Region:North America

Author(s):Dev

Product Code:KRAC0398

Pages:83

Published On:August 2025

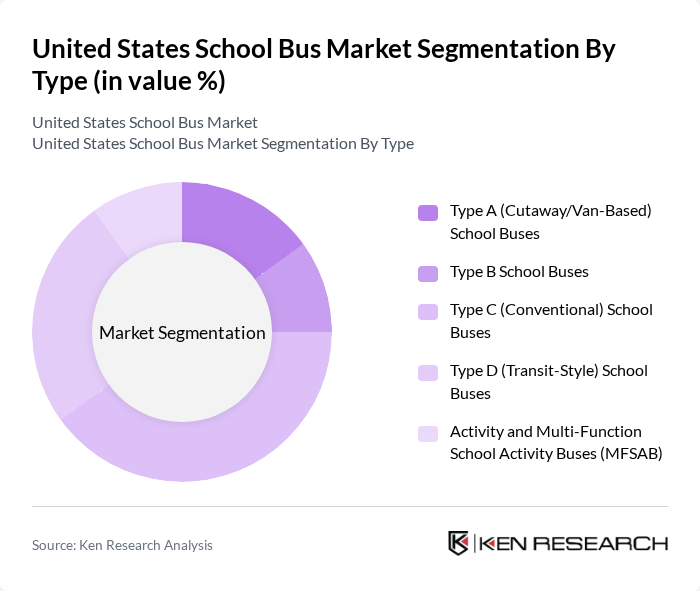

By Type:The market is segmented into various types of school buses, including Type A (Cutaway/Van-Based), Type B, Type C (Conventional), Type D (Transit-Style), and Activity and Multi-Function School Activity Buses (MFSAB). Each type serves different needs based on capacity, design, and intended use, catering to diverse educational institutions and transportation requirements.

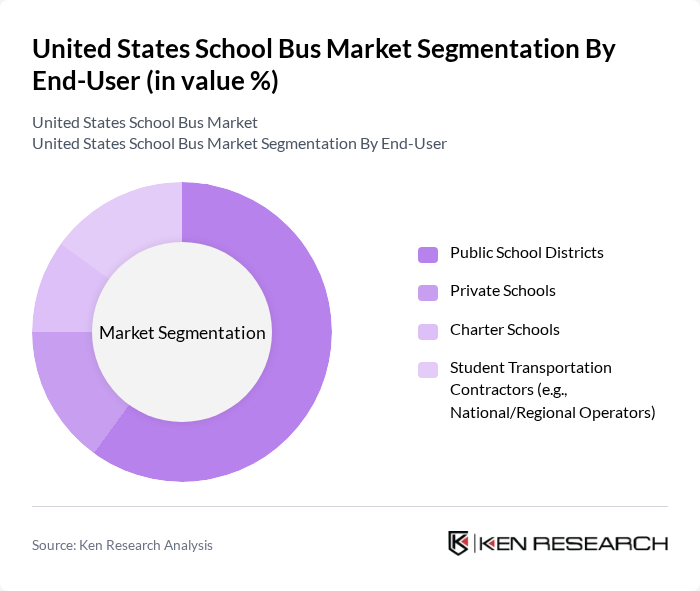

By End-User:The end-user segmentation includes Public School Districts, Private Schools, Charter Schools, and Student Transportation Contractors. Each segment has unique requirements and funding sources, influencing their purchasing decisions and the types of buses they utilize for student transportation.

The United States School Bus Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blue Bird Corporation, Thomas Built Buses, Inc. (A Daimler Truck North America brand), IC Bus (Navistar, a Traton Group company), Collins Bus Corporation, Lion Electric Company, GreenPower Motor Company, Trans Tech Bus, Micro Bird (Girardin/Blue Bird), Starcraft Bus (Forest River), Elkhart Coach (Forest River), BYD Motors Inc., Pegasus Specialty Vehicles, Phoenix Motorcars, ROUSH CleanTech (propane powertrains supplier), and Navistar, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. school bus market appears promising, driven by a strong emphasis on sustainability and safety. As federal and state governments continue to prioritize eco-friendly transportation, the adoption of electric buses is expected to accelerate in future, supported by continued Clean School Bus Program awards and deployments. Additionally, advancements in technology will enhance fleet management and safety features, making school transportation more efficient. The integration of smart systems is expected to reshape the landscape, ensuring that school buses meet modern safety and environmental standards while improving the overall user experience.

| Segment | Sub-Segments |

|---|---|

| By Type | Type A (Cutaway/Van-Based) School Buses Type B School Buses Type C (Conventional) School Buses Type D (Transit-Style) School Buses Activity and Multi-Function School Activity Buses (MFSAB) |

| By End-User | Public School Districts Private Schools Charter Schools Student Transportation Contractors (e.g., National/Regional Operators) |

| By Bus Size | Small (Type A/Short Wheelbase) Medium (Type B/Short Type C) Large (Full-Size Type C/Type D) |

| By Fuel/Powertrain | Diesel Gasoline Propane (LPG) Compressed Natural Gas (CNG) Battery Electric |

| By Purchase Type | New Buses Used/Refurbished Buses |

| By Sales Channel | Direct OEM Sales Authorized Dealers/Distributors State/Cooperative Procurement Programs |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| School District Transportation Management | 120 | Transportation Directors, Fleet Managers |

| Bus Manufacturing Insights | 90 | Product Managers, Sales Executives |

| Regulatory Compliance and Safety Standards | 80 | Compliance Officers, Safety Inspectors |

| Electric Bus Adoption Trends | 70 | Environmental Policy Makers, Sustainability Coordinators |

| Funding and Budget Allocation for Transportation | 85 | School Administrators, Financial Officers |

The United States School Bus Market is valued at approximately USD 5 billion, driven by factors such as the adoption of electric buses, fleet replacements, and a focus on student safety and emissions reduction, supported by federal and state grants.