Region:North America

Author(s):Dev

Product Code:KRAA8260

Pages:96

Published On:November 2025

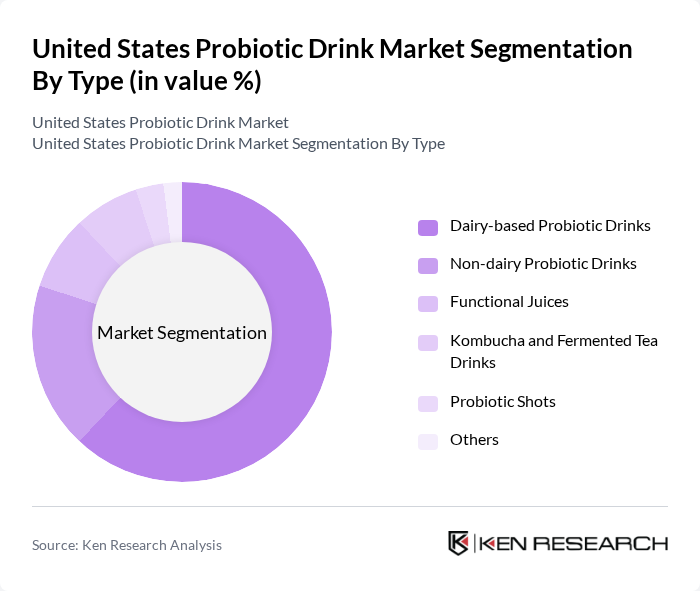

By Type:The market is segmented into Dairy-based Probiotic Drinks, Non-dairy Probiotic Drinks, Functional Juices, Kombucha and Fermented Tea Drinks, Probiotic Shots, and Others. Dairy-based Probiotic Drinks are the leading segment, supported by consumer familiarity and the popularity of yogurt-based beverages. Non-dairy options are rapidly gaining traction, particularly among lactose-intolerant and plant-based consumers. Functional juices and kombucha are also experiencing increased demand, driven by the broader health and wellness movement and consumer interest in digestive and immune health benefits .

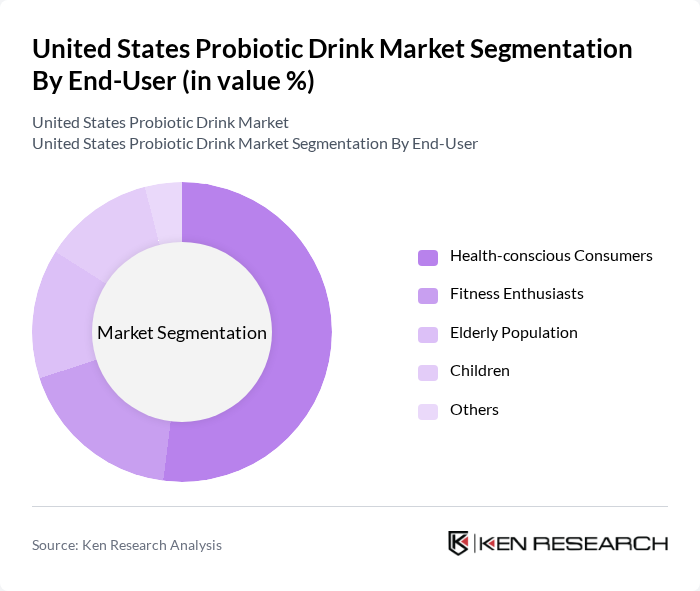

By End-User:The end-user segmentation includes Health-conscious Consumers, Fitness Enthusiasts, Elderly Population, Children, and Others. Health-conscious consumers represent the dominant segment, driven by growing awareness of probiotics’ benefits for digestive and immune health. Fitness enthusiasts increasingly incorporate probiotic drinks for gut health and recovery, while the elderly population seeks products that support digestive function and immunity. Parents are also seeking healthy beverage options for children, contributing to the growth of this segment .

The United States Probiotic Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danone North America, PepsiCo (KeVita), Nestlé Health Science, Yakult U.S.A. Inc., KeVita (A PepsiCo Company), GT's Living Foods, Lifeway Foods, Inc., The Hain Celestial Group, Inc., GoodBelly (NextFoods, Inc.), Bio-K Plus International Inc., Health-Ade LLC, Brew Dr. Kombucha, Suja Life, LLC, Culture Pop Soda, and Remedy Drinks contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. probiotic drink market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly prioritize gut health, the demand for innovative probiotic formulations is expected to rise. Additionally, the integration of technology in personalized nutrition will likely enhance consumer engagement. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture market share and meet evolving consumer preferences in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Dairy-based Probiotic Drinks Non-dairy Probiotic Drinks Functional Juices Kombucha and Fermented Tea Drinks Probiotic Shots Others |

| By End-User | Health-conscious Consumers Fitness Enthusiasts Elderly Population Children Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Online Retail Convenience Stores Pharmacies/Health Stores Others |

| By Packaging Type | Bottles Cans Tetra Packs Pouches Others |

| By Flavor | Fruit Flavors Herbal Flavors Mixed Flavors Others |

| By Region | Northeast Midwest South West |

| By Price Range | Premium Mid-range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Probiotic Drink Sales | 100 | Store Managers, Beverage Category Buyers |

| Health and Wellness Consumer Insights | 90 | Health Enthusiasts, Fitness Trainers |

| Product Development Feedback | 60 | R&D Managers, Product Innovation Specialists |

| Market Trends and Forecasting | 50 | Market Analysts, Industry Consultants |

| Distribution Channel Effectiveness | 50 | Logistics Managers, Supply Chain Analysts |

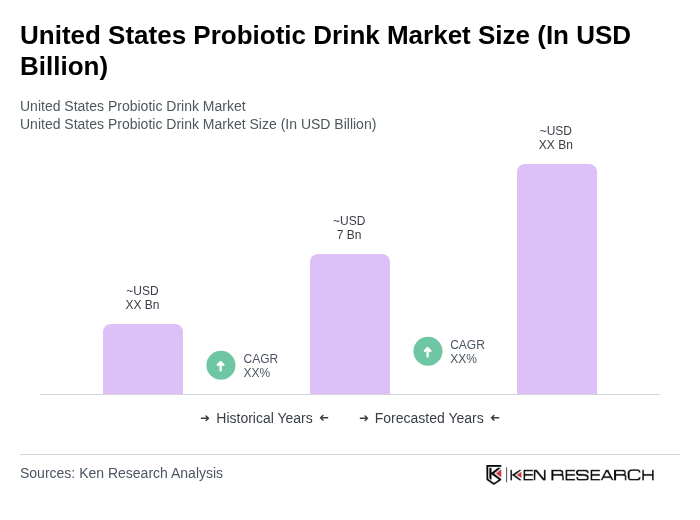

The United States Probiotic Drink Market is valued at approximately USD 7 billion, reflecting significant growth driven by increasing consumer awareness of gut health and the rising demand for functional beverages.