Region:North America

Author(s):Shubham

Product Code:KRAC0613

Pages:90

Published On:August 2025

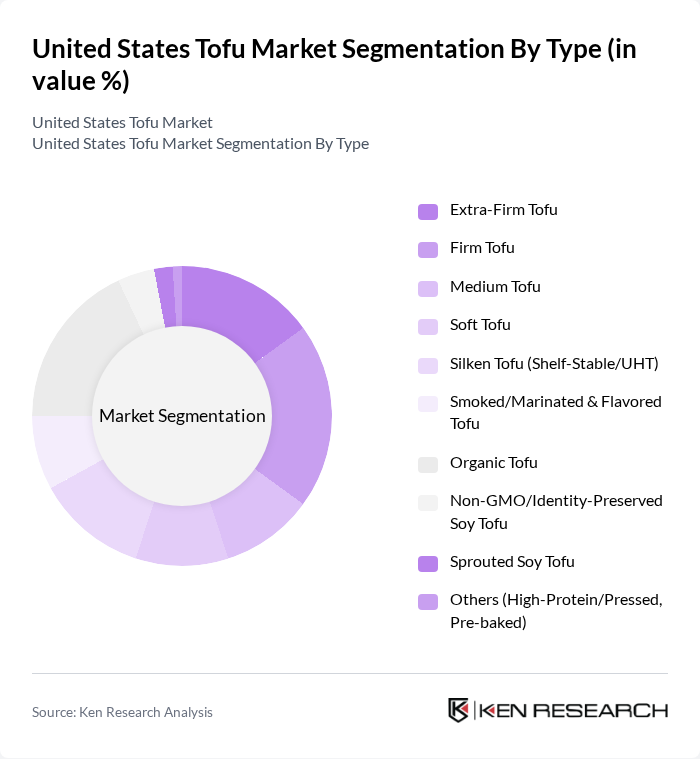

By Type:The tofu market can be segmented into various types, including Extra-Firm Tofu, Firm Tofu, Medium Tofu, Soft Tofu, Silken Tofu (Shelf-Stable/UHT), Smoked/Marinated & Flavored Tofu, Organic Tofu, Non-GMO/Identity-Preserved Soy Tofu, Sprouted Soy Tofu, and Others (High-Protein/Pressed, Pre-baked). Among these, Organic Tofu is gaining significant traction due to the increasing consumer preference for organic products, non-GMO claims, and heightened awareness of health and environmental issues in plant-based purchasing.

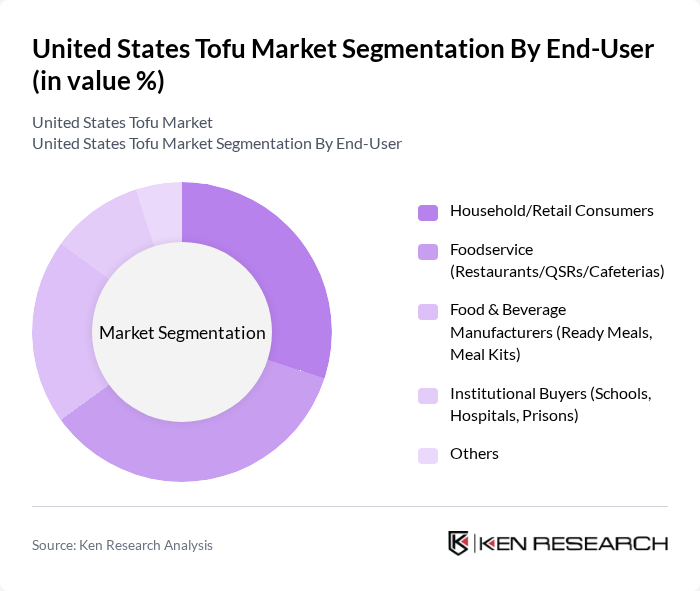

By End-User:The end-user segmentation includes Household/Retail Consumers, Foodservice (Restaurants/QSRs/Cafeterias), Food & Beverage Manufacturers (Ready Meals, Meal Kits), Institutional Buyers (Schools, Hospitals, Prisons), and Others. The Foodservice segment is noteworthy as it has been expanding in line with menu innovation and wider plant-based offerings across restaurant chains and independent operators, supported by growing consumer interest in tofu-based dishes.

