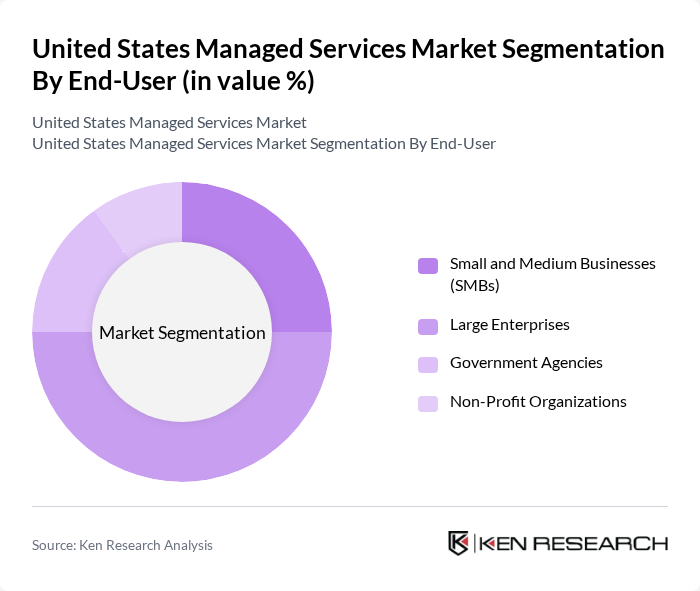

By End-User:End-user segmentation includes Small and Medium Businesses (SMBs), Large Enterprises, Government Agencies, and Non-Profit Organizations.Large Enterprisesdominate this segment due to their extensive IT requirements, complex operational environments, and heightened focus on regulatory compliance and cybersecurity. The ongoing digital transformation, adoption of cloud-based solutions, and the need for scalable managed services further drive demand among large organizations.

The United States Managed Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Accenture plc, Cisco Systems, Inc., Dell Technologies Inc., Hewlett Packard Enterprise (HPE), AT&T Inc., Rackspace Technology, Inc., Cognizant Technology Solutions, DXC Technology Company, Infosys Limited, Wipro Limited, Tata Consultancy Services (TCS), Capgemini SE, NTT DATA Corporation, Unisys Corporation, Fujitsu Limited, Science Applications International Corporation (SAIC), Leidos Holdings, Inc., CDW Corporation, SHI International Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. managed services market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly prioritize digital transformation, the demand for integrated managed services will likely rise. Additionally, the focus on automation and artificial intelligence will reshape service delivery models, enhancing efficiency. Companies that adapt to these trends and invest in innovative solutions will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | IT Managed Services Network Managed Services Security Managed Services Cloud Managed Services Application Managed Services Data Center Managed Services Managed Mobility Services Managed Backup and Recovery Services Others |

| By End-User | Small and Medium Businesses (SMBs) Large Enterprises Government Agencies Non-Profit Organizations |

| By Industry Vertical | Healthcare Financial Services (BFSI) Retail Manufacturing Education Telecommunications Media & Entertainment Logistics Others |

| By Service Model | On-Premises Cloud-Based Hybrid |

| By Deployment Type | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Subscription-Based Pay-As-You-Go Fixed Pricing |

| By Geographic Focus | National Regional (e.g., California, New York, Midwest, Southeast) Local |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Managed Services | 100 | IT Directors, Healthcare Administrators |

| Financial Services IT Outsourcing | 80 | CIOs, Compliance Officers |

| Manufacturing IT Support Services | 70 | Operations Managers, IT Managers |

| Retail Managed IT Services | 90 | Retail Managers, E-commerce Directors |

| Telecommunications Managed Services | 50 | Network Engineers, Service Delivery Managers |

The United States Managed Services Market is valued at approximately USD 88 billion, reflecting significant growth driven by factors such as cloud computing adoption, cybersecurity needs, and the complexity of IT infrastructure management among businesses.