Region:North America

Author(s):Shubham

Product Code:KRAD4613

Pages:86

Published On:December 2025

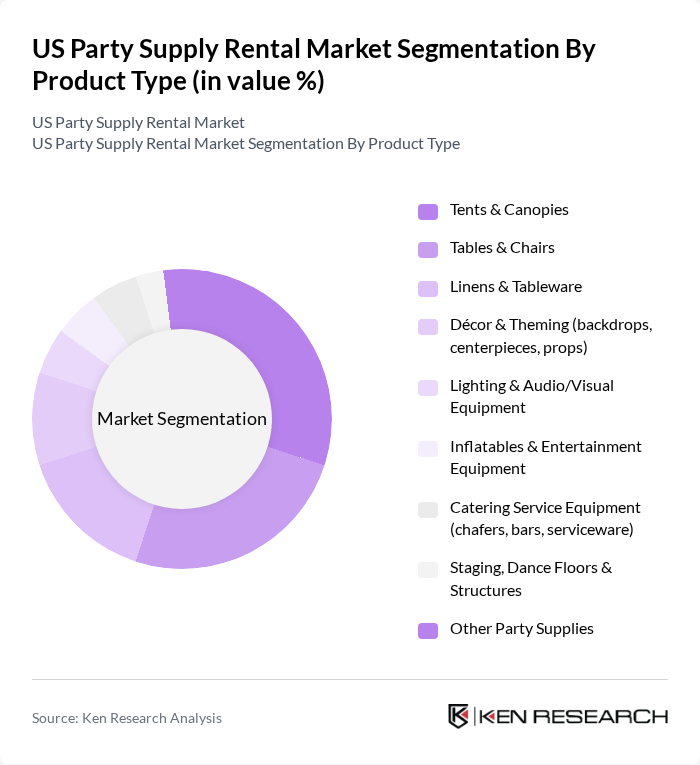

By Product Type:The product type segmentation includes various categories such as Tents & Canopies, Tables & Chairs, Linens & Tableware, Décor & Theming, Lighting & Audio/Visual Equipment, Inflatables & Entertainment Equipment, Catering Service Equipment, Staging, Dance Floors & Structures, and Other Party Supplies. Among these, Tents & Canopies and Tables & Chairs are the leading subsegments due to their essential role in outdoor and indoor events, respectively. The demand for these items is driven by the increasing number of weddings, corporate events, and social gatherings.

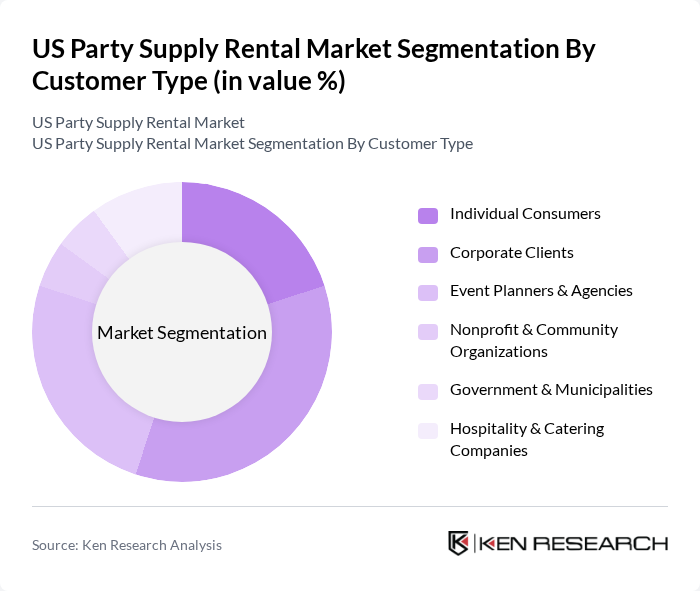

By Customer Type:The customer type segmentation includes Individual Consumers, Corporate Clients, Event Planners & Agencies, Nonprofit & Community Organizations, Government & Municipalities, and Hospitality & Catering Companies. Corporate Clients and Event Planners & Agencies are the dominant segments, driven by the increasing number of corporate events and the professionalization of event planning services. These segments are characterized by higher spending and a preference for comprehensive rental solutions.

The US Party Supply Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Party City Holdings Inc., CORT Party Rental, Bright Event Rentals LLC, All Occasions Party Rental, American Party Rental, A Classic Party Rental, Party Reflections Inc., Big D Party Rentals, Baker Party Rentals, Avalon Tent & Party, Premiere Events, Ventura Rental Center, Taylor Rental, Pleasanton Rentals, Reventals Event Rentals contribute to innovation, geographic expansion, and service delivery in this space.

The US party supply rental market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As event personalization becomes increasingly important, companies that leverage data analytics to tailor their offerings will gain a competitive edge. Additionally, the integration of eco-friendly practices and sustainable products will resonate with environmentally conscious consumers, further enhancing market appeal. The rise of virtual events may also create new avenues for rental services, expanding the market's reach and potential customer base.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Tents & Canopies Tables & Chairs Linens & Tableware Décor & Theming (backdrops, centerpieces, props) Lighting & Audio/Visual Equipment Inflatables & Entertainment Equipment Catering Service Equipment (chafers, bars, serviceware) Staging, Dance Floors & Structures Other Party Supplies |

| By Customer Type | Individual Consumers Corporate Clients Event Planners & Agencies Nonprofit & Community Organizations Government & Municipalities Hospitality & Catering Companies |

| By Event Type | Weddings & Social Events Corporate Events & Conferences Private Parties (birthdays, graduations, baby & bridal showers) Festivals, Fairs & Community Events Trade Shows & Exhibitions School & University Events Other Special Events |

| By Rental Duration | Single?Day Rentals Multi?Day / Weekend Rentals Long?Term / Seasonal Rentals Recurring / Contract?Based Rentals |

| By Service Offering | Dry Hire (rental only) Delivery, Setup & Teardown Full?Service Event Production Design & Customization Services On?site Support & Coordination |

| By Booking Channel | Offline / Traditional (showrooms, phone, walk?ins) Company?Owned Online Platforms Third?Party Marketplaces & Aggregators Event Planner / Venue Referral Networks |

| By Geographic Focus | Local / Single?Metro Operators Regional / Multi?State Operators National Players |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wedding Event Rentals | 120 | Wedding Planners, Venue Managers |

| Corporate Event Rentals | 110 | Corporate Event Coordinators, HR Managers |

| Private Party Rentals | 90 | Homeowners, Party Planners |

| Festival and Fair Rentals | 75 | Event Organizers, City Officials |

| Non-Profit Event Rentals | 65 | Non-Profit Coordinators, Fundraising Managers |

The US Party Supply Rental Market is valued at approximately USD 5 billion, reflecting a significant growth driven by increased consumer spending on events and a shift towards renting rather than purchasing party supplies.