Region:Middle East

Author(s):Rebecca

Product Code:KRAC8412

Pages:84

Published On:November 2025

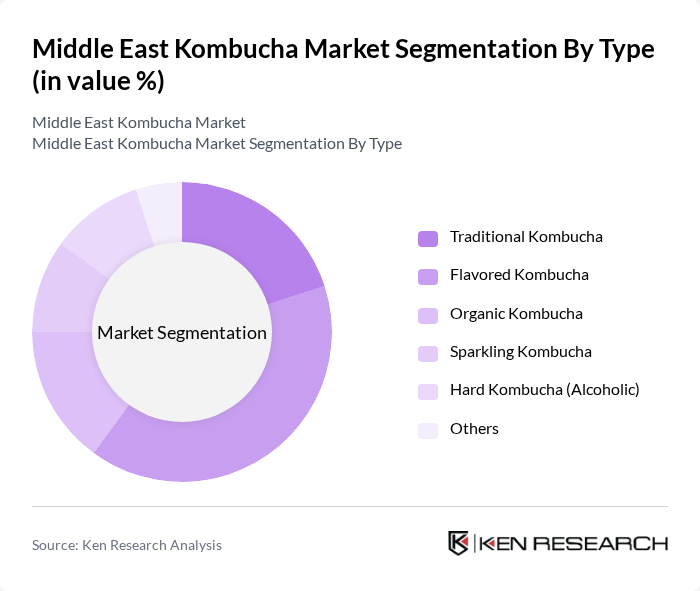

By Type:The market is segmented into various types of kombucha, including Traditional Kombucha, Flavored Kombucha, Organic Kombucha, Sparkling Kombucha, Hard Kombucha (Alcoholic), and Others. Among these,Flavored Kombuchais gaining significant traction due to its appealing taste profiles and variety, attracting a broader consumer base. This aligns with the regional trend toward innovative flavors and premium beverage experiences.

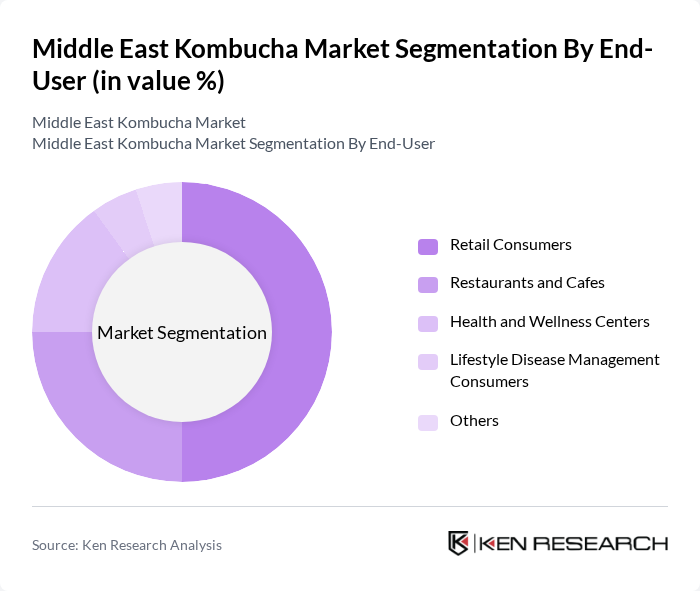

By End-User:The end-user segmentation includes Retail Consumers, Restaurants and Cafes, Health and Wellness Centers, Lifestyle Disease Management Consumers, and Others.Retail Consumersdominate the market as they increasingly seek healthy beverage options in supermarkets and online platforms. The trend is supported by the region’s growing health awareness and the convenience of modern retail channels.

The Middle East Kombucha Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kombucha ME (UAE), BuchaBox (Saudi Arabia), Remedy Drinks (Australia / UAE), Equinox Kombucha (UK / UAE), Real Raw Organics (International), Soulfresh (International), Brothers and Sisters (International), MOMO Kombucha (International), Wild T Kombucha (UAE), The Kombucha Company (UAE), House of Kombucha (Dubai, UAE), Kombucha Arabia (Saudi Arabia), Brewed Awakening (UAE), The Kombucha Shop (International), Kombucha Town (International) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East kombucha market appears promising, driven by increasing health awareness and a growing preference for functional beverages. As consumers continue to prioritize health, the demand for kombucha is expected to rise significantly. Additionally, the expansion of distribution channels and the emergence of local craft brands will likely enhance market accessibility. Innovations in flavors and packaging will further attract diverse consumer segments, positioning kombucha as a staple in the health beverage category in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Traditional Kombucha Flavored Kombucha Organic Kombucha Sparkling Kombucha Hard Kombucha (Alcoholic) Others |

| By End-User | Retail Consumers Restaurants and Cafes Health and Wellness Centers Lifestyle Disease Management Consumers Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail Health Food Stores Specialty Stores Convenience Stores Health-Oriented Cafes and Restaurants Others |

| By Packaging Type | Glass Bottles Cans PET Bottles Others |

| By Flavor Profile | Original Ginger-Turmeric Berry Citrus Herbal and Botanical Exotic Fruits (e.g., Mango, Coconut, Apple) Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Iraq) North Africa (Egypt, Morocco, Algeria, Tunisia) Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Kombucha Retail Market | 120 | Store Managers, Beverage Buyers |

| Health Food Distributors | 90 | Distribution Managers, Sales Representatives |

| Kombucha Producers | 60 | Founders, Production Managers |

| Consumer Preferences | 140 | Health-Conscious Consumers, Kombucha Drinkers |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

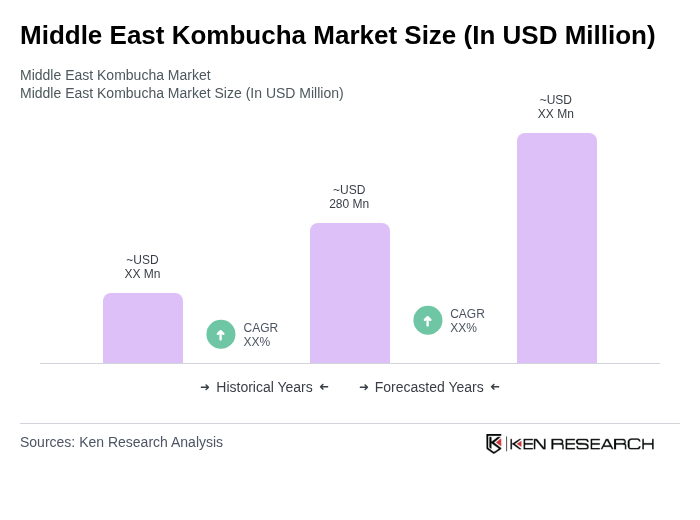

The Middle East Kombucha Market is valued at approximately USD 280 million, reflecting a significant growth trend driven by increasing health consciousness and the demand for natural beverages across the region.