The United States Tofu Market is characterized by a dynamic mix of regional and international players. Leading participants such as House Foods America Corporation, Pulmuone Foods USA (Nasoya, Wildwood), Morinaga Nutritional Foods, Inc. (Mori-Nu), Hodo Foods, Inc., Superior Natural Foods Co. (SoyBoy), Ota Tofu (Ota Tofu Company), San José Tofu Company, Phoenix Bean Tofu (Lotus Foods, Inc. – Chicago), WestSoy (Tofu) – part of Hain Celestial, Small Planet Tofu, Vitasoy USA Inc. (North American presence), Wildwood Foods (brand under Pulmuone), Trader Joe’s (Private Label Tofu), Whole Foods Market 365 (Private Label Tofu), Franklin Farms (Tofu and tofu-based products; part of Keystone Natural Holdings) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. tofu market appears promising, driven by increasing health awareness and a growing preference for plant-based diets. As consumers continue to seek sustainable and nutritious food options, tofu is likely to benefit from innovations in product offerings and flavors. Additionally, the expansion of online retail channels will facilitate greater accessibility, allowing tofu to reach a broader audience. These trends suggest a dynamic market landscape that will evolve in response to consumer preferences and environmental considerations.

| Segment | Sub-Segments |

|---|---|

| By Type | Extra-Firm Tofu Firm Tofu Medium Tofu Soft Tofu Silken Tofu (Shelf-Stable/UHT) Smoked/Marinated & Flavored Tofu Organic Tofu Non-GMO/Identity-Preserved Soy Tofu Sprouted Soy Tofu Others (High-Protein/Pressed, Pre-baked) |

| By End-User | Household/Retail Consumers Foodservice (Restaurants/QSRs/Cafeterias) Food & Beverage Manufacturers (Ready Meals, Meal Kits) Institutional Buyers (Schools, Hospitals, Prisons) Others |

| By Distribution Channel | Supermarkets/Hypermarkets (Off-Trade) Convenience & Grocery/Club Stores (Off-Trade) Natural/Specialty Retailers (e.g., Whole Foods, Sprouts) Online Retail (DTC and Marketplaces) Foodservice/On-Trade (Restaurants & Institutional) Others |

| By Packaging Type | Shelf-Stable Aseptic Cartons (UHT/Tetra Pak) Refrigerated Plastic Tubs/Vacuum Packs Modified Atmosphere Packs (MAP) Bulk Foodservice Packs Others (Glass Jars, Compostable Packs) |

| By Price Range | Economy/Private Label Mid-Range Premium (Organic/Artisanal/Smoked) Others |

| By Flavor | Original/Plain Smoked Herb-Infused Spicy/Asian-Inspired Marinades Sweetened/Dessert (e.g., Pudding/Silken) Others |

| By Nutritional/Claims | High Protein Low/Reduced Fat Fortified (Calcium, Vitamin B12, Vitamin D) Organic/Non-GMO/Gluten-Free Claims Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Tofu Products | 140 | Health-conscious Consumers, Vegetarians, Vegans |

| Retail Distribution Channels for Tofu | 100 | Retail Managers, Grocery Store Owners |

| Food Service Industry Insights | 80 | Restaurant Owners, Menu Planners |

| Tofu Manufacturing Processes | 60 | Production Managers, Quality Control Specialists |

| Market Trends and Innovations in Tofu | 70 | Food Scientists, Product Development Managers |

The United States Tofu Market is valued at approximately USD 470 million, reflecting a significant growth trend driven by increasing demand for plant-based protein sources and rising health consciousness among consumers.