Region:North America

Author(s):Dev

Product Code:KRAD5143

Pages:93

Published On:December 2025

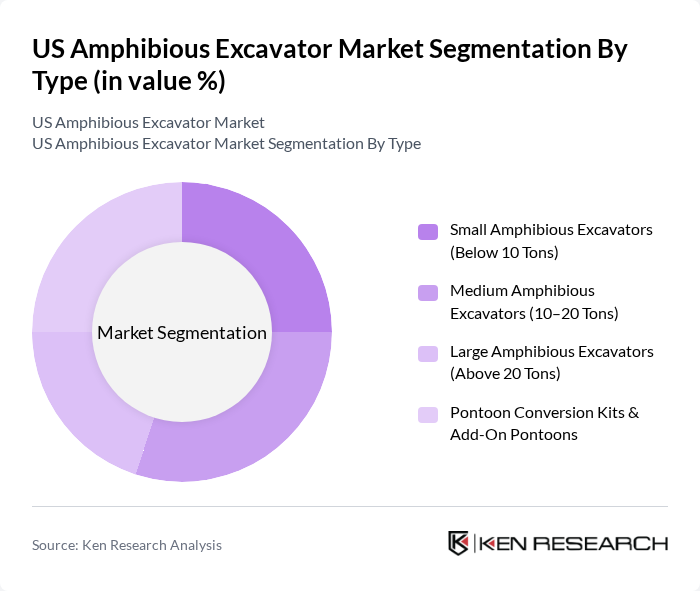

By Type:The market is segmented into various types of amphibious excavators, including small, medium, and large excavators, as well as pontoon conversion kits and add-on pontoons. This structure aligns with global industry practice, where machines are differentiated primarily by operating weight and undercarriage configuration. Each type serves different operational needs, with small excavators (generally below 10 tons) being favored for tight spaces, shallow canals, and urban or confined wetland works, while medium and large models are preferred for heavy-duty dredging, river training, port maintenance, and major land reclamation or flood control projects where higher reach and bucket capacity are required.

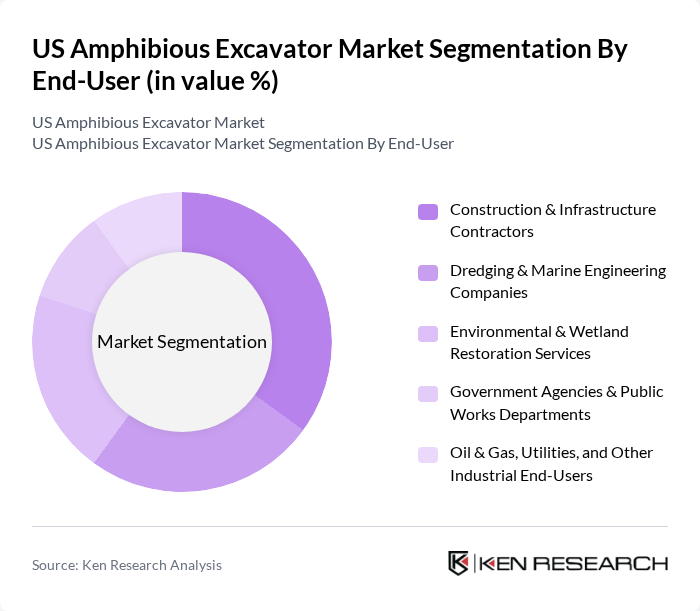

By End-User:The end-user segmentation includes construction and infrastructure contractors, dredging and marine engineering companies, environmental and wetland restoration services, government agencies, and public works departments, as well as oil and gas utilities. This breakdown reflects how amphibious excavators are deployed across channel deepening, shoreline reinforcement, bridge and road approaches, pipeline and cable corridors, habitat restoration, and municipal stormwater or drainage management. Each end-user has distinct requirements that drive the demand for amphibious excavators, with contractors and dredging firms emphasizing productivity and versatility, environmental service providers prioritizing low-impact access to sensitive sites, and public agencies focusing on long-term asset maintenance and resilience against flooding and erosion.

The US Amphibious Excavator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wilco Manufacturing, LLC (USA), Wetland Equipment Company, Inc. (USA), Wilson Marsh Equipment, Inc. (USA), EIK Engineering Sdn Bhd (Amphibious Excavator Attachments – US Presence), REMU Oy (Amphibious Excavators – US Distribution), Bell Dredging Pumps (Bell Amphibious Excavators – US Projects), Aquatic Plant Management, Inc. (US Amphibious Equipment Operator & Fleet Owner), Marsh Buggies, Inc. (USA), Normrock Industries Inc. (North America – US Supply), Caterpillar Inc. (Amphibious Excavator Conversions via US Partners), Volvo Construction Equipment (US Amphibious Excavator Deployments), Hyundai Construction Equipment Americas, Inc., SANY America Inc., Doosan Bobcat North America, XCMG North America Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US amphibious excavator market is poised for significant growth, driven by increasing investments in infrastructure and environmental restoration projects. As regulations become more stringent, the demand for advanced, eco-friendly excavation solutions will rise. Additionally, technological advancements, such as automation and IoT integration, will enhance operational efficiency. Companies that adapt to these trends and invest in workforce training will likely gain a competitive edge, positioning themselves favorably in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Amphibious Excavators (Below 10 Tons) Medium Amphibious Excavators (10–20 Tons) Large Amphibious Excavators (Above 20 Tons) Pontoon Conversion Kits & Add-On Pontoons |

| By End-User | Construction & Infrastructure Contractors Dredging & Marine Engineering Companies Environmental & Wetland Restoration Services Government Agencies & Public Works Departments Oil & Gas, Utilities, and Other Industrial End-Users |

| By Application | Dredging & Waterway Maintenance Flood Control & Disaster Management Wetland Restoration & Habitat Management Pipeline & Cable Installation in Marshlands Land Reclamation & Shoreline Protection |

| By Payload/Operating Weight Class | Below 10 Tons –20 Tons –30 Tons Above 30 Tons |

| By Region | Northeast Midwest South West |

| By Technology / Powertrain | Conventional Diesel-Hydraulic Advanced Telematics-Enabled Systems Hybrid / Electric-Assisted Amphibious Excavators Retrofit & Specialized Attachments |

| By Ownership / Financing Model | Direct Purchase (Capex) Operating Lease / Rental Dealer & OEM Financing Programs Government-Backed and Public-Project Financing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Utilization | 100 | Project Managers, Site Supervisors |

| Environmental Restoration Projects | 80 | Environmental Engineers, Project Coordinators |

| Dredging Operations | 70 | Operations Managers, Marine Contractors |

| Government Infrastructure Initiatives | 60 | Policy Makers, Urban Planners |

| Rental Services for Excavators | 90 | Rental Fleet Managers, Business Development Executives |

The US Amphibious Excavator Market is valued at approximately USD 2.1 billion, reflecting a significant growth driven by increased demand for specialized excavation equipment in various environmental and infrastructure projects.