Region:Global

Author(s):Shubham

Product Code:KRAA3150

Pages:99

Published On:August 2025

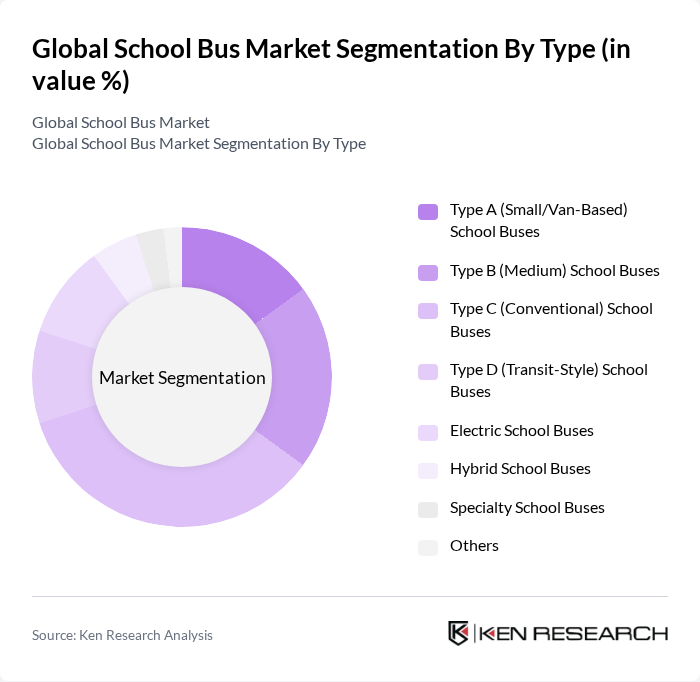

By Type:The market is segmented into Type A (Small/Van-Based), Type B (Medium), Type C (Conventional), Type D (Transit-Style), Electric School Buses, Hybrid School Buses, Specialty School Buses, and Others. Each type addresses distinct operational needs, ranging from small, van-based buses for limited routes to large, conventional and transit-style buses designed for high-capacity student transport. Electric and hybrid models are increasingly favored for their lower emissions and reduced operating costs, while specialty buses serve unique accessibility or program requirements .

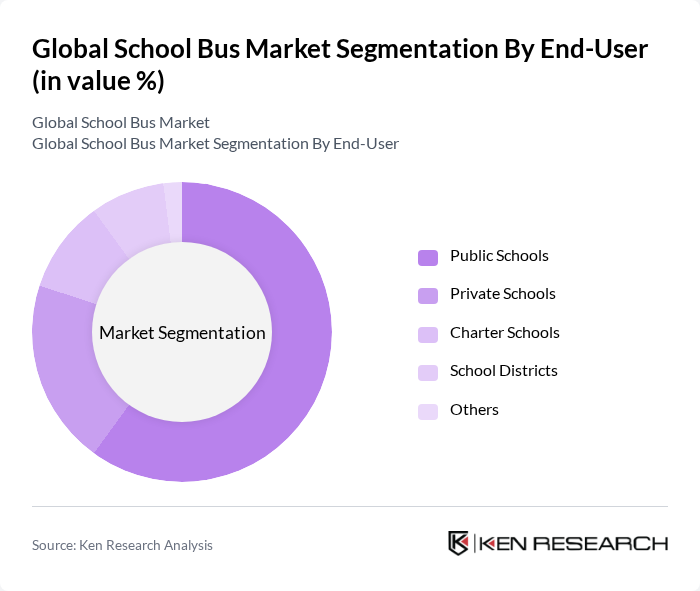

By End-User:The market is segmented by end-user into Public Schools, Private Schools, Charter Schools, School Districts, and Others. Public schools represent the largest segment, reflecting government funding and regulatory compliance requirements. Private and charter schools, along with independent school districts, contribute to market diversity, each with distinct procurement processes and transportation needs .

TheType C (Conventional) School Busessegment dominates the market, favored for their high passenger capacity, robust safety features, and cost-effectiveness. These buses are widely adopted by public school systems for daily student transport, with manufacturers focusing on compliance with evolving safety regulations and integration of advanced technologies such as telematics and ADAS (Advanced Driver Assistance Systems) .

ThePublic Schoolssegment leads the end-user market, supported by government funding and a mandate to provide safe, reliable transportation for students. Public schools typically maintain long-term contracts with bus manufacturers, ensuring consistent demand and adherence to evolving safety and environmental regulations. The segment's dominance is reinforced by ongoing investments in fleet modernization and compliance with federal and state transportation standards .

The Global School Bus Market features a dynamic mix of regional and international players. Leading participants such as Blue Bird Corporation, Thomas Built Buses, Inc., IC Bus, Inc. (Navistar International Corporation), Daimler Truck AG (Mercedes-Benz Buses/EvoBus), Collins Bus Corporation, Gillig LLC, BYD Company Limited, Lion Electric Company, GreenPower Motor Company Inc., Trans Tech Bus, Starcraft Bus, ElDorado National (REV Group), Tata Motors Limited, Yutong Bus Co., Ltd., and Anhui Ankai Automobile Co., Ltd. drive innovation, geographic expansion, and service delivery. These companies invest in R&D for safety and alternative propulsion systems, expand their product portfolios, and prioritize sustainability to meet evolving market demands .

The future of the school bus market appears promising, driven by increasing investments in education and a growing emphasis on sustainability. As governments prioritize eco-friendly transportation solutions, the adoption of electric school buses is expected to rise significantly. Furthermore, advancements in technology will continue to enhance safety and operational efficiency, making school transportation more reliable. The integration of smart solutions will likely reshape fleet management, ensuring that school districts can meet the evolving needs of students and parents alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Type A (Small/Van-Based) School Buses Type B (Medium) School Buses Type C (Conventional) School Buses Type D (Transit-Style) School Buses Electric School Buses Hybrid School Buses Specialty School Buses Others |

| By End-User | Public Schools Private Schools Charter Schools School Districts Others |

| By Bus Size | Small Buses (Up to 30 Passengers) Medium Buses (31-50 Passengers) Large Buses (Above 50 Passengers) |

| By Fuel Type | Diesel Gasoline CNG (Compressed Natural Gas) Propane Electric Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct Sales Distributors/Dealers Online Sales |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public School Districts | 100 | Transportation Directors, School Administrators |

| Private School Transportation Services | 60 | Operations Managers, Business Administrators |

| School Bus Manufacturers | 40 | Product Development Managers, Sales Executives |

| Parents and Guardians | 80 | Parents of School-Aged Children, Community Leaders |

| Regulatory Bodies | 40 | Policy Makers, Transportation Safety Officials |

The Global School Bus Market is valued at approximately USD 15 billion, driven by investments in educational infrastructure, rising student enrollment, and a focus on safety and transportation efficiency.