Region:North America

Author(s):Shubham

Product Code:KRAA8768

Pages:87

Published On:November 2025

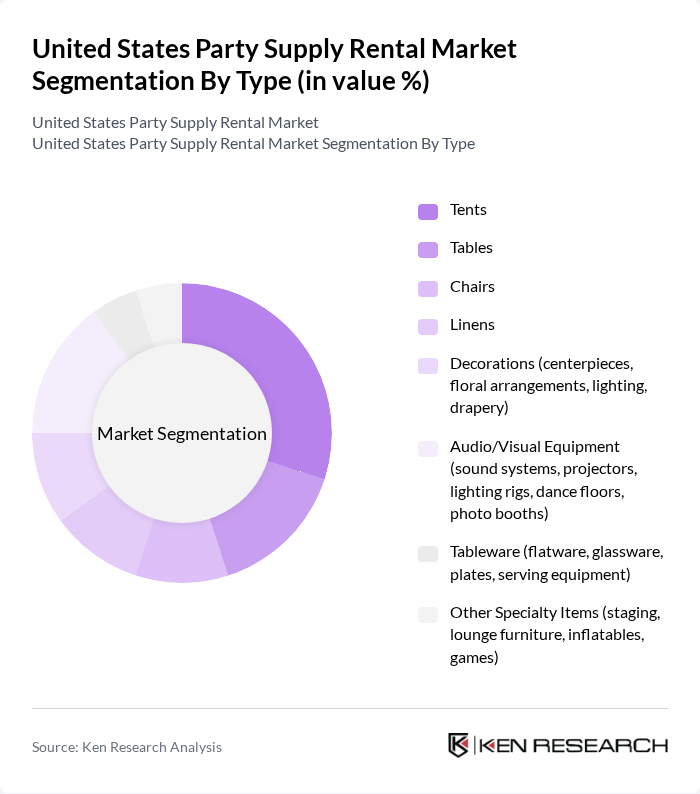

By Type:The market is segmented into various types of rental supplies, including tents, tables, chairs, linens, decorations, audio/visual equipment, tableware, and other specialty items. Among these, tents and audio/visual equipment remain particularly dominant due to their essential role in outdoor events and corporate functions. The demand for high-quality audio/visual setups has surged as events increasingly incorporate technology for enhanced experiences and immersive environments. Sustainability trends are also influencing product choices, with eco-friendly linens and reusable decorations gaining traction .

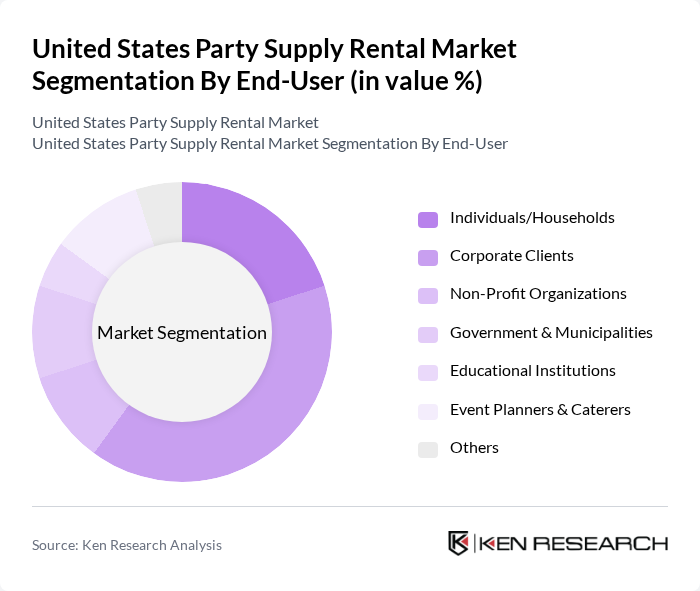

By End-User:The end-user segmentation includes individuals/households, corporate clients, non-profit organizations, government & municipalities, educational institutions, event planners & caterers, and others. Corporate clients are the leading segment, driven by the increasing number of corporate events and the need for professional setups. The trend of hosting elaborate corporate functions has led to a significant rise in demand for rental services tailored to business needs. Event planners and caterers are also a rapidly growing segment, as demand for personalized, high-impact experiences continues to rise .

The United States Party Supply Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as CORT Party Rental, Classic Party Rentals, Bright Event Rentals, All Occasions Party Rentals, A Classic Party Rental, Big D Party Rentals, Avalon Tent & Party, Baker Party Rentals, Party Reflections, Inc., Pleasanton Rentals, Taylor Rental, Ventura Rental Center, Premiere Events, Event Rentals Unlimited, Reventals Event Rentals contribute to innovation, geographic expansion, and service delivery in this space .

The future of the party supply rental market in the United States appears promising, driven by evolving consumer preferences and technological advancements. As event personalization continues to gain traction, companies that adapt their offerings to meet these demands will likely thrive. Additionally, the integration of technology in rental processes, such as online booking and inventory management, will streamline operations and enhance customer experiences, positioning businesses for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Tents Tables Chairs Linens Decorations (centerpieces, floral arrangements, lighting, drapery) Audio/Visual Equipment (sound systems, projectors, lighting rigs, dance floors, photo booths) Tableware (flatware, glassware, plates, serving equipment) Other Specialty Items (staging, lounge furniture, inflatables, games) |

| By End-User | Individuals/Households Corporate Clients Non-Profit Organizations Government & Municipalities Educational Institutions Event Planners & Caterers Others |

| By Event Type | Weddings (traditional, destination) Corporate Events (conferences, product launches, seminars) Private Parties (birthday, anniversary, graduation) Festivals (cultural, food, music) Nonprofit & Fundraising Events Others |

| By Rental Duration | One-day Rentals Weekly Rentals Monthly Rentals Long-term/Seasonal Rentals Recurring Events Others |

| By Geographic Distribution | Northeast Midwest South West Major Metropolitan Areas Others |

| By Customer Segment | B2C (Business to Consumer) B2B (Business to Business) Government Contracts Event Planners & Agencies Caterers & Hospitality Providers Others |

| By Service Type | Delivery and Setup On-site Support/Staffing Cleaning and Maintenance Pickup & Breakdown Services Online Booking & Virtual Previews Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wedding Event Rentals | 100 | Wedding Planners, Venue Coordinators |

| Corporate Event Rentals | 80 | Corporate Event Managers, HR Representatives |

| Private Party Rentals | 60 | Homeowners, Party Organizers |

| Festival and Fair Rentals | 50 | Event Organizers, Municipal Event Coordinators |

| Equipment and Furniture Rentals | 70 | Rental Business Owners, Operations Managers |

The United States Party Supply Rental Market is valued at approximately USD 5.9 billion, reflecting a significant growth trend driven by increased event hosting and a preference for rental services over ownership due to cost-effectiveness and convenience.